Ethereum co-founder Vitalik Buterin says decentralized finance (DeFi) has reached a turning point, one where on-chain savings are not only viable but beginning to rival traditional banks.

Speaking in a pre-recorded address at a Dromos Labs event on Wednesday, Buterin said he’s “encouraged” by how far DeFi on Ethereum has come in terms of security, maturity, and usability.

“We’ll be seeing, I think, a growth in more and more cases of people, institutions, and all kinds of users around the world actually using this as their primary bank account,” he said. “DeFi as a form of savings is finally viable.”

Can DeFi Become Your Next Bank Account? Vitalik Buterin Believes It’s Time

Buterin’s remarks reflect a broader evolution in the sector that he believes is shifting from speculation toward stability.

Ethereum-based DeFi was previously associated with high-risk lending, complex yield strategies, and frequent protocol exploits. But Buterin said the difference between 2025 and the early DeFi era of 2020 or 2019 is “night and day.”

Despite acknowledging recent breaches, including the multi-million-dollar Balancer hack earlier this month, he said smart contract security has improved substantially.

Blockchain analytics firm Elliptic noted that while crypto losses in 2025 technically “dwarf” last year’s, much of that figure stems from the historic Bybit hack in February, rather than DeFi’s structural weaknesses.

Buterin emphasized the “walkaway test,” a simple measure of DeFi safety ensuring users can always recover their funds independently.

He urged developers to keep Ethereum’s founding principles at the core: open-source code, interoperability, and censorship resistance.

He also called on builders to design applications with both the Ethereum mainnet and Layer 2 networks in mind. With new tools such as Lighter, which has reached over 10,000 transactions per second, Buterin said scalability is improving on both L1 and L2.

“With the right kind of engineering, that level of scaling is open to anyone to build today,” he added.

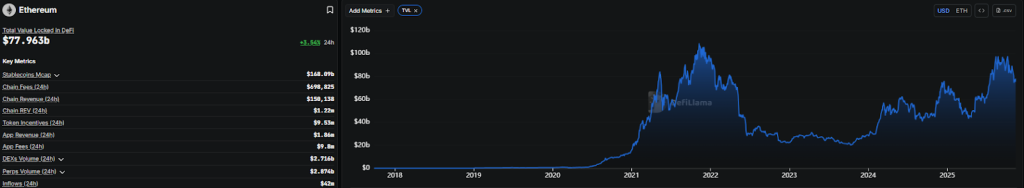

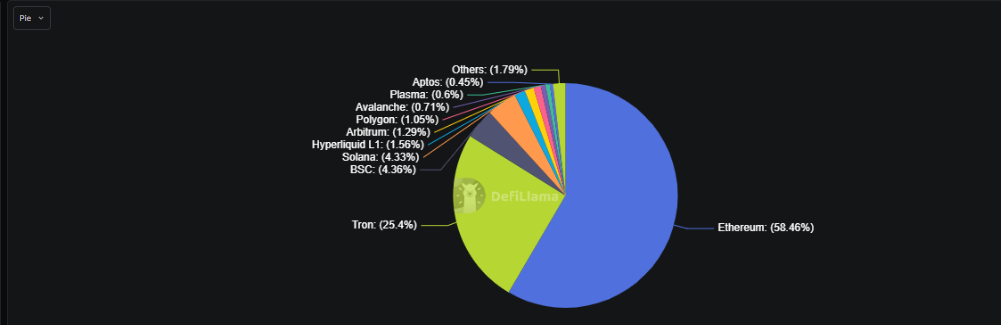

Ethereum’s DeFi ecosystem now processes over $1.9 trillion in transactions per quarter, with a $77 billion market and over 312 million active users as of mid-2025.

Average DeFi savings yields hover around 8.2%, compared with roughly 2.1% in traditional banking.

Although operational costs in DeFi remain lower, the sector still faces ongoing risks, including $1.1 billion in fraud and hacks reported in the first half of 2025.

By contrast, global banks manage about $370 trillion in assets and process $405 trillion per quarter, but their slow settlement times and higher fees make DeFi’s permissionless structure increasingly attractive to users seeking autonomy and speed.

Ethereum Goes Back to Basics with Buterin’s ‘Trustless Manifesto’

Buterin’s optimism follows his September essay promoting “low-risk DeFi” as Ethereum’s sustainable economic backbone, a form of decentralized banking that could support the network much like Google Search funds Google’s ecosystem.

He argued that stablecoin lending and flatcoins pegged to inflation indices or currency baskets could stabilize Ethereum’s economy while preserving its values.

Buterin wrote that blue-chip DeFi protocols like Aave, offering around 5% stablecoin yields, provide the low-risk finance Ethereum needs.

Earlier today, Buterin and the Ethereum Foundation published “The Trustless Manifesto,” warning developers against compromising decentralization for convenience.

The document criticized trends like centralized sequencers in Layer 2s and hosted RPC nodes, arguing that “decentralization is not destroyed by capture, but by convenience.”

It proposed three “laws” for trustless design: no critical secrets, no irreplaceable intermediaries, and no unverifiable results.

Meanwhile, Ethereum continues to strengthen its technical and institutional foundations. The network hosts over 75% of tokenized real-world assets and 58% of the global supply, with firms like BlackRock, Securitize, and Ondo Finance deploying tokenized Treasury products on-chain.

Its Layer 2 networks now secure more than $50 billion in value, while privacy and scaling work has accelerated through the Ethereum Foundation’s new 47-member Privacy Cluster.

The post Vitalik Buterin Says Ethereum DeFi Now Rivals Banks — On-Chain Savings Finally Safe appeared first on Cryptonews.