Hello from Yifan in Silicon Valley, your #techAsia host this week.

It’s been a busy week for the chip industry. In addition to anxiously waiting for the long-threatened semiconductor tariffs, now floated at around 300 per cent by US President Donald Trump, the biggest AI and semiconductor industry barometer, Nvidia, reported earnings on Wednesday.

Despite logging another over 50 per cent year-on-year revenue jump, investors seemed dissatisfied. Nvidia shares dipped over 3 per cent during extended trading on Wednesday following the earnings release.

Part of the market reaction might be because Nvidia’s road to recovering the China market is proving to be tougher than first expected.

While investors cheered the deal Nvidia and other chipmakers made with the Trump administration — 15 per cent of their revenue in exchange for China export licenses — the Chinese government is putting some new roadblocks on Nvidia’s return by calling the H20 chip — a downgraded artificial intelligence chip specially designed for the Chinese market — a “security risk.”

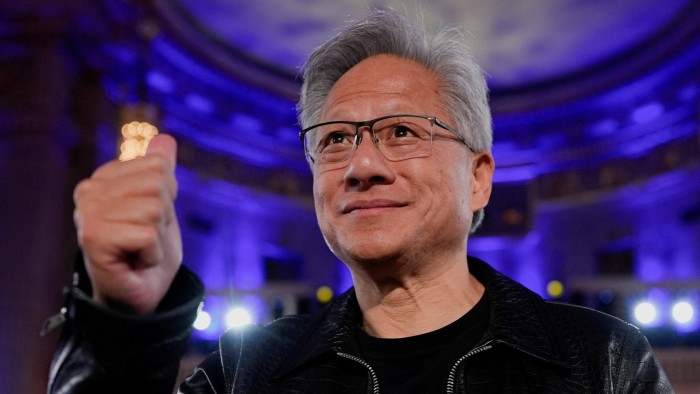

However, on Wednesday, Nvidia chief Jensen Huang said he still sees China being a $50bn market for the company this year as long as it can provide competitive products there, adding that bringing its advanced Blackwell graphics processing unit to the country is a “real possibility.”

It reminded me of a conversation I had with a venture capitalist from Beijing earlier this month about why the Chinese government is calling out H20 and Nvidia. In addition to the usual motive of promoting Chinese domestic chip supply, the VC suggested bashing H20 could also be the Chinese government’s way of pressuring Nvidia and Washington to open up Blackwell for export.

I chuckled and dismissed his “conspiracy theory” way of thinking, but now looking back, he might have been right.

Meanwhile, another US chip giant is also making headlines. Intel sold about 10 per cent of its shares to the US government for grant money from the Chips Act and another defence programme it was already promised by previous president Joe Biden’s administration before Trump returned to the White House.

The equity was not part of the deal under the original Chips Act terms, and I distinctly remember during a briefing with Biden’s Department of Commerce officials that they told me the companies would definitely get the money as promised because it was in an enforceable “contract.” But tech companies are learning that Trump makes his own arrangements with little regard to precedent.

Meanwhile, Trump has said that he wants to make more deals like the one with Intel, meaning big fish like Taiwan Semiconductor Manufacturing Co and Samsung Electronics or other smaller Chips Act awardees could be next.

$2bn to $5bn worth of geopolitics

For the three-month period ended July 27, Nvidia recorded $46.7bn in revenue, up 56 per cent on the year and 6 per cent higher from the previous quarter, the company announced on Wednesday.

For the third quarter, the company set expected revenue at $54bn, plus or minus 2 per cent. But the company’s outlook is clouded by uncertainties in China as it did not include any sales of its H20 — a downgraded artificial intelligence chip specially designed for the Chinese market — there in the estimate, Nikkei Asia’s Yifan Yu reports.

In addition to its 15 per cent revenue sharing deal with the administration of US President Donald Trump yet to be “codified,” Nvidia is also facing headwinds in China as Beijing recently summoned domestic tech giants including ByteDance, Alibaba, Tencent and Baidu to discuss their use of Nvidia chips over alleged security concerns.

