U.S.-focused digital asset investment funds recorded their first weekly withdrawals in a month, losing $952 million after delays tied to the long-delayed CLARITY Act rattled investors and reignited worries about regulation.

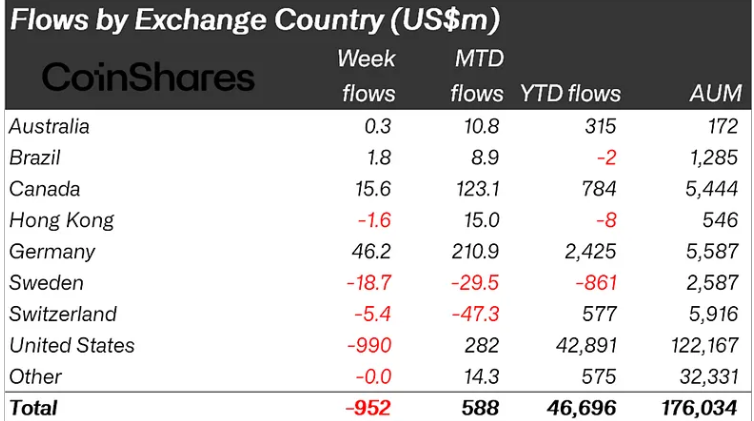

According to data from CoinShares, digital asset investment products saw $952 million in net outflows over the past week, marking the first negative flow since late November.

The retreat was largely driven by delays linked to the Digital Asset Market Clarity Act, widely referred to as the CLARITY Act, which has extended regulatory uncertainty for crypto firms operating across America.

Fears of ongoing selling from major holders further dragged on sentiment.

Ether and Bitcoin Lead Crypto Fund Outflows While SOL and XRP Survive

The outflows were heavily centered in the U.S., which made up $990 million of that total.

This was only partially offset by inflows from Canada and Germany, where investors added $46.2 million and $15.6 million, respectively.

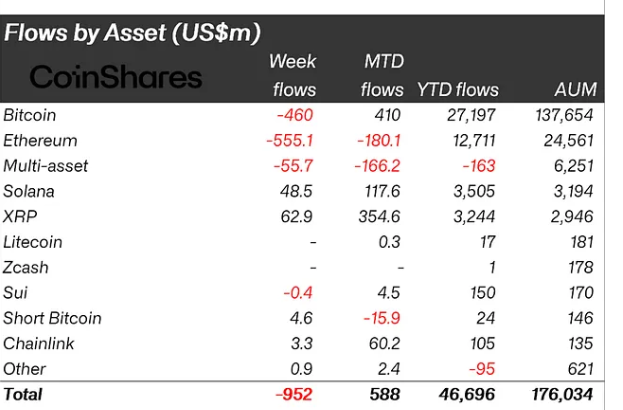

Ethereum bore the brunt of the selling, recording $555 million in outflows.

Analysts noted that Ether’s sensitivity to regulatory developments is higher than most assets, given its central role in decentralized finance and staking-related products that could be directly affected by U.S. market structure rules.

Despite the recent pullback, Ethereum investment products have still attracted $12.7 billion in inflows so far this year, well above the $5.3 billion recorded over the same period in 2024.

Bitcoin products followed closely behind, recording $460 million in outflows. While Bitcoin still leads the market in absolute terms, year-to-date inflows of $27.2 billion remain below last year’s $41.6 billion.

Total assets under management across all crypto exchange-traded products now stand at $46.7 billion, down from $48.7 billion at the same point in 2024, making it unlikely the sector will surpass last year’s totals.

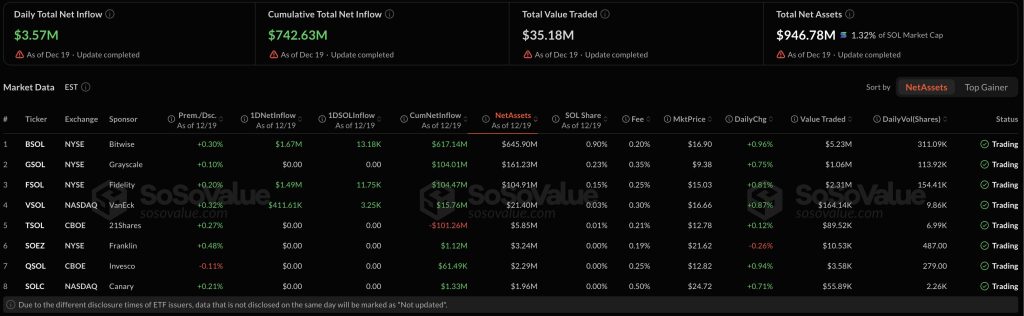

U.S. spot Bitcoin ETFs reflected similar pressure, posting a weekly net outflow of $497.05 million as of December 19, even as cumulative inflows remain elevated at $57.41 billion.

In contrast, Solana and XRP continued to attract fresh capital. Solana investment products recorded $48.5 million in inflows, while XRP products added $62.9 million.

The trend was mirrored in U.S. spot ETFs, where XRP funds posted $82.04 million in weekly inflows, and Solana ETFs added $66.55 million over the same period, extending a multi-month pattern of steady accumulation.

Crypto Market Bill Faces Fresh Delay as Senate Kicks Vote to January

The market reaction unfolded as lawmakers confirmed further delays to the CLARITY Act.

On Thursday, White House AI and crypto czar David Sacks announced that the Senate markup for the long-awaited Clarity Act will take place in January 2026, delaying previous expectations that the bill would reach President Trump’s desk before the end of 2025.

The House passed the legislation in July, but the Senate has yet to complete its review, with the timeline disrupted by a record 43-day government shutdown in October and November.

The bill is designed to clarify whether digital assets fall under securities or commodities law and to define the roles of the Securities and Exchange Commission and the Commodity Futures Trading Commission.

While supporters argue it would reduce uncertainty and establish clearer compliance pathways, progress has slowed amid political and procedural challenges.

Senate Banking Committee Chair Tim Scott and Agriculture Committee Chair John Boozman are expected to lead the markup, which could still face amendments before reaching a full vote.

Senator Cynthia Lummis had previously suggested the bill could reach President Donald Trump’s desk before the end of 2025, but that outlook now appears less certain as election-year pressures begin to weigh on bipartisan negotiations.

The post U.S. Crypto Funds Shed $952M as Clarity Act Delay Sparks Panic – But These 2 Alts Survive appeared first on Cryptonews.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.