Bitcoin trades at $113,078, with daily volume topping $49 billion and a market cap of $2.25 trillion. Despite a modest 0.04% dip over the last 24 hours, the long-term outlook is drawing more attention than the day-to-day moves.

Bitwise CIO Matt Hougan believes Bitcoin could soar to $1.3 million by 2035. His forecast isn’t based on speculation but on an institutional model that considers government debt, gold’s role as a store of value, and the rapid inflow of Wall Street capital via exchange-traded funds (ETFs).

Hougan argues that Bitcoin has shifted from a fringe asset to a legitimate building block of global portfolios, sitting alongside equities, bonds, and real estate.

The launch of spot ETFs has removed barriers to entry for traditional investors, while regulators, once resistant, have begun to carve out clearer rules for crypto adoption.

Bitcoin vs. Gold as a Store of Value

A central theme of Hougan’s outlook is Bitcoin’s potential to rival gold. If Bitcoin captures even 25% of gold’s $14 trillion market, it could fundamentally reprice the cryptocurrency.

Combined with rising sovereign debt levels U.S. debt surpassed $34 trillion in 2025—investors are searching for alternatives that preserve value against inflation and fiscal uncertainty.

Other drivers include:

- ETF adoption: Record inflows show sustained institutional demand.

- Geopolitical uncertainty: Conflicts and currency risks push investors toward hedges like BTC.

- Scarcity factor: With only 21 million coins ever to be mined, supply limits amplify demand shocks.

Short-Term Price Forecast and Risks

From a technical standpoint, Bitcoin is consolidating after breaking its ascending channel earlier this month. Price is retesting the 200-SMA at $114,059, with $114,709 acting as a ceiling.

Candlestick patterns suggest hesitation, with spinning tops and small-bodied candles signaling indecision.

The RSI at 50 shows stabilization but no clear bullish divergence, while the 50-SMA remains below the 200-SMA, signaling short-term caution.

A confirmed breakout above $114,700 could pave the way toward $116,150 and $117,808, while failure risks a decline to $111,095 or even $108,424.

For traders, the setup remains binary:

- Bullish case: Close above $114,700 unlocks targets at $116,000–117,800.

- Bearish case: Drop below $111,095 opens downside to $109,771.

Long-term, Hougan’s thesis remains intact: institutional adoption is only beginning. If the floodgates fully open, Bitcoin’s climb toward seven figures may no longer sound unrealistic.

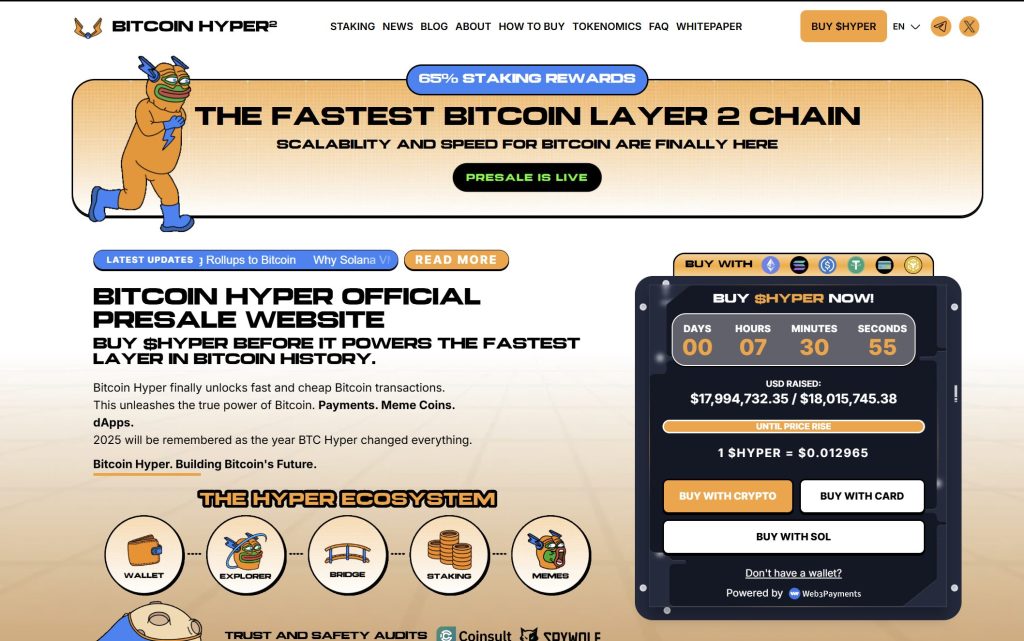

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.9 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012965—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Institutional Floodgates Are Opening – BTC Can Go Much Higher Than $1 Million appeared first on Cryptonews.