One of the largest pieces of news impacting crypto markets today is that Coinbase has requested the dismissal of a lawsuit filed against them by the United States Securities and Exchange Commission (SEC), according to an announcement made today by Paul Grewal, the company’s Chief Legal Officer.

Grewal disseminated the news on X, stating, “Coinbase filed our brief asking the Court to dismiss the SEC’s case against us.”

With this latest development in mind, what are the best cryptos to buy now?

Coinbase has emphasized in its main argument that it does not sell investment contracts.

These are a particular type of securities, as outlined by multiple Supreme Court cases and legal precedents over the years.

Grewal sharply criticized the SEC for allegedly overstepping its bounds, bypassing due process, and neglecting its own interpretations of securities laws.

He also argued that the SEC has gone beyond its authority, as granted by Congress, by overlooking other binding legal precedents.

This is a significant update in a series of legal back-and-forths that began with the SEC’s lawsuit against Coinbase in June.

The SEC’s initial lawsuit accuses Coinbase of trading unregistered securities, including ADA, and operating an unregistered securities exchange.

This legal action followed a Well Notice that the SEC had sent to the company earlier in the year.

Despite facing accusations, Coinbase has reiterated that it has never listed securities on its platform.

The company has consistently argued that the SEC lacks the regulatory authority to oversee cryptocurrencies.

Looking ahead, Grewal has expressed confidence in Coinbase’s ability to successfully counter the SEC’s lawsuit. He anticipates that the court will consider the case by the end of October.

Legal experts are closely monitoring the Coinbase/SEC case, as it could have significant ramifications for the regulation of cryptocurrencies and potential crypto market price fluctuations.

Despite regulatory uncertainty surrounding Coinbase, GMX, Cowabunga, XDC Network, Chimpzee, and Injective remain some of the best cryptos to buy now, thanks to their strong fundamentals and/or promising technical analysis.

GMX Sees Positive Turnaround: Is Momentum Shifting?

