This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. We end the week with news that the owner of 7-Eleven has just rejected a historic takeover bid, and the US military is planning for the potential breakdown of Gaza ceasefire talks.

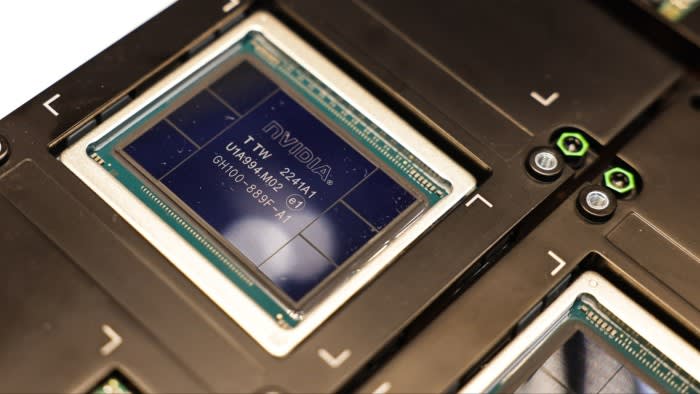

But first, we have an exclusive report on Nvidia. The cost of renting cloud services using the company’s leading artificial intelligence chips is cheaper in China than in the US, a sign that the advanced processors are easily reaching the Chinese market despite Washington’s export restrictions.

Four small-scale Chinese cloud providers charge local tech groups roughly $6 an hour to use a server with eight Nvidia A100 processors in a base configuration, companies and customers told the Financial Times. Small cloud vendors in the US charge about $10 an hour for the same set-up.

The low prices, according to people in the AI and cloud industry, are an indication of plentiful supply of Nvidia chips in China and the circumvention of US measures designed to prevent access to cutting-edge technologies. Here’s more on the thriving black market for the company’s most powerful AI chips.

-

Intel in crisis: The company remains far behind Nvidia, with senior departures and a plunging share price adding to CEO Pat Gelsinger’s worries.

Here’s what else I’m keeping tabs on today and over the weekend:

-

Economic data: The EU releases final second-quarter GDP figures today, while Halifax publishes its UK house price index. The US has jobs data that will be closely watched ahead of an interest rate decision later this month.

-

UK politics: The Green party’s autumn conference begins today, while Prime Minister Sir Keir Starmer meets Ireland’s Taoiseach Simon Harris in Dublin tomorrow.

-

Elections: Algeria holds its presidential election tomorrow, while Russia has local polls on Sunday.

-

Sport: The US Open tennis finals start with the women’s singles tomorrow and the men’s the next day. The Paris Paralympics close on Sunday.

The FT Weekend Festival starts in London tomorrow, featuring speakers including Sir Ian McKellen, UK health secretary Wes Streeting and FT editor Roula Khalaf. FirstFT readers get a special discount — register here now.

Five more top stories

1. France’s new prime minister Michel Barnier promised to respect “all political forces” as he accepted the nomination by Emmanuel Macron yesterday, ending two months of political limbo. But the respite for both president and premier could yet be brief, not least because they are hemmed in by a divided parliament that could topple the government at any time.

2. The US military is preparing for the possible collapse of ceasefire talks between Israel and Hamas. General CQ Brown, chairman of the US joint chiefs of staff, told the Financial Times that he was weighing how regional actors would respond to such a breakdown and the potential of a broader conflict. Read more from the interview.

3. Chinese car buyers are shunning Elon Musk’s Tesla as rival manufacturers flood the world’s largest car market with more up-to-date electric vehicle models. The US company’s share of Chinese EV sales, including battery and plug-in hybrids, slipped to 6.5 per cent in the first seven months of the year from almost 9 per cent a year earlier. Here are the local rivals giving Musk’s group a run for its money.

4. 7-Eleven’s owner has rejected a takeover offer from Canada’s Alimentation Couche-Tard, saying it was “opportunistically timed and grossly undervalues” the business. In a letter made public today, the board of Seven & i Holdings said even if the offer were improved, US competition rules would still entail “multiple and significant challenges”.

5. The UK needs to overhaul its capital markets in order to attract £1tn of investment in the next decade to fund housebuilding, infrastructure and start-ups, according to City grandee Sir Nigel Wilson. In a long-awaited report, the chair of Canary Wharf Group said Britain’s economy had fallen behind the US and told the FT that some changes would “require a home bias”.

How well did you keep up with the news this week? Take our quiz.

The Big Read

Cracks are appearing in the global economy as the plumbing that underpins trade — the networks carrying cargo, commodities and information — increasingly becomes politicised. Although Beijing and Washington are using subsidies, tariffs and export controls to compete for critical minerals and technological advantages, the system is proving more resilient than many expected.

We’re also reading . . .

-

Iranian society: The Islamic republic’s leaders are worried about declining religious observance and population decline as youth fall out of love with marriage.

-

Boeing: The aerospace giant’s work with Nasa dates back to the Apollo missions. But recent setbacks raise a once unthinkable question: should it exit the space business?

-

Frozen croissants: Unwitting coffee shop customers are eating pre-made goods in record volumes, hastening the displacement of freshly produced pastries — even in France.

-

ESG backlash: Despite the anti-woke crusade, stakeholderism is flourishing in new ways, writes Gillian Tett.

Chart of the day

How would an economist optimise their morning routine? One consideration is how much to sleep, writes Soumaya Keynes. Are higher earners responding to stronger incentives to stay awake? Or does joining their ranks mean waking up early to get ahead?

Take a break from the news

Household mess is an unavoidable fact of life, so why hide it from guests? Oliver Burkeman is embracing “scruffy hospitality”, a concept that would be valuable enough if all it conveyed was permission to put a little less effort into keeping a pristine home. But there’s more to it.

Additional contributions from Melody Abike Adebisi and Benjamin Wilhelm