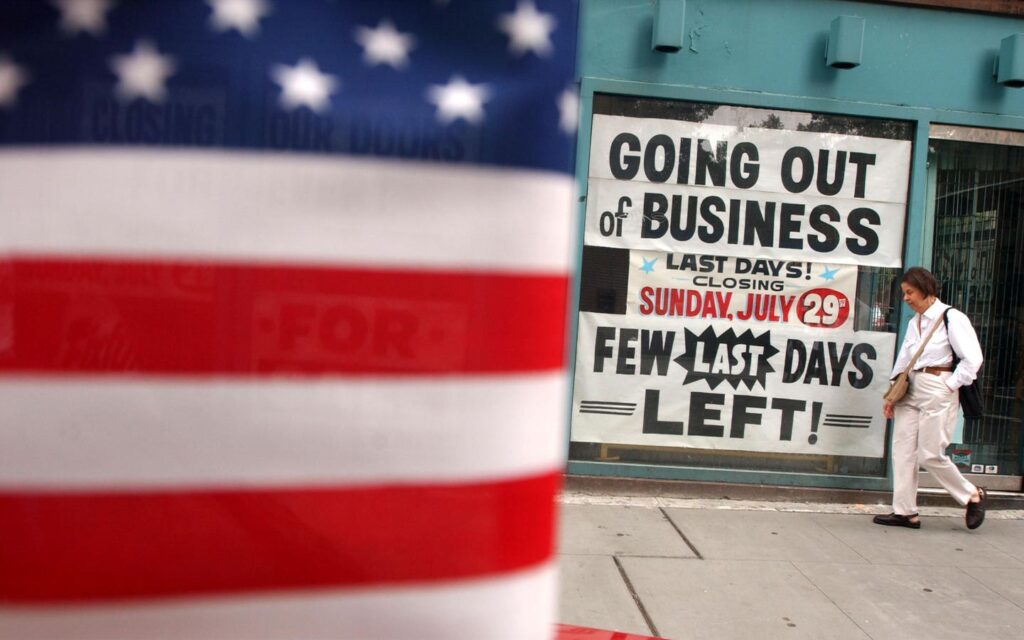

394877 06: A girl walks previous a closed retailer September 24, 2001 in New York City. While the financial system … [+]

Getty ImagesRecession.

For over a 12 months, we’ve been listening to warnings that the United States was on the verge of falling right into a recession.

Jamie Dimon, CEO of JPMorgan Chase

JPM

, is the most recent enterprise chief to assert {that a} recession is on the horizon.

Whether we enter a recession or not is for economists to debate. Today I need to focus on the steps you possibly can take proper now to arrange for one.

If we enter a recession, you’ll be prepared. If we don’t, your funds will probably be higher off. It’s a win-win state of affairs. Let’s get began.

Prepare Your Finances

Preparing for a recession requires a stable monetary plan. Here are some key steps to think about:

Build an Emergency Fund

In a recession, probably the most vital monetary threat is job loss. When the financial system contracts and companies earn much less, they begin shedding staff.

Having an emergency fund is crucial throughout a recession.

In regular situations, your emergency fund ought to cowl at the least three to 6 months of dwelling bills. If you suppose you could have a higher-than-average likelihood of being laid off, you need to enhance how a lot you’re saving in your fund. Having a 12 months or extra shouldn’t be a nasty thought in these occasions.

When the fears of a recession go, these are additional financial savings you possibly can make investments on your future. Put your emergency fund in a high-yield financial savings account so that you’re incomes curiosity.

Reduce Your Debt

Once you’ve expanded your emergency fund, work in direction of lowering high-interest debt. This will cut back your month-to-month bills and enable you to climate a recession extra shortly.

If you could have low-interest debt, resembling pupil loans or a mortgage, make the common funds. Depending on once you obtain the mortgage, these charges could also be decrease than what you may get from a financial savings account or CD.

If you possibly can, take into account consolidating higher-interest debt if you may get it right down to a decrease charge. It could also be troublesome in our charge surroundings, but it surely could possibly be value investigating.

Simplify Your Financial Systems

Now is a wonderful time to search for complexity in your monetary system and take steps to simplify them. Do you could have too many financial institution accounts? What about bank cards? Look to consolidate them so your system is simpler to grasp.

