As Bitcoin’s (BTC) daily trading volume soars above the $10 billion mark, pushing the price of Bitcoin, the world’s largest cryptocurrency, into positive territory, the persistent question arises: has the bear market ended?

Amidst this momentum, an intriguing development in the form of a surge in cryptocurrency mining stocks, with Hut 8 Mining leading the pack, further fuels optimism in the cryptocurrency sphere.

This update dives into a comprehensive Bitcoin price prediction, considering these key market dynamics and exploring BTC’s technical outlook.

Skyrocketing Crypto Mining Stocks: Hut 8 Mining Takes Lead

The recent uptick in the cryptocurrency mining sector is being led by Hut 8 Mining, with their shares surging by 19.6% to reach a peak of $2.75 – a threefold increase since the start of the year.

Similar growth is observed in other mining firms such as Bit Digital, Bitfarms, Marathon Digital Holdings, Cleanspark, and Riot Blockchain, as they, too, experience a rise in their stock prices.

Over the past five days, the predominant cryptocurrency has increased by 7.2%. This upswing is likely contributing to the rally in mining stocks.

The mining sector is thriving, creating attractive investment opportunities within the cryptocurrency market.

The buoyant mining sector, accompanied by the surge in cryptocurrency mining stocks, including Hut 8 Mining, could positively impact Bitcoin’s price.

The intensified interest and success in mining signify a growing confidence in the cryptocurrency market, which may spur the continued ascent of Bitcoin’s price.

Bitcoin Price Prediction

Bitcoin is currently in a consolidation phase, experiencing a tug-of-war between the resistance level of $31,000 and the support level of $30,000.

Leading technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), as seen in the daily timeframe, are in the overbought territory, which might suggest a pending downward correction for BTC.

Despite this, fundamental solid factors are holding the potential bearish pull in check.

From a technical standpoint, Bitcoin’s most formidable barrier is around the $31,000 threshold.

If Bitcoin can cross this barrier, the next potential target is at $32,500, and if this level is crossed, the subsequent milestone could be at $34,000.

Conversely, if Bitcoin plunges below the $30,000 support, it might steer the cryptocurrency toward the 38.2% Fibonacci retracement level of $28,700 or even the 50% retracement level at $28,000.

The 50-day exponential moving average could also present significant resistance to Bitcoin’s downward trend around the $28,000 mark.

In essence, the advisable approach is to wait for Bitcoin to make a decisive move out of the currently discussed tight range before proceeding with substantial trading actions.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

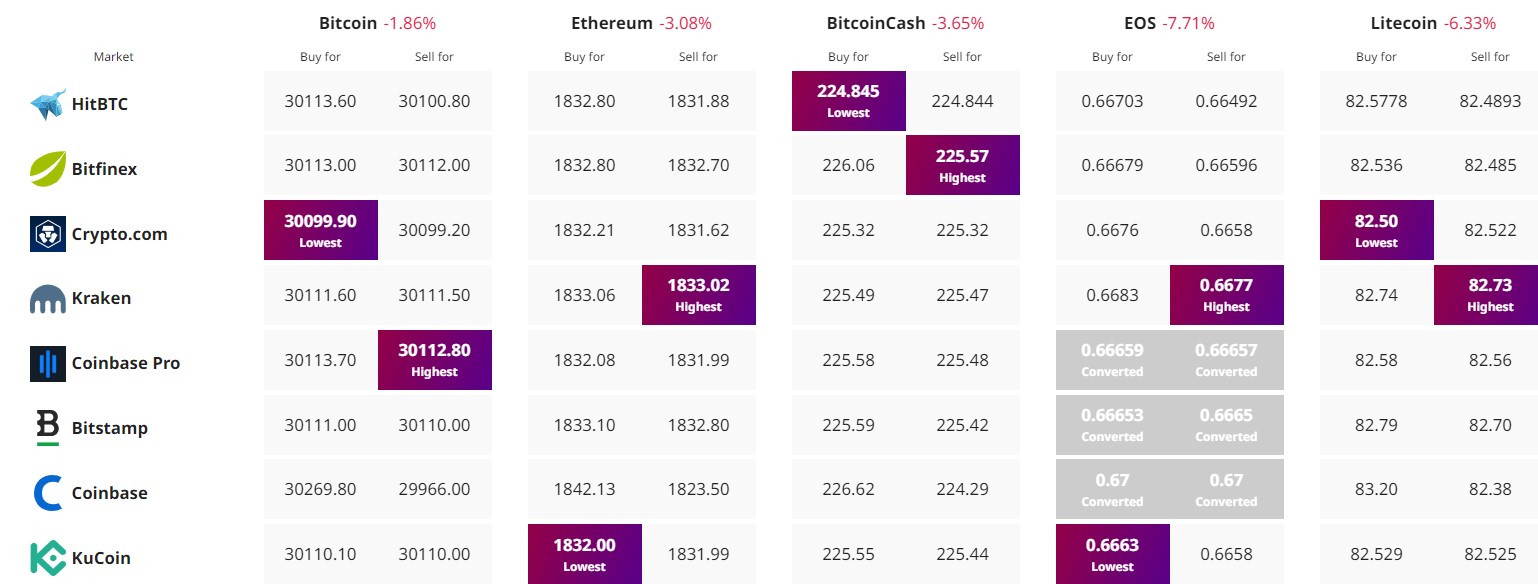

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.