This article is an online version of our Scoreboard newsletter. Premium subscribers can sign up here to get the newsletter delievered every Saturday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

It’s been a good week for Gianni Infantino. On Wednesday, Fifa’s president finally filled in one of the key missing pieces in the Club World Cup jigsaw: how much clubs will be paid for taking part.

The $1bn prize pot should certainly help drum up a bit more enthusiasm for the project — a few months ago clubs had been budgeting zero from the competition. How the money is divvied up could still be contentious, particularly for the smaller clubs. Handing tens of millions of dollars to a team in New Zealand or Egypt could be hugely disruptive to domestic competitions. European giants such as Real Madrid and Bayern Munich will demand the lion’s share.

Fifa expects revenue from the CWC of $2bn, thanks in no small part to the contribution from the now Saudi-backed streamer DAZN, which is forking out $1bn for global rights to the 32-team tournament. That in turn has led Fifa to boost its revenue projection for the four-year period ending with the World Cup next summer to $13bn, close to double what it earned from the cycle ending in Qatar.

What exactly all that money is for remains to be seen. Fifa already has reserves of $3.5bn.

This week we’re looking at another Saudi-backed project — in boxing. And we speak to a VC fund with investments in chess and volleyball. Do read on — Josh Noble, sports editor

Send us tips and feedback at scoreboard@ft.com. Not already receiving the email newsletter? Sign up here. For everyone else, let’s go.

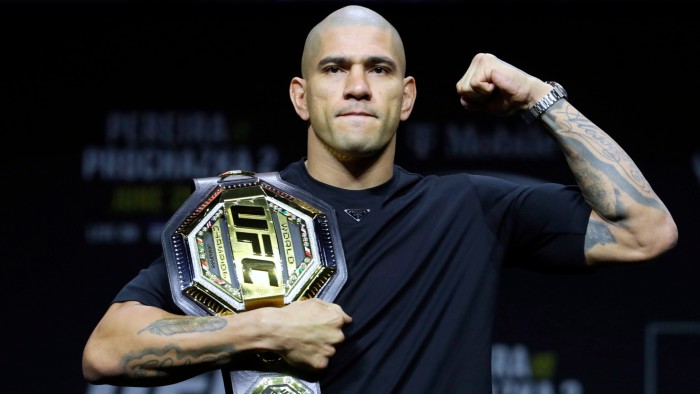

Dana White teams up with Riyadh for boxing revolution

The idea of a new boxing league modelled on the Ultimate Fighting Championship has been discussed for some time. But this week those behind the plans broke cover, with UFC-owner TKO teaming up with Saudi events company Sela, and Turki al-Alsheikh, a royal court adviser and now the most influential man in boxing.

Details so far are scant. The tie-up will create a “highly structured system” for developing talent, give boxers access to the UFC’s performance centres in Las Vegas, Shanghai and Mexico City, and bring TKO in to handle the media operations.

However, TKO president Mark Shapiro hailed the agreement as a “strategic opportunity to reimagine the sport of boxing globally”. UFC’s Dana White and WWE’s Nick Khan will both be involved. More information on the new set-up will be released “in the coming months”, the group said in a statement this week.

Saudi Arabia has already established itself as boxing’s new power broker — able to bankroll the biggest fights and get rival promoters to set aside their differences.

In an age where storytelling is key, boxing’s complex web of federations and promoters has made it hard to build narratives and organise top fights. That the summer bout between retiree Mike Tyson and YouTuber Jake Paul was the most watched in history says a lot about where the sport is these days.

Boxing has been crying out for a revolution. Here it comes.

Q&A: the venture capitalist disrupting sports

Inspired by the search for the next UFC, New York-based venture capital firm Left Lane has invested in former FC Barcelona star Gerard Piqué’s Kings League, a football competition tailor-made for social media; Freestyle Chess, a tour featuring world No.1 Magnus Carlsen; League One Volleyball, a professional women’s competition; and Olympic gold medallist Shaun White’s winter sports company Snow League.

We recently caught up with Harley Miller, chief executive of Left Lane, which is betting that new business models can shake up sport.

What’s the Left Lane approach?

There’s been historically a lot of private equity money and/or billionaires who own teams in the Premiership or the NFL or whatever. But there hasn’t really been much in the form of institutional venture money to lead the seed Series A rounds.

