Stay informed with free updates

Simply sign up to the Automobiles myFT Digest — delivered directly to your inbox.

South Korea’s Hyundai Motor Group plans to make a record Won24.3tn ($16.7bn) investment in its home market this year as it accelerates its shift to electric vehicles amid growing domestic and geopolitical challenges.

The group, which includes Hyundai Motor and affiliate Kia, is grappling with tougher competition abroad, as Donald Trump’s second term is expected to bring higher tariffs, while sluggish domestic demand has been compounded by an escalating political crisis.

The world’s third-largest carmaker behind Toyota Motor and Volkswagen said on Thursday the planned investment included Won11.5tn in research and development as the company bets on electrification and connected cars. Won12tn will go towards upgrading its facilities for EV production, while the rest will be used to accelerate its technological development for autonomous driving.

“Hyundai Motor Group is making the largest investment ever in South Korea this year because it believes that continuous and stable investments are essential to overcome the crisis and secure future growth engines in the face of growing uncertainties,” said the company.

The news initially drove up shares of Hyundai and Kia 1 per cent and 3.7 per cent, respectively, while the benchmark Kospi was little changed. Hyundai shares closed down 0.2 per cent, while Kia shares were up 2.3 per cent.

The statement comes after Hyundai’s chair Euisun Chung last week warned of growing external risks for the company, with Trump threatening to impose universal 10 per cent tariffs on imported goods as soon as this month.

The group aims to increase global sales by 2 per cent to 7.4mn vehicles in 2025 after it failed to meet its targets last year amid tougher competition in the US and Europe.

“They will have a hard time this year to compete with lower-cost Chinese rivals in Europe and developing countries,” said Lee Hang-koo, head of the Jeonbuk Institute of Automotive Convergence Technology. “Their margins are likely to be squeezed further as they won’t be able to offset falling overseas demand with domestic sales.”

Domestic sentiment is deteriorating in its home market as consumers refrain from purchasing big-ticket items amid growing political chaos following President Yoon Suk Yeol’s impeachment by parliament last month.

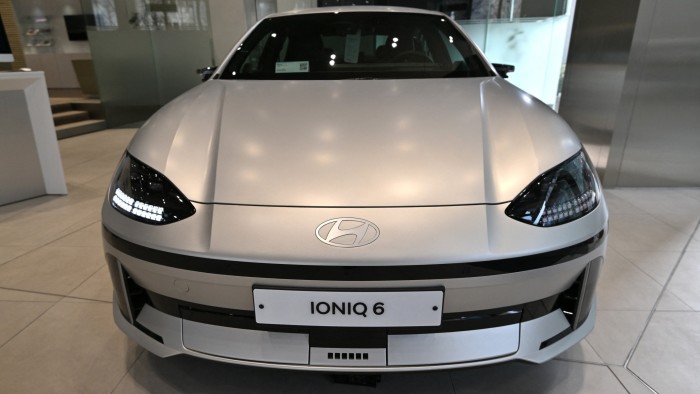

Hyundai’s EVs are now among the foreign vehicles eligible for US tax credits under the Inflation Reduction Act. Its $7.6bn plant in Georgia began operations last year producing its flagship Ioniq electric sport utility vehicle. But there is growing concern over the IRA’s fate after Trump threatened to scrap it.

Despite the increasing uncertainties, Hyundai plans to invest $90bn globally by the end of the decade to expand its EV and hybrid models. The carmaker named José Muñoz as its first foreign chief executive last year to tackle Trump’s new trade policies.

Localising production in the US, which is Hyundai’s “most important market”, is one of the “simplest and better” solutions to deal with policy changes, Muñoz told Bloomberg last week.

Hyundai on Thursday also became the first carmaker to sell its cars on Amazon in an effort to lure younger drivers. It expects revenue from online platforms to account for up to 30 per cent of its total US sales by 2030, describing the channel as “the future of automotive retail”, helping reduce the time for a car purchase to just 15 minutes.