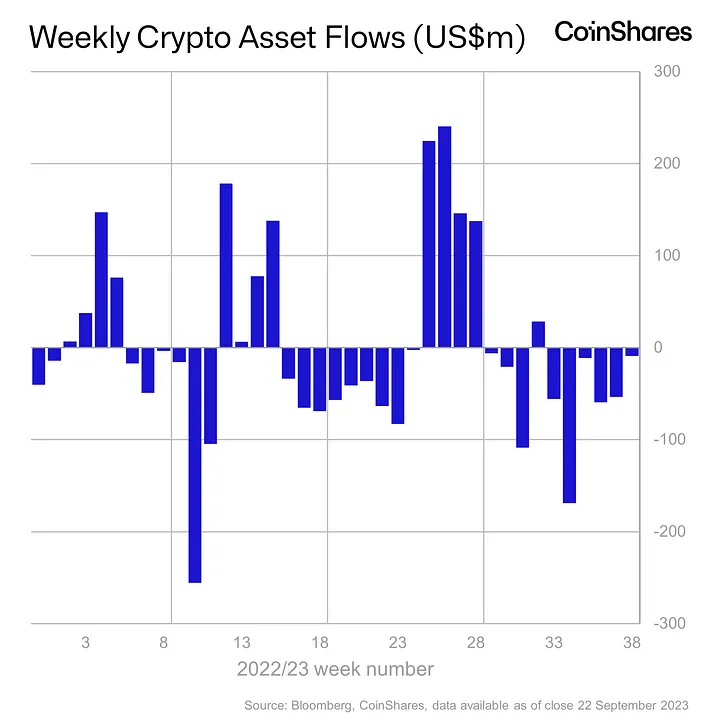

Cryptocurrency funding merchandise recorded outflows for the sixth consecutive week with market leaders Bitcoin (BTC) and Ethereum (ETH) main the pack.

A brand new CoinShares market report exhibits whole outflows from digital asset merchandise totaling $9 million with BTC accounting for $6 million in its third consecutive week of outflows whereas main altcoin ETH in its sixth consecutive week of outflows posted $2.2 million.

As the crypto winter ravages the area, volumes have been additionally considerably decrease at $820 million for the week than the yearly common of $1.3 billion

As the crypto winter ravages the area, volumes have been additionally considerably decrease at $820 million for the week than the yearly common of $1.3 billion

Short-bitcoin noticed whole exits hitting $2.8 million far under its $15 million excessive this month with 78% of belongings below administration (AUM) withdrawn in the final 22 weeks.

Multi-asset merchandise are additionally in slight losses this previous week with whole outflows for the yr tapping $32 million.

Meanwhile, amidst losses from BTC and ETH, altcoins like Ripple (XRP) and Solana (SOL) recorded inflows of $0.66 million and $0.31 million following investor confidence in the opposite altcoins.

Bull’s eye development amid chaos

At press time, the worth of Bitcoin trades at $26,337, approach under this yr’s $31,000 excessive after the BlackRock ETF utility adopted by a number of companies making comparable strikes exhibiting a renewed institutional funding.

Despite this, bulls are eager on a change in the established order and this may be seen in the week-on-week stories to date.

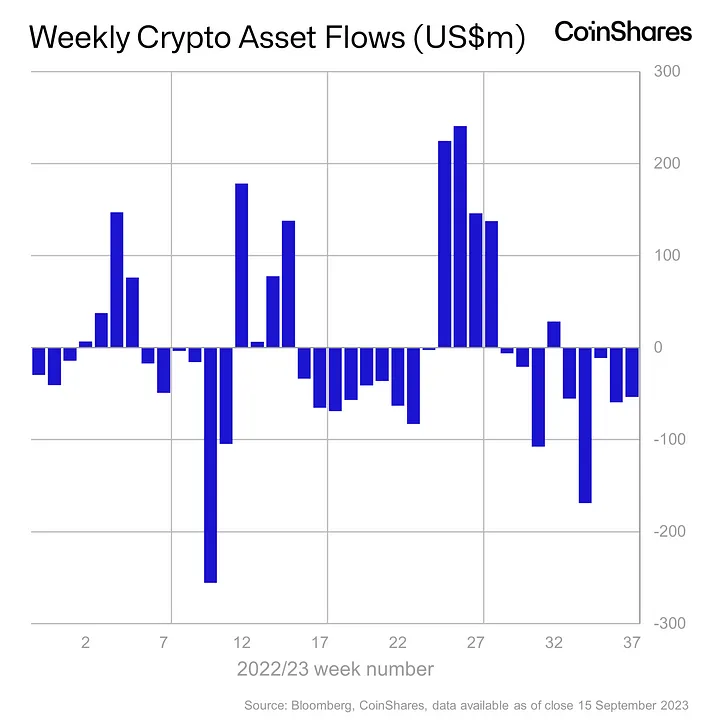

In the earlier report, weekly outflows in funding merchandise totaled $54 million with a staggering eight weeks sum of $455 million. BTC additionally led the pack with $45 million in exits, 85% of the whole quantity.

Ethereum alternatively recorded restricted outflows of $4.8 million with the United States posting the very best variety of exits.

Ethereum alternatively recorded restricted outflows of $4.8 million with the United States posting the very best variety of exits.

Europe takes the torch

It has been extensively famous that the UK market has been in a little bit of chaos following unclear guidelines and a number of court docket instances. This actuality is encapsulated in the report.

Per the information, Europe recorded inflows of $16 million in digital asset merchandise whereas United States traders withdrew $14 million from the market pointing to a divergence in latest funding narratives in each areas.

In whole month-to-month investments, outflows in the US stay greater at $67.5 million whereas Europe recorded $24 million with Germany, Sweden, France, and Switzerland most notable.

The main driver of this development stays clear laws in Europe following the signing of the Market in Crypto Assets (MiCA) regulation.

Recently {industry} executives have criticized the bottleneck and enforcement by court docket method of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission.

Pro-market coverage watchers have additionally reiterated a possible migration of web3 expertise away from the US to industry-friendly jurisdictions.

This month, Coinbase introduced a worldwide growth plan itemizing areas just like the UK, Europe, Brazil, and Hong Kong as “near-term priorities” whereas criticizing regulators in the United States.