We’ve got a handful of really interesting sports IP investments in the ground, and also a really good understanding of the derivative technology and assets that might be related or adjacent to a Kings League, whether it be sports betting or daily fantasy sports or merchandise or e-commerce or youth assets.

Where are the opportunities?

Our thesis has been we want to invest in leagues, not teams because we think that there’s more upside value, more alpha to be driven. Our [limited partners] aren’t investing in us to make a safe 2x [return] on buying into a franchise of a big four sport. That’s just not what our product is.

We look at the UFC as a brilliant case study of something that was born in the last couple of decades. And that is something that has scale globally with single market sort of economies of scale, and very, very high Ebitda margins.

I didn’t mean to suggest that Left Lane is focused on combat sports, but more on what are the mechanics and merits and attributes of the UFC that allow it to be so successful, so large and frankly so darn profitable.

How crucial are media rights to your investments?

We certainly don’t need media rights deals to make the economics or the math of the things we invest in work. We view that as big upside, not as conditional on the viability of the business because it’s not something you can take for granted.

What’s different about the new breed of sports investor?

Historically, making money was perhaps secondary. It was vanity. They were trophy assets, right. And they were oftentimes teams or it was investing in teams. They were loss making. Owners made money from the disposition of those investments because there was always a wealthier person on the other side who wanted to own whatever it was. That’s starting to change both at the team level but also at the league level.

We can’t afford to do things for vanity purposes. I’d be out of business quickly if that were the case. You could, of course, absolutely go public if you get to meaningful scale and can be an enduring standalone asset.

What’s the exit?

You have multiple paths to exit liquidity. You have private equity, the mega billionaires who own teams in different leagues that have the scale of small sovereign wealth [funds] who could be acquirers. You have a lot of money in the Gulf.

And the future?

We think that we’ve tied up with a handful of unbelievable founders and legends of the game, and partners and advisers and other co-investors that we think will lead to some of the next really large big IP properties out there that hopefully can stand one day toe to toe with Formula One, Liberty Media, as opposed to just getting acquired by a group like that for a couple of billion dollars.

Highlights

-

The Women’s Tennis Association introduced paid maternity leave for players, in a project funded by Saudi Arabia’s sovereign wealth fund. The deal follows an existing partnership formed with the Public Investment Fund last year. “This marks the beginning of a meaningful shift in how we support women in tennis, making it easier for athletes to pursue both their careers and their aspirations of starting a family,” said two-time Australian Open winner Victoria Azarenka.

-

Premier League chief Richard Masters defended the increasingly international range of investors in England’s elite football competition. “There has been a temptation to think that because the Premier League has 10 American owners and 15 who aren’t from the UK, that somehow the history and traditions of English football would be eroded from the inside. That hasn’t been the case,” he told the FT.

-

Bjørn Gulden, the ‘chaotic’ ex-footballer revamping Adidas, said that running shoes and clothing would become new drivers of growth. The comments leave the door open to new sports partnerships after the German company’s return to Formula One as supplier to the Mercedes team.

-

Former F1 owner CVC Capital Partners is considering a bid for the Miami Open and Madrid Open. The tennis tournaments are two assets being sold by Endeavor Group, which is controlled by US investment firm Silver Lake.

Transfer Market

Now under the ownership of the Friedkin Group, English Premier League football club Everton FC has hired a new chief executive from Leeds United. Angus Kinnear will join the Liverpool-based team in June. He will take over from Colin Chong, who is staying on to oversee Everton’s new stadium at Bramley-Moore Dock and the regeneration of the local area.

The Crucible (sort of)

“WHERE IS IT?!”

Cat-like reflexes from David Gilbert! 🐈😂#WorldGrandPrix pic.twitter.com/f1nYh78sMD

— WST (@WeAreWST) March 6, 2025

Okay, the World Snooker Championship doesn’t return to the Crucible in Sheffield until April, but bear with us.

Snooker is a genteel game, in which players are still forced to wear tuxedos despite learning their chops in pubs and clubs. Nevertheless, distractions come in all shapes and sizes.

Just check out David Gilbert’s battle with a wasp. It’s not so long ago that one of his opponents was challenged by a stinging flying insect.

Scoreboard is written by Josh Noble, Samuel Agini and Arash Massoudi in London, Sara Germano, James Fontanella-Khan, and Anna Nicolaou in New York, with contributions from the team that produce the Due Diligence newsletter, the FT’s global network of correspondents and data visualisation team

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here