The troubled US-based Bitcoin (BTC) miner Core Scientific has filed its reorganization plan under Chapter 11 of the US bankruptcy law, and now plans to convert debt to equity for creditors.

The filing was made in the Southern District of Texas on Wednesday, and shows that the mining firm has agreed to a restructuring plan by a group of creditors to convert debt into 97% ownership of the company.

Under the plan, current Core Scientific shareholders would also retain some ownership of the company and thus avoid getting completely wiped out.

The plan would help Core Scientific eliminate debt of hundreds of millions of dollars, which would also drastically cut its annual interest expenses.

The firm said it is “seeking to build as much consensus as possible” in regard to the its new look after the bankruptcy proceedings, and noted that it remains optimistic about a future revival of its business.

The restructuring proposal is still subject to approval by the court.

Plan comes six months after bankruptcy

The reorganization plan is a result of negotiations with key stakeholders, and comes six months after the firm originally filed for bankruptcy protection.

At the time, the mining firm attributed its bankruptcy to a $7 million unpaid debt from bankrupt crypto lender Celsius Network.

It also said it had suffered a net loss of $434.8 million for the three months ending September 30, 2022, and had just $4 million in liquidity at the time of its bankruptcy filing.

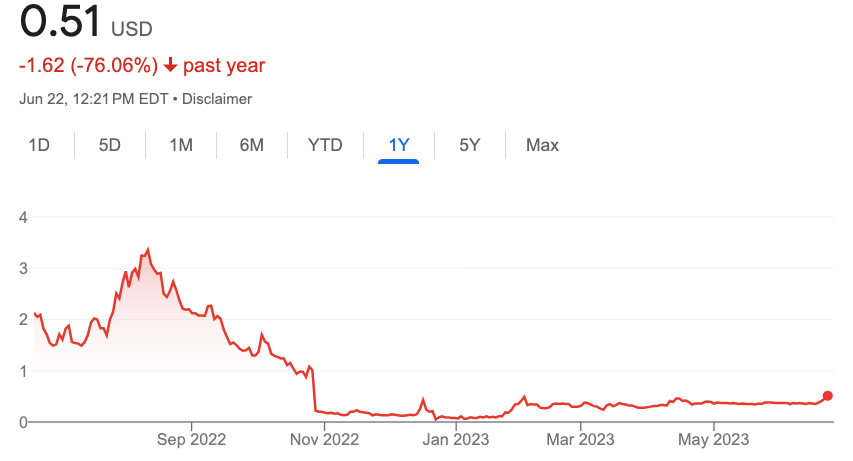

Core Scientific shares, which are traded on the over-the-counter (OTC) market under the ticker CORZQ, rose more than 11% on Wednesday, the day the plan was made public.

The surge continued on Thursday, when the stock rose 12%, helped by a generally bullish sentiment in the spot Bitcoin market.

Over the past 12-months, the stock still remains down by 76% to trade at a price of $0.51.