Google’s parent company Alphabet beat analyst estimates for its second-quarter earnings on Wednesday, but its stock faltered after Alphabet reported it would increase its capital expenditures by $10 billion this year.

Investors have been closely monitoring Alphabet for signs of weakness as more and more people turn to ChatGPT instead of Google to find answers on the internet.

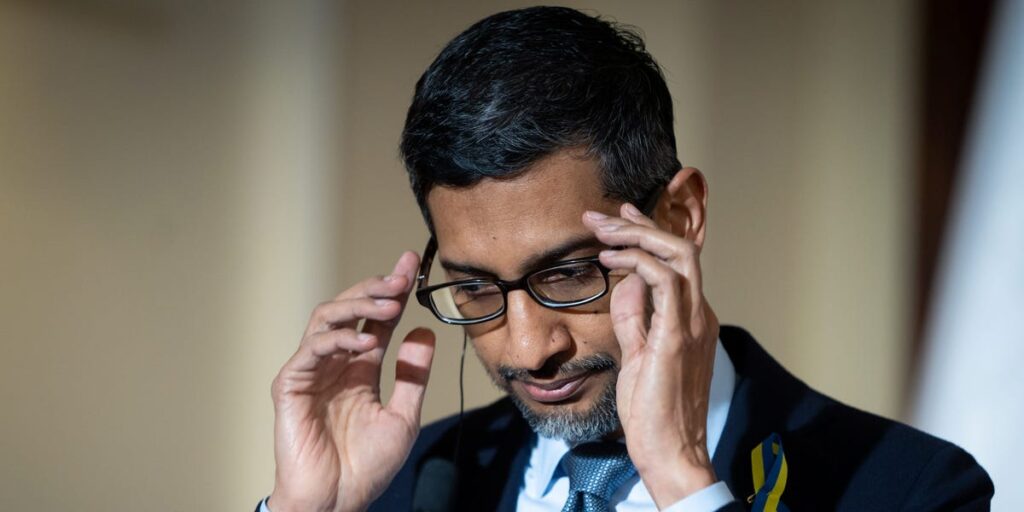

The tech giant saw strong growth in its core search business, which was up over 11% year-over-year, fueled in part by the strong performance of its AI overviews, CEO Sundar Pichai said in a statement.

Alphabet also reported strong growth for Google Cloud, which recently signed on OpenAI as a customer and grew by a third to over $13 billion in revenue for Q2.

“We had a standout quarter, with robust growth across the company,” Pichai said. “We are leading at the frontier of AI and shipping at an incredible pace.”

Despite the strong performance, investors were spooked over Google’s announcement that it would boost capital expenditures by $10 billion this year — bringing its total to a staggering $85 billion.

Most of those massive expenditures are for keeping Google at the leading edge of an increasingly competitive AI race.

Meta has upped the stakes with that announcement of a new “superintelligence labs” division and an aggressive hiring spree, reportedly making offers of $100 million or more to top AI researchers.

Here are the key numbers for Alphabet’s second quarter, compared to analysts’ estimates compiled by Bloomberg and LSEG:

Earnings per share: $2.31 vs $2.17 expected

Revenue: $96.42 billion vs $93.94 billion expected

Google advertising revenue: $71.34 billion vs $69.6 billion expected

YouTube advertising revenue: $9.79 billion vs $9.5 billion expected

Search revenue: $54.19 billion vs $52.7 billion expected

This story is developing. Check back for updates.