Terry Smith, the fund supervisor of the £23.7 billion ($30 billion) Fundsmith Equity Fund, is commonly known as Britain’s reply to Warren Buffett.

He’s coming off a 12 months through which he underperformed his benchmark, the MSCI world index, which he attributed to weak point in Estee Lauder

EL,

+1.26%,

McCormick

MKC,

-0.03%

and Mettler-Toledo

MTD,

+2.99%

amongst different holdings, although his annualized 15.3% return since 2010 is about 4 factors forward.

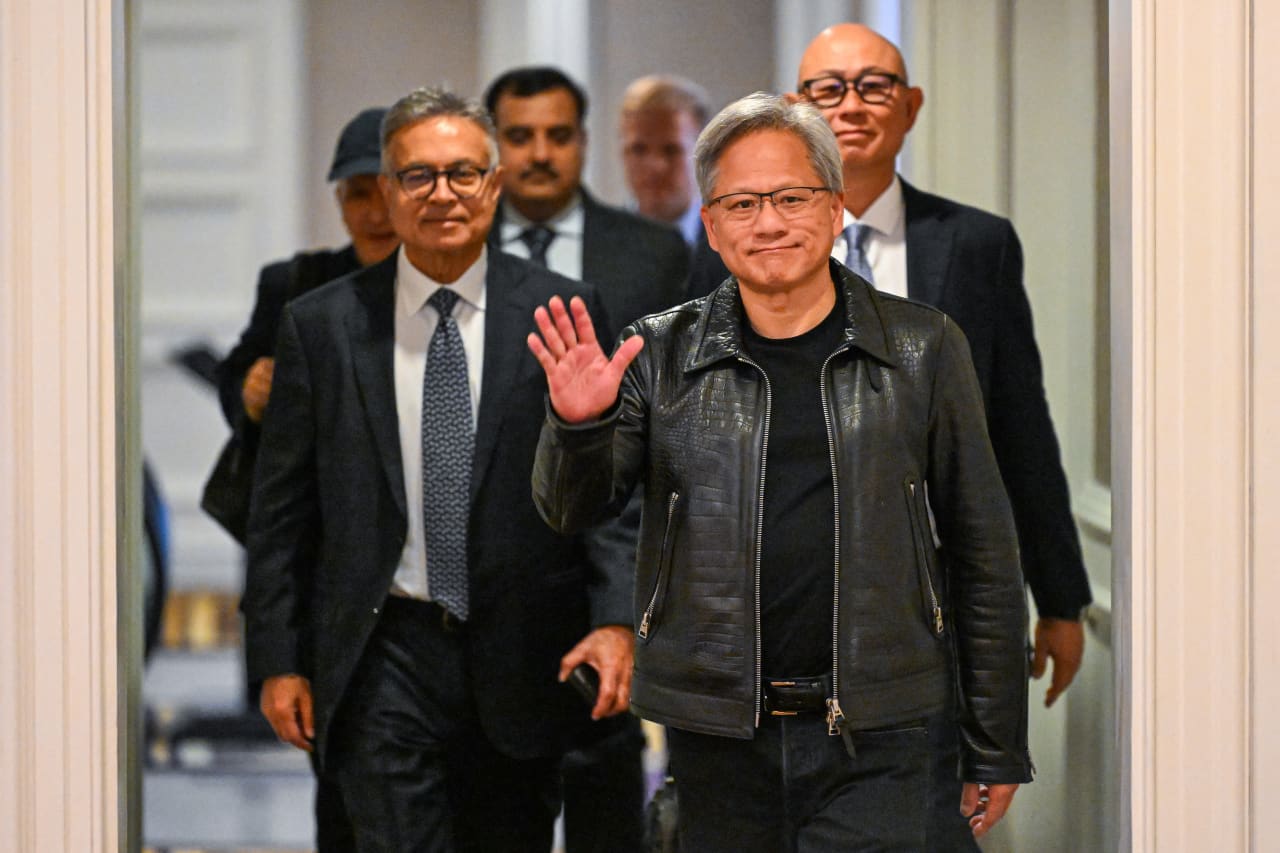

In Smith’s annual letter to traders, he mentioned the inventory market has determined that Nvidia

NVDA,

+6.43%

would be the winner in designing chips for synthetic intelligence and that Microsoft

MSFT,

+1.89%

would be the winner because the supplier of an AI mannequin.

“If it may well achieve this at this stage it might appear to me to be a break with custom. Think again to a number of the main know-how developments of the previous half century or so and the early leaders:

- Microchips: Intel

- Internet Service Providers: AOL

- Mobile Phones: Nokia

- Search Engines: Yahoo

- Smartphones: Research In Motion (Blackberry)

- Social Media: Myspace.”

Where are they now, he asks? (Intel is making an attempt to re-establish itself; Apollo Global Management owns each AOL and Yahoo after each fell on exhausting occasions; Nokia and Research In Motion are each out of the cellphone enterprise; and Myspace now not exists.)

It must be famous that Smith does maintain Microsoft, which after Meta Platforms

META,

+1.91%

was the second-best driver of efficiency for his fund. He mentioned even when the entire so-called Magnificent Seven fitted the fund’s funding standards, he wouldn’t need to personal all of them, owing to focus threat.