The last item you need to do in an emergency is must navigate pointless complexity.

Prepare for a Potential Career Change

As we talked about earlier, probably the most vital threat in a recession is dropping your job. If you don’t lose your job, you threat having your hours or shifts minimize or chances are you’ll be requested to take a pay minimize.

Regardless of what occurs, right here’s what you are able to do to arrange for a possible profession change:

Improve Your Skills

It’s by no means a nasty thought to enhance your expertise, whether or not studying new ones or creating current ones. If you’re employed in a discipline with certifications and accreditations, take into account pursuing them so that you’re a extra invaluable worker.

There could also be a chance to enhance your expertise by taking programs or attending workshops specializing in creating new expertise or enhancing current ones. This is not going to solely make yet another invaluable to their present employer but additionally make them extra marketable to potential employers.

Refresh Your Resume

When was the final time you refreshed or up to date your resume? If you have been like me, you’ll by no means have finished it whereas nonetheless working.

It’s unsurprising since you’re not in “job search mode,” so that you don’t suppose to replace it. Now is the right time to do it as a result of your work remains to be contemporary in your thoughts. Make it a follow to replace your resume each six to 12 months since you don’t know once you’ll want it.

Start Networking

You’ve most likely heard phrases like “the best jobs are not advertised” or “most jobs are filled by networking.” While the stats might not be correct, their thought holds advantage.

Networking performs a major position in hiring as a result of relationships are important. It’s not merely how many individuals you recognize however the closeness of these relationships.

You can develop your community by assembly extra individuals and rising these relationships over time. Attend business occasions, conferences, and seminars to fulfill new individuals and broaden your skilled community. This could not at all times result in a brand new job, but it surely doesn’t damage.

Job Security

Job safety is essential throughout a recession. One ought to take steps to make sure their job is safe, resembling performing properly at work, constructing a superb relationship with their boss, and proactively looking for new tasks or duties. It can be important to have a backup plan in case of job loss, resembling having a financial savings account or exploring different profession choices.

Build an Emergency Plan

Saving sufficient cash into an emergency fund is crucial, however what is going to you do when one thing occurs? What will you do if your organization lays you off?

The finest time to construct an emergency plan is earlier than you want it. You need to develop it at this time, whilst you’re calm and of sound thoughts, and never once you’ve simply been advised you’ll be fired in 2 weeks. That model of you’ll be panicking and emotional.

Start Budgeting Today

If you don’t have a good suggestion of your finances, now’s the time to make use of instruments to determine a finances. You want this as a result of it tells you precisely the place you’re from an revenue and bills standpoint.

If you do lose your job, you’ll know what bills you possibly can minimize at this time to start out saving cash. You can even make clever choices about these cuts so that you aren’t depriving your self of vital issues.

For instance, if I misplaced my job at this time, I’d cancel all our streaming leisure providers.

Learn the Unemployment Insurance Process

If you’re fired, you’ll qualify for unemployment insurance coverage in your state. Now is the time to learn to navigate that course of as a result of it’ll be 100 occasions tougher in case you attempt to do it after realizing you’ve been fired.

Learn what paperwork you want and see in case you can acquire any of these at this time. In Maryland, you want paperwork like paycheck stubs, W-2 varieties, and many others. You most likely have already got these; stick them in a folder so that you’re prepared.

Prepare for Other Emergencies Too

Losing your job is probably the most vital threat however not the one threat. Your automobile doesn’t know we’re anxious a few recession, so it might nonetheless have issues. Make certain you keep in mind the opposite potential dangers in your life and put together for these as properly.

A recession is a major financial threat but it surely’s hardly the one one we face each day.

When Recession Fears Pass

There will come a time when fears of a recession will go, and financial progress and prosperity are on the horizon. We gained’t know when that point will come, however I sense which you could inform based mostly on the temper and gossip in your organization.

When this occurs, the one step that you must take is to rethink how a lot you’re saving in your emergency fund. You can use these financial savings in direction of different financial savings targets or your retirement accounts.

Fortunately, each different step I’ve outlined on this article is helpful on your funds and one thing you need to preserve doing.