Hello everyone, this is Cissy from Hong Kong.

While Tuesday saw shares of Nvidia plunge again amid reports that the US Justice Department had subpoenaed the world’s top chipmaker (reports that the company later disputed), that is far from the only chip news in recent days, as you’ll see in this week’s issue.

Since Washington began placing curbs on Beijing’s access to cutting-edge chips, it is no secret that Chinese companies have been exploring loopholes to get around those restrictions, including procuring through small distributors and renting Nvidia-powered servers at overseas data centres from cloud providers including Google and Microsoft.

Crypto platforms are also joining the “catch me if you can” game. Earlier this week, I attended a workshop organised by a virtual assets exchange in Hong Kong. This exchange is gathering and “tokenising” idle computing power globally in order to sell it to small and midsize companies, including customers from China, while masking their identities.

The practice is not exclusive to this exchange but is widely known in the cryptocurrency industry. Other decentralised GPU firms have publicly promoted services in recent months that offer access to Nvidia-powered computing capacity at cost-effective prices.

What they are doing reminds me of an old Chinese saying that goes, “While the priest climbs one foot, the devil climbs 10,” meaning people will always find a way to circumvent rules.

Investment incentives

Vietnam is seizing on the opening created by the China-US tech war. The communist country is drawing up a list of perks, from tax breaks to fast-track export processes, to woo investment from chip companies, writes Nikkei Asia’s Lien Hoang.

According to Hanoi’s proposed Digital Technology Industry Law, incentives would include letting businesses write off 150 per cent of their research expenses, as well as grants, expedited visas and 10 years of rent-free land use.

The draft law also includes expedited paperwork and tax holidays on imported materials and personal income, applied to projects worth $160mn or more.

However, Vietnam faces a slew of challenges in implementing the proposed scheme, including finding enough cash, power and skilled labour. On top of that, Vietnam is one of a handful of countries where the US bans Nvidia from exporting some high-end chips out of fear they will wind up across the border in China.

Huawei’s hiccups

After the US banned export of high-performance AI processors to China, Chinese tech giants including Baidu, Tencent and iFlytek have rushed to buy Huawei’s alternative silicon, writes the Financial Times’ Eleanor Olcott, Ryan McMorrow and Tina Hu.

But adoption of the chip has been hampered — according to its customers and staff — by issues with its software platform Cann.

Nvidia has a stranglehold over AI chips in large part because of the superiority of its Cuda software platform, which is easy and efficient to use.

To ease the transition, Huawei has been deploying its massive engineering workforce to help customers transfer over to its rival chips. But industry insiders say there is a long way to go before it can replace the incumbent player.

Big spender

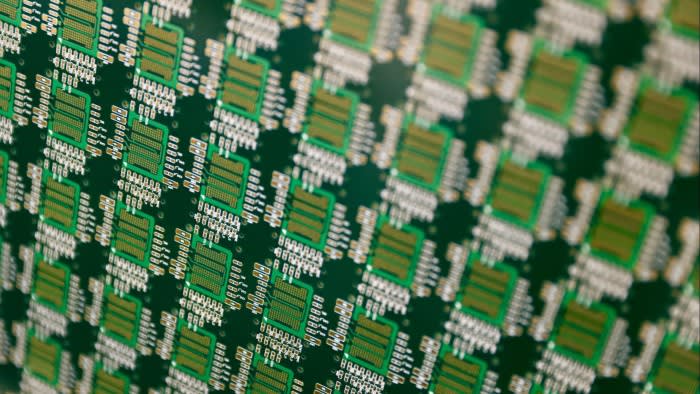

The clock is ticking on China’s chip self-reliance campaign. In the first half of the year, amid fear over further Western export restrictions, China spent a record $25bn on chipmaking equipment, more than South Korea, Taiwan and the US combined, according to global chip industry association SEMI.

Investment in semiconductor equipment is an important indicator of future market demand and a barometer of industry prospects, write Nikkei Asia’s Cheng Ting-Fang and Lauly Li.

China is also expected to be the biggest investor in constructing new chip factories, which includes the purchase of equipment, with total spending expected to hit $50bn for the full year.

Beijing’s record investment in chip production equipment is driven not only by its top-tier chipmakers like Semiconductor Manufacturing International Corp, but also growing momentum from its small and midsize chipmakers. The spending is expected to grow another 20 per cent next year, and a recent teardown shows that China’s chip capabilities are just three years behind TSMC.

Step on the gas

Taiwan’s top chipmakers are planning to localise the supply of neon gas, a critical material in the lithography step of chip manufacturing, by 2025, industrial sources told Nikkei Asia’s Cheng Ting-Fang.

The move comes at a time when the global supply of the gas is still feeling the effects of Russia’s invasion of Ukraine, which pushed prices up by as much as 20 times at one point. Leading companies like TSMC and UMC have convened meetings with other Taiwanese companies to secure supplies and mitigate the impact.

Winbond, Taiwan’s leading memory chipmaker, is working with the top industrial gas supplier Linde LienHwa, with the support of China Steel, the largest local steelmaker. And while UMC is in talks with Linde LienHwa about buying locally produced neon gas, TSMC said it is continuing to work closely with suppliers to mitigate the risks of supply chain disruptions.

Suggested reads

-

Alibaba to let rival Tencent’s payment app into its ‘walled garden’ (Nikkei Asia)

-

Russia built covert trade channel with India, leaks reveal (FT)

-

Japan to establish chip research centre with Intel (Nikkei Asia)

-

Sony chief bets on original content as part of ‘creation shift’ (FT)

-

Supply security now trumps price for chip industry: IQE CEO (Nikkei Asia)

-

Japan wants more rural data centres, and light-based networks may help (Nikkei Asia)

-

Blackstone set to acquire Australian data centre business AirTrunk (FT)

-

As with EVs, China self-driving cars have Tesla in their sights (Nikkei Asia)

-

Amazon and Bezos fund’s influence over carbon credit market raises alarm (FT)

-

Elon Musk is an unguided geopolitical missile (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at [email protected].