This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT. Here’s what’s on today’s agenda:

-

Lutnick hails Trump’s $5mn investor visa

-

US president exits G7 summit early

-

How the culture wars are remaking advertising

-

FT writers and critics choose their favourite reads of the year so far

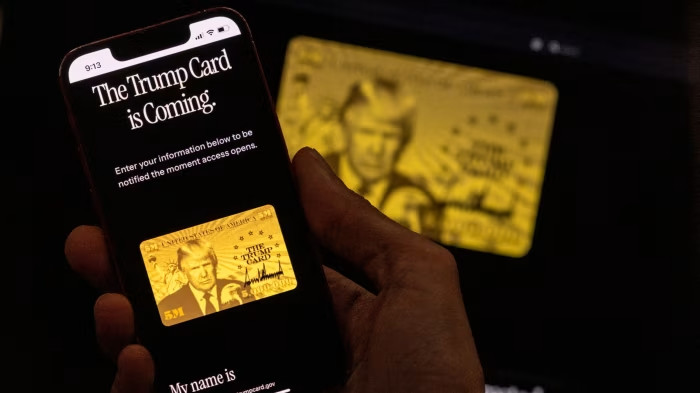

Nearly 70,000 people have signed up for the new golden Trump Card, a visa scheme led by commerce secretary Howard Lutnick that will grant the “world’s best and brightest” legal residency in the US at a cost of $5mn.

How does it work? Lutnick’s department launched a website — trumpcard.gov — for would-be applicants to register their interest in the visa and to provide basic contact information, including their name, email address and region of the world. The commerce secretary said the Trump Card will appeal to business leaders and companies seeking legal residency in the US for themselves or their employees and is pressing for it to replace the EB-5 visa programme.

When will it launch? Lutnick did not give a clear timeline when he spoke to the Financial Times but three months ago he told the All-In Podcast that it would launch in about a fortnight. The commerce department plans to issue tens of thousands of Trump Cards over the summer, people familiar with the matter said. But some of the scheme’s details have still not been agreed. For example, the design of a special tax structure for Trump Card holders has yet to be finalised. Vetting of applicants is expected to be done by the departments of homeland security, state and commerce but Trump has not yet decided whether citizens of any particular countries will be excluded from applying for the scheme.

What will the card look like? One issue that has been agreed is the look of the card. It will feature President Donald Trump’s face and signature, as well as an eagle, the Statue of Liberty and the American flag. “The card will be made of gold,” Lutnick told the FT. “It will be beautiful.” Read the full story.

Here’s what else we’re keeping tabs on today:

-

G7 summit: World leaders will conclude talks in Canada without Trump, who left early to manage the US response to the Israel-Iran conflict. The FT blog has live updates here.

-

Economic data: The US commerce department’s Census Bureau reports retail sales for May. Meanwhile, the labor department’s Bureau of Labor Statistics reports import and export prices for last month.

-

Interest rates: Chile‘s central bank is likely to keep its benchmark interest rate unchanged at 5%.

The FT Women in Business Summit 2025 takes place today. You can register here and watch it live here.

Five more top stories

1. Iran has told other countries in the Middle East that it will only agree to negotiate an end to the war with Israel and resume talks over its nuclear programme if Israeli forces halt their bombing campaign against the Islamic republic, according to diplomats. One diplomat in the region said Tehran’s message in discussions with neighbouring Gulf states was “very clear”. Here’s the latest on the diplomatic efforts to end the war.

2. Senate Republicans released a long-awaited version of Donald Trump’s flagship tax bill yesterday, setting up a possible clash with House Republicans over the so-called “big, beautiful bill”. Here’s more on the draft bill, including keeping the “Salt” tax deductions at the current level of $10,000.

3. The EU has refused to hold a flagship economic meeting with Beijing ahead of a summit next month because of a lack of progress on numerous trade disputes, people familiar with the matter said. The bloc’s stonewalling of the talks underlines the deep divisions between the sides despite Beijing’s efforts to court Europe.

4. UK chancellor Rachel Reeves is exploring reversing a decision to charge inheritance tax on the global assets of non-doms, following a spate of departures and lobbying by the City of London, according to government officials and financiers briefed on the discussions. Read the full report.

5. Central banks expect to keep buying more gold this year, and anticipate their holdings of US dollars will fall over the next five years, according to a survey of global monetary authorities. Gold prices have surged 30 per cent since January and doubled in the past two years, as global uncertainty and market volatility have propelled investor demand for bullion.

The Big Read

After years of corporate messaging that highlighted purpose and inclusion, the advertising industry is shrinking away from making socially progressive statements as the movement intensifies against diversity, equity and inclusion. Daniel Thomas reports from the annual Cannes Lions advertising festival on how the culture war is remaking the sector.

We’re also reading and listening to . . .

Chart of the day

Oil markets have shrugged off Israel’s threat to topple the Iranian regime, with crude exports from the Middle East so far unaffected by the escalating conflict. About 21mn barrels of oil from Iran, Iraq, Kuwait, Saudi Arabia, Qatar and the United Arab Emirates pass daily through the Strait of Hormuz, a narrow but critical waterway separating the Islamic republic from the Gulf states. About one-third of the world’s seaborne oil supplies pass through it and Iran has historically threatened to block it in times of conflict.

Take a break from the news

From politics, economics and history to art, food and, of course, fiction — FT writers and critics choose their favourite reads of the year so far.