Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

America is returning, its president claims, to a golden age. One company for whom that would be a dream come true is Intel. The US chipmaker had a $500bn market capitalisation back in 2000. Now, it is worth about $90bn — a piteous decline.

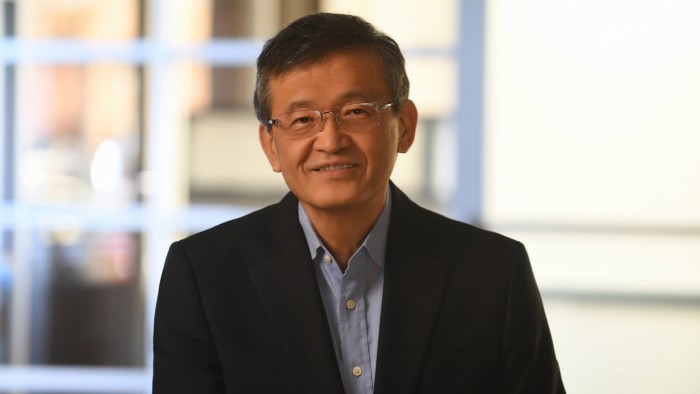

New chief executive Lip-Bu Tan is not promising a return to that gilded era. Far from it: after years of Intel missing its own targets, he kicked off his first quarterly earnings call by vowing to make difficult decisions, but with no ambitious numerical goals, and no quick fixes. Things may get worse before they get better for a company that has gone from $20bn of net income in 2021 to five consecutive quarters of losses.

Intel’s problems, Tan says, stem from “bad execution”. It missed the switch to artificial intelligence chips, losing out to the now-colossal Nvidia, and repeatedly fumbled its manufacturing endeavours. Tariffs add a new unwelcome twist. Executives warned on Thursday that these could shrink the size of its markets, with its faster-growing data-centre business dragged down more than its computer chip division.

Restoring a tarnished icon even in calm times is no simple task. Tan is at least in good company. Boeing this week reported narrowing losses under new CEO Kelly Ortberg, who also inherited a glitch-prone, debt-laden national champion-turned-embarrassment. The boss to beat, for both of them, is General Electric’s Larry Culp, who more than tripled shareholders’ money after taking on an inefficient, overleveraged mess in 2018.

There are some crucial differences. Culp was larded up with a bonus package potentially worth as much as $232mn. That makes Tan’s $66mn sign-on award look miserly. Moreover, Culp broke the company up, killing GE to cure it. Tan has already sold a $4.5bn stake in programmable chip business Altera, but seems minded to view Intel’s chip manufacturing and product development as a package, at least until both are on an even keel.

What is encouraging is that Tan is frank about Intel’s myriad challenges. He is already pledging to cut management layers, hire back lost talent and mend fences with customers. He has also discussed collaboration with massive Taiwanese chip rival TSMC. That is smart: TSMC’s annual capital expenditure is twice Intel’s, and going head to head is folly.

Culp, of course, had help in ways Tan probably would not. GE’s aerospace business was buoyed by a post-Covid recovery in air travel; its power turbine offshoot rose after the surge in artificial intelligence-related energy usage. By contrast, the Intel chief is in the opening stretch of a trade war and potential recession. The AI boom is already adolescent, and Intel is an also-ran.

There is at least something to be said for starting with low expectations, reflected in a market value that is roughly where it was in 2009. Tan said on Thursday that he liked to under-promise and over-deliver, which is just as well. There is little point in touting a return to the golden age when all Intel investors need is an end to the ice age.

john.foley@ft.com