Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. A broad sell-off in US markets yesterday, led by big tech stocks including Nvidia, spread to Asian markets this morning. We have more updates below.

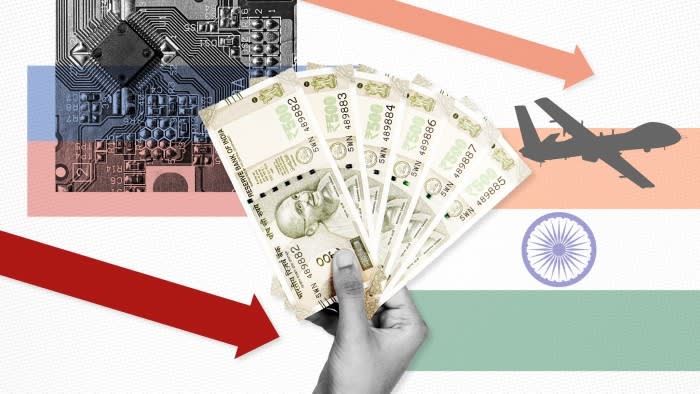

But first, we turn to Russia, where leaked correspondence seen by the Financial Times has revealed a covert trade channel with India and plans to build facilities in the country to secure components for Vladimir Putin’s war effort.

Moscow’s industry and trade ministry, which oversees defence production to support the full-scale invasion of Ukraine, drew up confidential plans in October 2022 to spend about Rs82bn ($1bn at the time) on securing critical electronics through channels hidden from western governments.

The plan, revealed in letters to a shadowy trade promotion body with strong links to the Russian security services, aimed to use “significant reserves” of rupees amassed by Russian banks from booming oil sales to India. It saw India as an alternative market to source crucial goods “previously supplied from unfriendly countries”.

Russia and its Indian partners targeted dual-use technologies — goods with both civilian and military applications — that are subject to western export controls, according to the documents, as well as western officials and two businessmen formerly involved in the trade. Moscow even envisaged pumping investment into Russo-Indian electronics development and production facilities, according to the files. We have more details here from the leaked exchange of letters.

Here’s what else I’m keeping tabs on today:

-

Economic data: France, Germany, Italy, the UK and Russia publish services purchasing managers’ indices, while the British Chambers of Commerce issues its economic forecast.

-

Russia: Vladimir Putin will meet leaders from Malaysia, China and Serbia in Vladivostok, which is hosting the Eastern Economic Forum.

-

Companies: Burberry and easyJet are set to move from the FTSE 100 to FTSE 250 when the indices are rebalanced. Insurer Direct Line releases its first results since an accounting error led it to overstate a measure of financial strength last month.

Join us in London for the annual FT Weekend festival this Saturday, featuring speakers including Sir Ian McKellen and UK health secretary Wes Streeting. FirstFT readers get a special discount — register here now.

Five more top stories

1. Big tech groups including Nvidia led a broad US stock market sell-off yesterday, as the S&P 500 suffered its worst day since a bout of global volatility early last month. The index dropped 2.1 per cent in the first trading session since the Labor Day holiday, while the chip giant closed 9.5 per cent lower. Here’s what prompted the market drop.

2. Ukraine’s wartime government is undergoing its biggest shake-up after a number of ministers resigned yesterday. President Volodymyr Zelenskyy said the reshuffle, which comes at a crucial point in the war, was part of an effort to “give new strength” to the country’s institutions. Here’s more on the “major reboot” in Kyiv.

-

Ukrenergo: The chief of Ukraine’s electricity grid was improperly ousted for “politically motivated” reasons, according to the company’s two foreign directors, who have quit over the move.

3. Exclusive: UK regulators will slash the maximum fraud losses that banks are forced to cover after strong pressure from ministers and fintech firms. The new maximum fraud payout is now expected to be set at just £85,000, according to people briefed on the plan, down from £415,000. Read the full story.

4. US homebuilders are facing their biggest credit crunch in more than a decade, with banks cutting lending for residential construction by more than 10 per cent. The slowdown could be because of lagging demand driven by weak housing sales, but could pick up as interest rates come down, an economist said. Here’s how the tightening of credit will affect the market.

5. The EU will not loosen post-Brexit curbs on UK touring musicians, according to internal briefing documents seen by the FT. The news is a blow to the Labour government, which has made a deal on touring artists one of its three main ambitions for a reset in relations with Brussels. Here’s why the bloc is “not prepared to consider” the scheme.

Our refreshed evening round-up Newswrap breaks down how the biggest stories relate to global economic and business trends, three times a week. Sign up for the newsletter.

The Big Read

The growing intersection of economic policy and national security in the US has many roots, but the biggest factor has been China. Fears about espionage and dual-use technologies have fused with economic nationalism to create an American mindset unrecognisable from its post-cold war free market approach — with dramatic implications for the future of the global economy.

We’re also reading . . .

-

Recep Tayyip Erdoğan: As the Turkish president’s popularity wanes, he has ratcheted up his condemnation of Israel and its Gaza offensive.

-

Federal Reserve: Rather than wait for weak labour market conditions, the onus is on the US central bank to forestall them, writes Andrew Law, chair of Caxton Associates.

-

UK-Israel ties: Sir Keir Starmer’s allies insist that it is the law and not politics that has driven recent moves, such as suspending some arms export licences.

-

European bonds: Europe’s hostile environment in corporate bonds freezes out small companies, and risks them heading for more opaque forms of lending, writes Katie Martin.

Chart of the day

Goldman Sachs has slashed its 2025 copper price forecast by a third, clouding the profit outlook for leading miners of the red metal. The Wall Street bank warned this week that an expected rally would not materialise as the Chinese property rout depresses demand for commodities.

Take a break from the news

Scientists are studying — and recreating — molecules that no longer exist, in a field known as “molecular de-extinction”, writes Anjana Ahuja. No, this isn’t about bringing back the dodo or the woolly mammoth, but rather trying to see whether their genomes hide long-lost molecules that offer solutions to our modern problems.

Additional contributions from Melody Abike Adebisi and Benjamin Wilhelm