Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

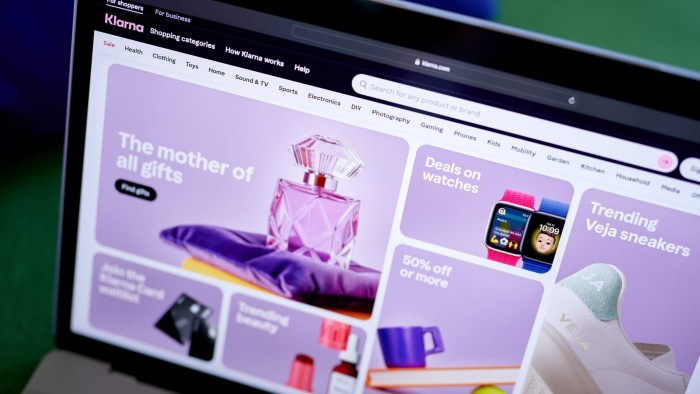

Swedish fintech Klarna is targeting an IPO in the US in April with a valuation of up to $15bn, in what would be one of the biggest listings this year.

The buy-now, pay later credit company is preparing to unveil its listing plans as soon as next month, according to people familiar with the company’s thinking. It filed for an IPO to the US Securities and Exchange Commission in November but has not yet picked a listing venue in the US, according to one person familiar with the matter. Klarna declined to comment.

The company was founded in 2005 by chief executive Sebastian Siemiatkowski and offers short-term interest free loans to consumers, typically at retailer checkouts.

It became an emblem of the fintech boom and bust when its valuation crashed to $6.7bn just a year after a 2021 fundraising valued it at $46bn and made it Europe’s most valuable start-up.

The fintech recently emerged from a governance crisis caused by a conflict between Siemiatkowski and his co-founder Victor Jacobsson that resulted in the latter’s representative being ousted from Klarna’s board last year.

Klarna has narrowed its losses in the past year, and appears on track to return to annual profitability. It was regularly profitable until 2019, when it started to accept some credit losses in order to pursue US expansion.

It has sought to cut costs and reduce its balance sheet ahead of an IPO, believing AI will allow it to almost halve its headcount. It has also been offloading loans in a drive to free up capital for lending growth and recently sold most of its UK portfolio to US hedge fund Elliott. It is also in talks to sell a US loan book, the FT has previously reported.