Coinbase’s earnings were truly box office in the third quarter — surging by over 400% compared with the same period last year.

But over on Crypto Twitter, it isn’t the financials that are grabbing headlines… it’s what CEO Brian Armstrong did at the end of a call with analysts. He said:

“I was a little distracted because I was tracking the prediction market about what Coinbase will say on their next earnings call. I just want to add here the words Bitcoin, Ethereum, blockchain, staking and Web3 — to make sure we get those in before the end of the call.”

Bets had been placed on what would be mentioned across Polymarket and Kalshi, with tens of thousands of dollars staked. Thanks to Armstrong, anyone who voted “yes” would have made a tidy profit.

This kind of exposes one of the biggest problems with Polymarket: if someone in a position of power realizes that wagers are being taken on their actions, it could change their behavior. (It’s important to stress that there’s no suggestion of insider trading here — and it’s doubtful that Armstrong has cashed in from this stunt.)

While some saw the funny side, describing the entrepreneur as a “legend,” others have openly wondered whether this amounts to market manipulation. Cinneamhain Ventures partner Adam Cochran wasn’t amused either, writing:

“If I were the CEO of an exchange with CFTC-regulated products, I would simply not purposefully manipulate the outcome states of prediction markets on other CFTC-regulated exchanges during an earnings call… and then post about it on Twitter.”

Let’s get back to the main event itself: Coinbase’s results for the third quarter of 2025. Net income in the three months to the end of September stood at a healthy $432.6 million — far beyond the $75.5 million over the same period in 2024. That’s the equivalent of $1.50 a share, far beyond the $1.10 anticipated by some analysts.

Revenue was also greater than expected at $1.8 billion, with $1 billion of this linked to transactions as trading volumes spiked — with users returning to the exchange to capitalize on Bitcoin and Ether hitting new record highs.

In a letter to shareholders, Coinbase revealed that it continues to increase the number of cryptocurrencies that can be bought and sold through its platform — meaning it now represents 90% of the industry’s total market capitalization.

On that ever-so-controversial earnings call, Armstrong declared it was a “great quarter” — and Coinbase’s core business is “incredibly strong.” He also stressed that the exchange held up well when the markets crashed back on October 10, with billions of dollars in liquidations as Binance suffered technical difficulties.

“We actually operated very well without disruption. And we didn’t have any downtime or degraded latency around market data or anything like that. So that was a result of a lot of investment we’ve made over the last year or two in doing load testing … several major exchanges experienced extended outages during that time and we didn’t have any.”

Armstrong repeated his ambition of transforming Coinbase into the “Everything Exchange” — and remains firm in his belief that all assets will eventually migrate on-chain. He went on to confirm that a special presentation is going to be held on December 17th, where Coinbase will reveal the products that it’s been working on in the second half of this year.

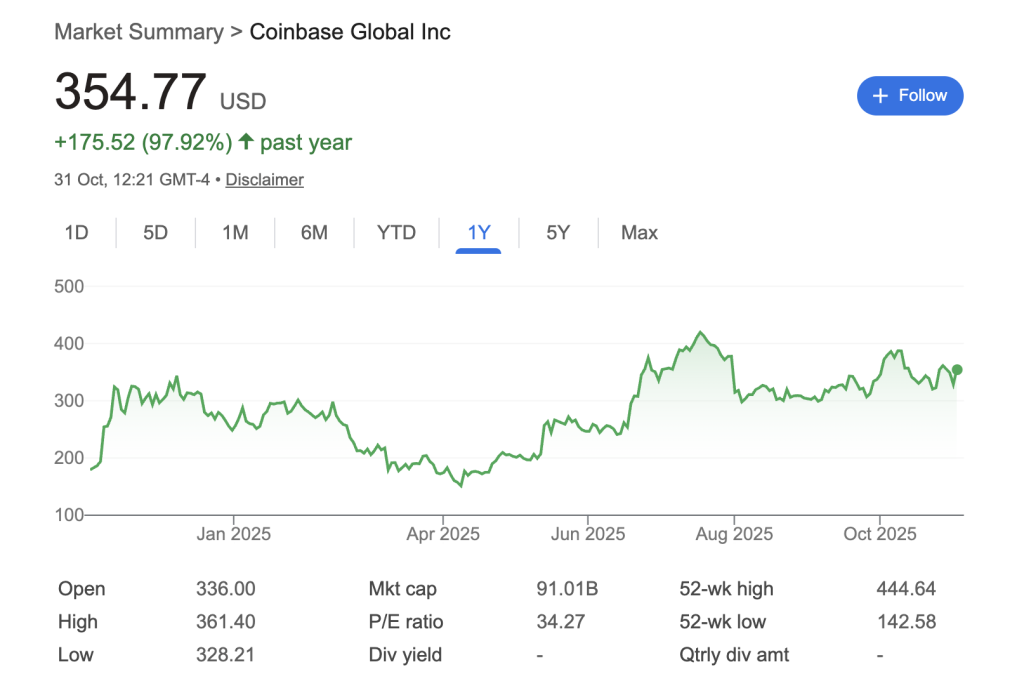

Coinbase’s share price jumped during Friday’s trading session on Wall Street — up by 8.8% at the time of writing. COIN has also jumped by 75.8% over the past six months, and is now double what it was worth a year ago.

However, the big challenge now is what happens next. The financial performance of top exchanges can often fluctuate wildly from one quarter to the next, as they rely on top assets showing bullish momentum. With BTC on the brink of closing this month down 2.7% — its first October loss since 2018 — Coinbase may struggle to sustain these impressive revenues.

Nonetheless, some analysts still believe Coinbase’s stock has some upside potential, with one setting a target of $421 per share, a rise of about 19% from current levels.

The post Coinbase Results Overshadowed By Brian Armstrong Stunt appeared first on Cryptonews.