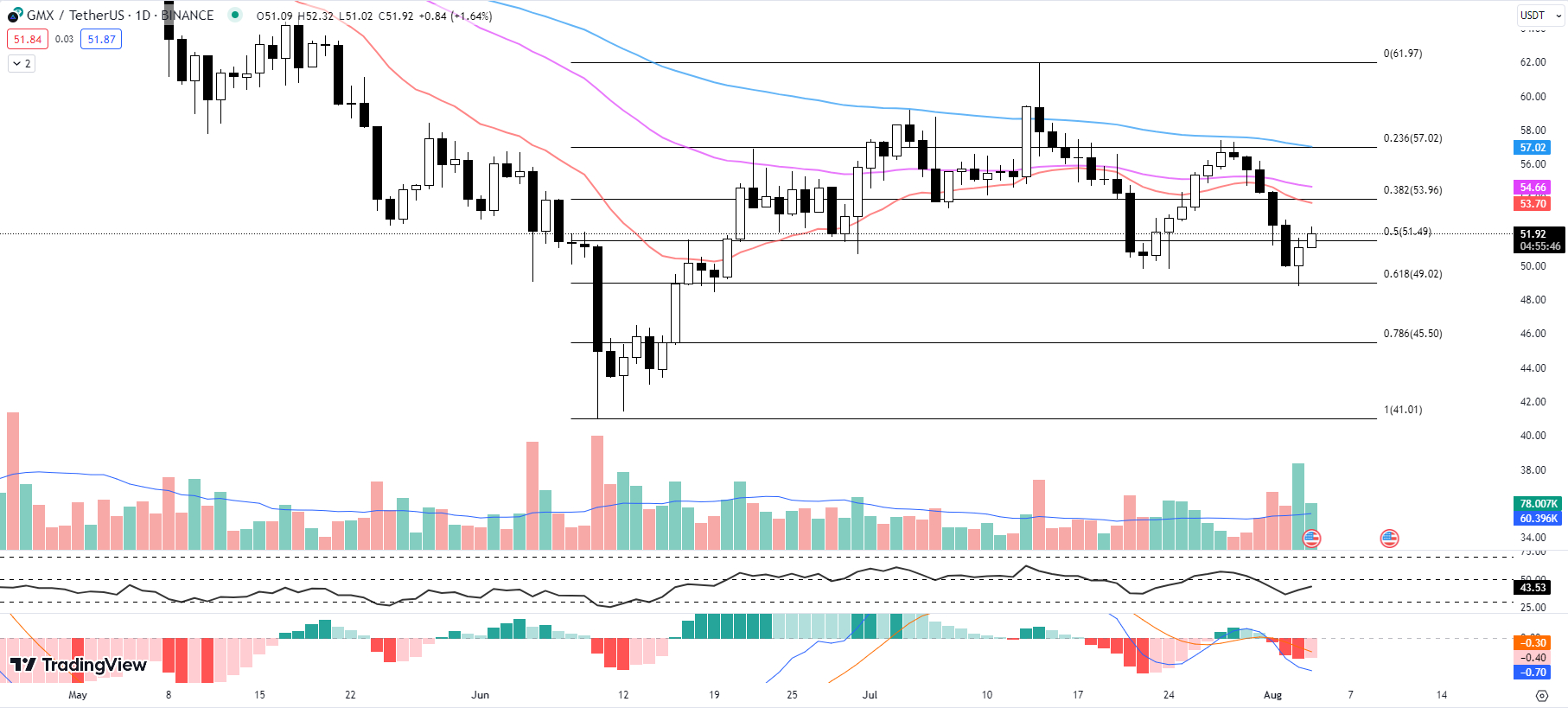

After being rejected from the Fib 0.236 level at $57.02 and enduring a four-day slide, GMX found much-needed support at the Fib 0.618 level at $49.02 on August 3.

This positive turnaround has continued into today, with GMX currently trading in the green and seemingly attempting to regain the Fib 0.5 level at $51.49.

Notably, the 20-day EMA for GMX stands at $53.70, slightly below the 50-day EMA at $54.66, and well below the 100-day EMA at $57.02.

This sequence, where shorter-period EMAs are below longer ones, typically points to a bearish trend. However, the current price of GMX at $51.92, along with a 1.64% rise so far today, may signal a potential shift in momentum.

Turning our attention to the RSI, we see a minor upward movement from 40.54 to 43.54.

While this is still below the mid-point of 50, indicating a prevailing bearish trend, the rise suggests that selling pressure may be weakening.

The Moving Average Convergence Divergence (MACD) histogram has also moved slightly upwards from -0.43 to -0.40.

This positive momentum indicates that the bears may be losing their grip, providing a potential opportunity for the bulls.

However, there are key levels to watch. The first suggests level is at the 20-day EMA at $53.70, which coincides with the Fib 0.382 level at $53.96. Overcoming this dual resistance would be a significant bullish signal.

Meanwhile, the immediate support level lies at the Fib 0.5 level at $51.49, slightly below the current price. If GMX slips back below this level, it could trigger further selling pressure and potentially send the stock back toward its recent support at $49.02.

While the overall trend remains bearish for GMX, recent movements, and technical indicators suggest a possible momentum shift.

Traders are advised to keep a close eye on the aforementioned resistance and support levels. The overcoming of resistance or failure to hold support will likely offer crucial insights into GMX’s immediate future.

Cowabunga Coin: One of the Best Cryptos to Buy Now for Teenage Mutant Ninja Turtles Fans

Replete with nostalgia for many, the phrase “Cowabunga!” is now leaping from the Teenage Mutant Ninja Turtles universe into the cryptocurrency market with the impending launch of Cowabunga Coin.

Corresponding with the recent box office success of the latest Teenage Mutant Ninja Turtles film, the new cryptocurrency seeks to capture the enthusiasm sparked by the film’s popularity.

Cowabunga Coin’s creators are pursuing a funding goal of $500,000 by offering 35% of the coin’s total supply for presale.

With only six days left before the presale’s conclusion, early crypto enthusiasts may perceive an opportunity to engage with a culturally significant project.

Previous endeavors by the same marketing team, such as the SpongeBob Coin, have seen successful returns, potentially indicating a similar path for Cowabunga Coin.

What distinguishes Cowabunga Coin further is its tokenomics.

The current presale pricing values the coin’s market capitalization at $1,428,571, providing ample growth opportunities.

With a finite supply and an attractive presale price, it’s possible that high demand could incite a decentralized exchange (DEX) launch for the project.

Cowabunga Coin also seeks to foster community spirit through rewards and incentives.

They plan to allocate 25% of the token supply for community rewards and airdrops, motivating early supporters to hold onto their tokens.

Additionally, 20% of the token supply is reserved for DEX liquidity, with another 10% set aside for centralized exchange (CEX) liquidity, indicating the project’s commitment to creating stability for its token holders.

Visit Cowabunga Now

XDC Network (XDC) Experiences Sudden Pullback After YTD High

XDC Network (XDC) recently experienced a significant development as it reached a new year-to-date high of $0.09450 earlier today.

However, shortly after reaching this milestone, the asset quickly experienced a sudden pullback from the horizontal resistance zone between $0.08907 and $0.09028.

This retraction caused XDC to break below the Fib 0.786 level at $0.08048, with the cryptocurrency now trading at $0.07590, marking a 16.58% decrease so far today.

The 20-day EMA for XDC stands at $0.05827, comfortably below the current price, indicating a prevailing bullish momentum in the immediate future.

This is further corroborated by the 50-day and 100-day EMAs at $0.04672 and $0.04108, respectively, which are also below the current price.

