(Reuters) – (This Sept. 26 story has been corrected to remove the incorrect references to liquidators of China Evergrande (HK:) New Energy Vehicle Group as they are related to parent company China Evergrande Group, in paragraphs 1 and 3)

Liquidators of debt-laden China Evergrande are still in talks with a potential buyer to sell a stake in the electric vehicle arm of the company with a view to provide a new credit line to support production.

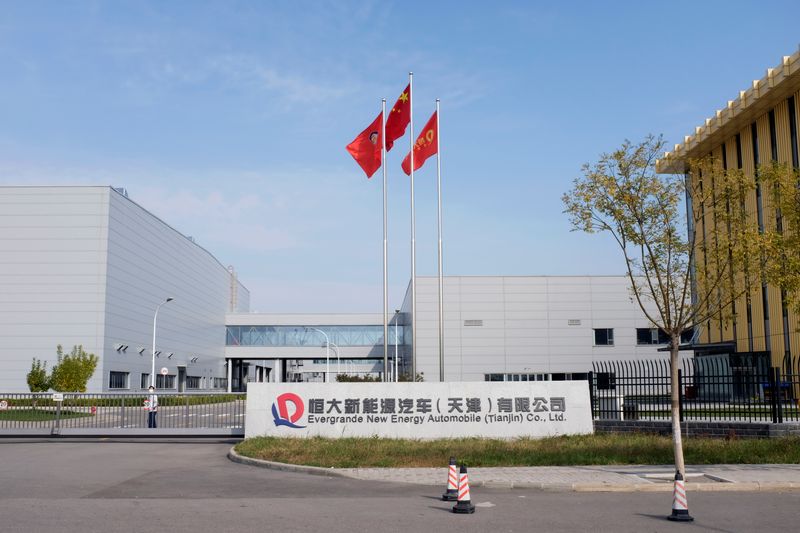

In its initial days, the electric vehicle (EV) maker aimed to take on Tesla (NASDAQ:) and had a market valuation higher than Ford Motor (NYSE:), but it has since been mired in the debt crisis engulfing its property developer parent.

China Evergrande New Energy Vehicle said on Thursday liquidators of its parent company China Evergrande had not yet entered an agreement with any potential stake buyer nor has there been any deal to extend credit to the electric vehicle manufacturer.

The non-binding deal put-forth by China Evergrande Group liquidators provides for a third-party buyer to take a stake of 29% in the unit, with an option for 29.5% more, the EV arm had said in a statement in late May.

The EV maker, which in August said two of its units had commenced bankruptcy proceedings, has been severely short of funds and has faced pressure from its creditors and a local government.