Bitcoin spent the early weekend bouncing around but kept its footing above $116,000, with an intraday low near $116,024. That resilience extends a three-week recovery as risk appetite improves after the Federal Reserve’s 25 bps rate cut, which lowered the target range to 4.00%–4.25%.

Just as important, the Fed’s outlook softened: the median path points to 3.6% for 2025, easing further to 3.4% in 2026 and 3.1% in 2027. If those estimates hold, the market could still see two more 25-bp moves (or one 50-bp step) this year.

Lower expected policy rates tend to loosen financial conditions, and crypto—being the furthest out on the risk curve—often feels the upside first. Layer in steady institutional interest and corporate treasury attention, and you’ve got a constructive backdrop for BTC.

Bitcoin (BTC/USD) Technical Outlook

On the 4-hour chart, Bitcoin price prediction seems bearish as BTC continues to track a rising channel. After completing an ABCD advance, price faded from the wedge top near $118k–$119k and is now grappling with a supply band at $116.2k–$116.8k.

The 50-SMA ($116,050) is capping rebounds intraday, while the 200-SMA (~$113,350) and a prior shelf at $114,400 define demand.

Candlesticks show spinning-top hesitation (small bodies, upper wicks), and RSI ~47 confirms cooling momentum, not capitulation.

The structure of higher lows remains intact unless $113,300 breaks—only then does the risk skew toward a deeper mean-reversion.

Key levels

- Support: $114,400–$114,600; $113,350–$113,300

- Resistance: $116,200–$116,800; $117,980; $119,150

Bitcoin (BTC/USD) Trade plan and risks

For beginners, patience near support beats chasing into resistance. Consider a buy-the-dip only if price revisits $114,400–$114,600 and prints a bullish hammer or engulfing on the 4H close—evidence that buyers absorbed supply. Place a stop below $113,200 (under the 200-SMA and last swing low) to keep risk defined.

First take-profit sits at $116,600 (mid-supply/50-SMA), with a second target at $117,980; if momentum flips decisively—think three white soldiers or a strong break-and-hold above the blue zone—leave a runner toward $119,150.

If instead you see three black crows driving a close below $113,300, step aside. That would signal the channel has failed and opens room toward $112,100. Big picture, the Fed’s gentler path and growing institutional demand keep the upside case alive, but the chart still demands confirmation above $116.8k for the next leg higher.

A genuine “surprise effect” could arrive if incoming data nudges the Fed even faster—fuel for a momentum pop—yet disciplined entries and exits remain your best edge.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

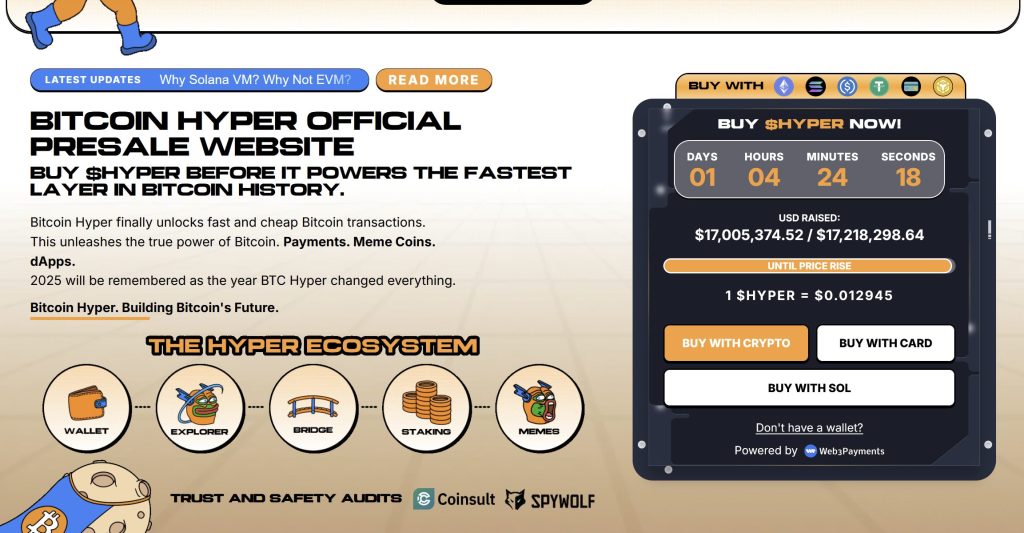

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.2 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012945—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: The Fed Just Cut Rates – Is a Surprise Effect About to Jolt BTC? appeared first on Cryptonews.