Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: [email protected]

One scoop to start: Blackstone Group has put First Eagle Investment Management up for sale for more than $4bn in an attempt to offload a large stake that the US private equity group has owned for a decade.

And one event: I’ll be in Abu Dhabi this week for our inaugural Future of Asset Management Middle East conference. Hope to see you there.

In today’s newsletter:

-

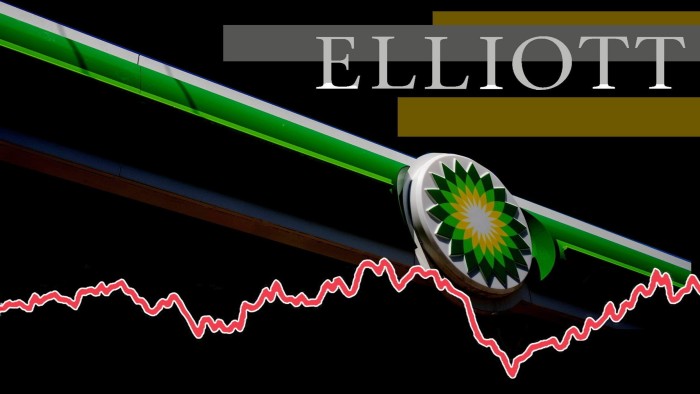

Activist Elliott shakes BP from its strategic slump

-

How Vanguard plans to play disruptor again

-

US egg prices soar as avian flu rips across farms

Pirates of the ‘Gulf of America’

A year ago Elliott Management questioned whether calling for an oil major to scale back its green spending would risk a backlash from environmentalists and even the media.

How times have changed. Last week it emerged that Elliott has become BP’s third-largest shareholder — behind only BlackRock and Vanguard — after building a near 5 per cent stake in the UK oil major worth almost £3.8bn.

The activist hedge fund’s energy team at its New York headquarters now have T-shirts with “Gulf of America” printed on them, including one with a picture of Donald Trump as a pirate, in honour of the president’s preferred name for the Gulf of Mexico.

As shares in BP sank to a two-year low last November, Elliott was already busy building its stake in the troubled company.

The move has started to pay off. Shares in BP have risen more than 26 per cent from that low, with Trump’s rallying cry of “drill, baby, drill” lifting the mood around oil and gas companies and putting greater focus on their core business of selling fossil fuels.

The activist’s arrival sets up a crucial test for BP chief executive Murray Auchincloss at its capital markets day on February 26. Amid frustration at the group’s lack of direction, Auchincloss has promised to “fundamentally reset” his predecessor’s strategy, which involved ramping up capital expenditure on energy transition businesses and building a portfolio including wind, solar, biofuels and hydrogen.

Elliott’s view is that BP must make significant divestments including in its green energy businesses, according to a person familiar with the hedge fund’s thinking. A break-up or a sale were not currently on the activist’s agenda, they said.

What was needed was “an aggressive chair leading an engaged board, with a chief executive that bought into the strategy”, the person added. The formula for BP was straightforward: “It is strong capital allocation, right sizing their costs, a divestiture plan and resetting the strategy. It is making sure that shareholders who have stuck with the company are rewarded. It is a fundamental pivot.”

Dive into the inside story of how Elliott shook BP from its strategic slump.

How Vanguard plans to play disruptor again

Vanguard has fundamentally reshaped equity investing. Its relentless emphasis on low costs and simple products that track indices rather than pick stocks has helped it become the world’s second-largest money manager, with a $10.1tn pile of assets under management and a client base of more than 9mn direct investors.

For much of its history, Vanguard catered mostly to do-it-yourself investors and employee-directed retirement plans. Though its online offerings were clunky compared with rivals, and its customer service lines had limited hours, investors were rewarded with low fees that led to superior returns.

Having forced rival asset managers to slash fees and rethink business models built around stockpicking, Vanguard is now taking aim at other parts of the financial services industry.

