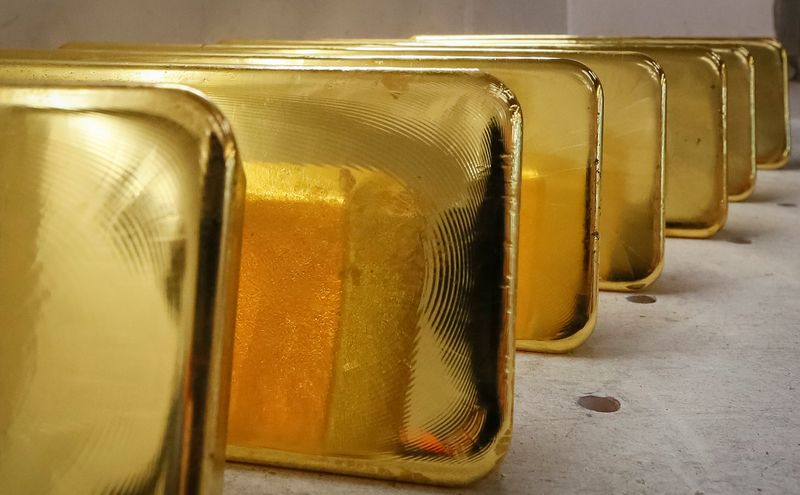

© Reuters

Investing.com– Gold costs fell under key ranges in Asian commerce on Tuesday, as merchants pivoted into the greenback earlier than U.S. inflation knowledge due later within the day, which is broadly anticipated to find out the trail of rates of interest.

The yellow metallic noticed a heavy diploma of revenue taking up to now two weeks, which pushed costs to an over three-week low because the prospect of higher-for-longer U.S. charges dampened gold’s outlook.

fell 0.1% to $1,944.71 an oz., whereas expiring in December fell 0.1% to $1,948.25 an oz. by 00:32 ET (05:32 GMT).

US CPI in focus, greenback and yields rise

Gold costs had been pressured by energy within the and as markets stored mainly to rate-sensitive belongings earlier than key inflation knowledge due later within the day.

The studying is anticipated to indicate some cooling in inflation via October, after inflation rose previous expectations for the previous two months. The studying additionally comes shortly after a string of Federal Reserve officers warned that sticky inflation might give the financial institution extra impetus to boost rates of interest additional.

Higher-for-longer charges are anticipated to strain gold, provided that they enhance the chance value of investing in bullion. This commerce battered gold over the previous 12 months, and has additionally stored its outlook largely unsure.

Still, expectations of a slowdown within the world economic system have stored alive some bidders for the yellow metallic. Data due later within the day is anticipated to indicate the euro zone within the third quarter.

The ongoing Israel-Hamas conflict can be anticipated to feed some protected haven demand for gold, though merchants started pricing in a a lot decrease threat premium on the yellow metallic over the previous two weeks.

Copper pressured by weak China knowledge

Among industrial metals, copper costs fell on Tuesday, dealing with continued strain from weak Chinese financial knowledge.

expiring December fell 0.3% to $3.6603 a pound.

China, the world’s largest copper importer, noticed a extreme decline in via October, knowledge confirmed on Monday. The studying indicated that liquidity ranges within the nation had been dropping off regardless of current stimulus measures from the federal government.

More financial cues from the nation are on faucet this week, with , and readings due on Wednesday.