“We’re still waiting on several of the geopolitical issues going back and forth between the governments and the companies trying to determine their purchases and what they want to do,” Nvidia Chief Financial Officer Colette Kress said on Wednesday’s earnings call.

But if the geopolitical issues are resolved, the company estimates reaping $2bn to $5bn in H20 revenue for the ongoing quarter, if not more.

SoftBank’s Son favoured by Trump

SoftBank’s Masayoshi Son has emerged as one of Donald Trump’s most favoured overseas investors, funding deals with OpenAI and Intel that have been welcomed in Washington, write the FT’s David Keohane, Leo Lewis, Michael Acton, Stephen Morris and Joe Miller.

Over golf, multiple meetings in the White House and mammoth investment pledges, Son has been building close ties to Trump ever since he was first elected. Son will need to maintain that relationship should he want control over more physical and politically sensitive assets.

The SoftBank boss has been eyeing up Intel’s foundry business — both the Japanese group and the US government are now shareholders — and has ambitious plans for an AI and robotics site in Arizona.

As his commercial efforts intensify, it is also the political side of his role in Washington that is causing concern for Japanese diplomats, cautiously trying to work the situation to their advantage but railing against Son’s position as a gatekeeper.

“The dilemma is that if [Son is] not close to Trump, he’s not usable,” said Kunihiko Miyake, visiting professor at Ritsumeikan University in Kyoto and a former Japanese diplomat. “If he’s too close, it’s dangerous.”

Up and up

Thanks to strong AI demand, total net profits at publicly listed companies around the world rose 7 per cent on year in the April-to-June quarter, led by US artificial intelligence and semiconductor companies, Nikkei’s Kensho Motowaki writes.

Data from roughly 25,000 listed companies in Japan, the US, Europe, China and elsewhere — including market forecasts in cases where earnings were not released — accounting for more than 90 per cent of global market capitalisation, showed total net profits rose to about $1.2tn, marking a fifth straight quarter of growth.

Some sectors in particular shined. Net profits in information technology surged 58 per cent, while electronics, including semiconductors, saw a 16 per cent increase in net profits.

In contrast, tariff-sensitive industries suffered, with automakers’ net profits dropping 37 per cent.

No China tools for 2-nanometer chips

Taiwan Semiconductor Manufacturing Co will not use Chinese tools in its latest 2-nanometer chipmaking production lines — the most advanced in the entire industry — which will go into mass production this year, Nikkei Asia’s Cheng Ting-Fang reports.

The move is to avoid any potential US restrictions that could disrupt 2nm production which is scheduled to start first in Hsinchu, Taiwan, followed by the southern Taiwan city of Kaohsiung. The Taiwanese chip titan is also building a third plant in Arizona to eventually make such chips.

TSMC’s decision was influenced by a potential US regulation that could prohibit chipmakers that receive American funding or financial support from using Chinese manufacturing equipment, sources said.

Suggested reads

-

The likely winners and losers from Trump’s threatened 300% chip tariff (Nikkei Asia)

-

Japanese media groups sue AI search engine Perplexity over alleged copyright infringement (FT)

-

China crackdown boosts lithium prices, but how long can the rally last? (Nikkei Asia)

-

Temu resumes direct shipping from China to US after Trump truce (FT)

-

China’s food delivery discount war chops Meituan profit by 97% (Nikkei Asia)

-

Sony is building a vast games empire: can it keep control? (FT)

-

Japan to invest $68bn in India over 10 years, including AI and chips (Nikkei Asia)

-

Chinese semiconductor shares surge after DeepSeek gives boost to homegrown chips (FT)

-

Japanese newspapers Nikkei and Asahi sue Perplexity AI over copyright (Nikkei Asia)

-

TikTok to lay off hundreds of UK moderators as it shifts to AI (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at [email protected]