Salim Ramji, a former BlackRock executive who last summer became the first outsider to lead the group, is spearheading pushes into investment advice, actively managed bond funds and cash accounts. The strategy seeks to make Vanguard the financial destination for a new generation of investors and enable it to compete more assertively for customers outside its US heartland.

“They’ve taken the indexing thing about as far as they can,” says Dan Wiener, who founded an investment advisory business and newsletter focused on the company’s funds.

But the shift comes as many rival asset managers are now matching it on fees, while fintech upstarts such as Robinhood and Betterment have been wooing younger investors with sleek apps, free stock trading and algorithm-driven online advice. Vanguard will have to raise its own offering if it is to compete.

Venturing into financial advice defies the instincts of its late founder Jack Bogle, who spent a lifetime urging investors to “minimise the croupier’s take”.

“It’s really a problem of size,” says Dan Sotiroff, a senior analyst at Morningstar who follows Vanguard. “They are getting so big that they have to deliver what they promise to clients.”

Don’t miss this Big Read, in which Brooke Masters visits Vanguard’s headquarters in suburban Pennsylvania to tell the story of how the firm built a passive investing powerhouse — and why it needs to improve its tech and service if it is to play disruptor again.

Chart of the week

US egg prices are soaring to record highs as farmers are forced to slaughter millions of chickens in an attempt to halt the spread of bird flu, which has ripped through the nation’s poultry barns in recent months.

A dozen eggs reached more than $8 in wholesale markets this week, more than double the price of a year ago and the highest ever recorded, according to Expana, a commodity price information service. Grocers including Walmart and Kroger have begun to ration purchases in certain cases. The Waffle House chain — a staple in the US south and Midwest — has tacked a surcharge of 50 cents an egg on to its dishes.

Supplies of fresh eggs are falling short as farmers cull millions of hens to control a variant of avian influenza that first emerged in a US commercial flock three years ago.

Like petrol prices, eggs are a visible, if volatile, signpost of inflation to consumers. The consumer price index increased by 3 per cent year on year in January, with an index for eggs climbing more than 50 per cent, the Bureau of Labor Statistics reported on Wednesday. The average US resident will eat about 270 eggs this year, the US Department of Agriculture forecasts.

Egg prices also have political resonance and were an attack line in last year’s campaign for the White House. Then US vice-presidential candidate JD Vance in September stood before a supermarket egg case to criticise the economic policies of his predecessor Kamala Harris, when the US city average price of large Grade A eggs was $3.82 a dozen, according to the Bureau of Labor Statistics. The price was $4.95 in January.

Democrats have now seized on the issue. “We went to get some eggs, and we can see the prices of these eggs had now jumped to about $8. But there were no eggs,” Ted Lieu, a Democratic representative from California, said last week of a recent trip to the grocery store.

Five unmissable stories this week

BlackRock has awarded chief executive Larry Fink a carried interest sweetener for the first time, underlining the increasing importance of private markets to the world’s largest asset manager.

Ken Griffin’s hedge fund Citadel has made a £305mn bet against drugmaker GSK, the biggest short position against the company in more than a decade.

“Trump trade” bets on a stronger dollar and higher bond yields have backfired this year as investors take a more bearish view on the economic fallout from the new US administration’s global trade war.

Goldman Sachs Asset Management is aiming to become a “leading provider” of active exchange traded funds in Europe as UK investment houses Schroders and Jupiter prepare to enter this part of the market.

Institutional investors with $1.5tn in funds, including Scottish Widows, the People’s Partnership and Brunel Pension Partnership, have told asset managers to step up on climate action or risk being dumped.

And finally

I agree with every word of this glorious love letter to Hampstead Heath by Rebecca Rose, editor of FT Globetrotter. The experience of swimming in the silty, silky waters of the ponds is beautifully captured in At the Pond: Swimming at the Hampstead Ladies’ Pond, a collection of contemporary essays.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at [email protected]

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here