Nonetheless, the recent downturn in price is reflected in XDC’s RSI, which has dropped to 67.78 from yesterday’s high of 87.86.

This drop suggests a potential cooling off of previously overbought conditions and might indicate that a period of consolidation or further retracement could be on the horizon.

The MACD histogram also presents a lower figure today at 0.00263, down from yesterday’s 0.00304.

The decreasing MACD histogram suggests that bearish momentum is creeping in, potentially paving the way for a short-term downtrend.

In terms of the market stature, XDC’s market cap has seen a reduction of 5.38% for the day, standing at $1.059 billion, while the 24-hour volume is also down by 7.64% to $37.9 million.

This decrease in trading volume could signify dwindling trader interest, adding another layer of concern for bullish prospects.

For traders eyeing potential entry or exit points, the immediate resistance is at the Fib 0.786 level at $0.08048, which lies in confluence with the horizontal resistance zone of $0.07913 to $0.08054. Any significant move upwards must breach this resistance for the bulls to regain control.

Meanwhile, immediate support lies at the Fib 0.618 level at $0.06952, which may serve as a critical line in the sand for preventing further downside.

While XDC has shown promising performance in the past few days, today’s technical indicators suggest caution.

Traders should closely monitor these key levels and market indicators to make informed decisions.

Chimpzee: The Charity-Focused Web3 Project Making a Real-World Difference

Chimpzee is seeing a growing interest in its ongoing presale, as it continues to attract investors while celebrating raising over $1.1 million in funds.

The presale is now in stage 8, allowing investors to mint Chimpzee Gold Passport NFTs, which offer the holder a healthy 18% annual yield.

The project plans to build a unique ecosystem, complete with a shop-to-earn merchandise store, trade-to-earn NFT marketplace, and a play-to-earn game named “Zero Tolerance.”

This project’s combination of philanthropy and a wide range of features make it one of the best cryptos to buy now.

Chimpzee recently made a substantial donation of $20,000 to the WILD Foundation and has already been involved in numerous reforestation efforts in Brazil and Guatemala.

The project’s roadmap includes a series of donations to various organizations, demonstrating a firm commitment to making a real-world difference.

The project’s merchandise store will allow users to contribute to charitable causes while shopping.

The upcoming t-shirt line, which Chimpzee recently previewed, will see a portion of the profits donated to listed charities.

Chimpzee’s $CHMPZ token stands out for its deflationary model.

The project burns tokens used to purchase Chimpzee Passport NFTs, along with any leftover tokens from each presale stage.

The plan is to burn at least 70% of the initial 200 billion token supply, reducing the $CHMPZ supply to less than 60 billion.

An allocation of 45% of the $CHMPZ supply is available to the public during the presale, while the rest of the tokens are designated for exchanges and liquidity, marketing, development, community rewards, the team, and charity.

With its verification by Cyberscope and auditing by Solidity Finance, the project team has made significant strides in the crypto community.

As Chimpzee advances through its presale stages, it solidifies its position as a green cryptocurrency that combines a range of features with a charitable philosophy.

Visit Chimpzee Now

INJ Struggles with Resistance: Will It Break Through?

INJ has been stuck in a consolidation phase over the past few weeks, with resistance persisting at the 20-day EMA at $8.181 and the Fib 0.618 level at $8.225.

This resistance, fortified by these two key technical indicators, has so far rejected any attempts to push past this barrier, thus creating a persistent struggle for upward price movement for the past 10 days.

Adding complexity to the situation is the declining trading volume that has been observed. This is an important factor to monitor, as it could be indicative of a major price movement on the horizon.

A decline in volume often precedes significant price swings as traders tend to wait on the sidelines during periods of uncertainty.

The trend of the market is also depicted by the RSI and the MACD histogram. The RSI, which currently sits at 46.83, is down from yesterday’s 48.74, suggesting that INJ is neither overbought nor oversold. However, the slight decrease hints at a potential decline in buying pressure.

The MACD histogram is also showcasing a bearish signal, with its value shifting from -0.086 to -0.072, indicating a potential negative momentum in the market.

The price of INJ has been in a slight downtrend, currently trading at $8.025, down by 1.21% so far today.

Looking at the support level, the 50-day EMA at $7.969, closely followed by the Fib 0.5 level at $7.686, provides the immediate buffer for any potential downward price movement.

Traders should closely monitor these levels as a breach of these supports could potentially lead to a more pronounced price decline.

The technical indicators for INJ point to a market that’s on edge. The decline in trading volume, combined with the fluctuating RSI and MACD histogram, suggests that a decisive price move may be imminent.

As such, traders should be prepared for potential volatility in the coming days, whether it is a breakout to the upside, triggering a new upward trend, or a breakdown below current support levels, setting the stage for further downward movement.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.