Stay knowledgeable with free updates

Simply signal as much as the World myFT Digest — delivered on to your inbox.

This article is an on-site model of our FirstFT e-newsletter. Sign as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning.

German insurers together with Munich Re and Allianz have amassed greater than €3bn of publicity to the struggling property empire owned by actual property billionaire René Benko.

The community of companies in Benko’s Signa group not solely borrowed from banks together with Julius Baer and UniCredit, but additionally relied closely on funding from greater than half a dozen insurers, in accordance with paperwork reviewed by the Financial Times and other people with first-hand information of the main points.

The individuals added that a few third of this publicity was not backed by any collateral. “For some insurers, this will be extremely painful,” one of many individuals stated.

Signa Holding, the central firm within the group that owns Selfridges in London, the Chrysler constructing in New York and KaDeWe in Berlin, filed for administration final month. The firm had constructed up €5bn in debt by the tip of September, nearly all of it through the first 9 months of this yr.

Benko has not disclosed the whole debt gathered by companies throughout the Signa group, however individuals acquainted with the construction say his different entities have borrowed greater than twice that quantity. Many firms throughout the group are nonetheless buying and selling, however individuals near the enterprise stated additional insolvencies had been anticipated inside days. Read the complete unique story.

And right here’s what else I’m conserving tabs on as we speak:

-

Economic knowledge: The UK releases month-to-month labour market knowledge, Zew publishes its financial sentiment survey for Germany, whereas the US has its shopper value index.

-

COP28: A draft settlement which has dropped references to the phaseout of fossil fuels will face fierce opposition from many international locations on the UN local weather summit’s remaining day.

-

Thames Water: Cathryn Ross and Alastair Cochran, interim co-chiefs of the utility, will probably be grilled by MPs on the Environment, Food and Rural Affairs Committee following revelations within the FT that £500mn in “new equity funding” was the truth is a mortgage by the corporate’s homeowners.

-

Egyptian elections: Polls shut in a race the place Abdel Fattah al-Sisi is operating for a 3rd presidential time period.

-

UK politics: Prime Minister Rishi Sunak will search to face down hardening opposition from rightwing Tory rebels at a parliamentary vote for “emergency” laws to save lots of his Rwanda migration coverage. For extra on British politics, join our Inside Politics e-newsletter by Stephen Bush.

Five extra high tales

1. The EU is exploring emergency funding for Ukraine exterior the bloc’s shared funds, after Hungarian Prime Minister Viktor Orbán stated he would block Brussels’ bid to supply a vital €50bn monetary support lifeline to Kyiv at an EU summit on Thursday. Failure to conform to funding would mark probably the most egregious reversal within the bloc’s assist since Russia’s invasion.

2. Exclusive: An Indian billionaire pays £138mn in London’s most costly dwelling sale this yr and the UK capital’s second-most costly dwelling ever offered. “Vaccine prince” Adar Poonawalla will purchase Aberconway House, a 25,000 sq. foot Mayfair mansion close to Hyde Park, via a UK subsidiary of his household’s Serum Institute of India. Here’s extra on the sale.

3. KKR is in talks to purchase an almost $11bn stake in a Veritas Capital enterprise, in accordance with individuals briefed on the matter. The deal for a 50 per cent stake in healthcare know-how firm Cotiviti comes after the same take care of one other bidder, Carlyle, fell aside in April. The new deal might be clinched within the subsequent few weeks. Read the complete story.

4. Exclusive: Puma is terminating its sponsorship of Israel’s nationwide soccer group in a choice the world’s third-biggest sportswear firm stated was taken a yr in the past and was not associated to renewed requires shopper boycotts. In current weeks, the model’s shops in some western cities have been focused with demonstrations. Here’s why the German group made the transfer.

-

Israel-Hamas battle: Israel’s defence forces will open a second checkpoint for the screening of humanitarian support into Gaza, which they stated may double the assist flowing into the strip.

-

Opinion: Rebuilding Gaza would require a long-term imaginative and prescient for Palestine, however the circumstances for a two-state resolution have worsened significantly up to now many years, writes Gideon Rachman.

5. Google has misplaced an antitrust lawsuit introduced towards it by Epic, the corporate behind well-liked online game Fortnite, which accused the search large of suppressing competitors within the Android app market to safe billions of {dollars} in income from its Play Store. The verdict by a federal jury was returned yesterday after a weeks-long trial in San Francisco. Here’s what’s going to occur subsequent.

The Big Read

Industry figures have described Kirkland & Ellis’s singular, aggressive approach of doing enterprise as extra akin to a hedge fund or an funding financial institution equivalent to Goldman Sachs, shaking up the historically risk-averse company legislation trade. A growth in non-public fairness meant bumper pay and speedy promotion for its companions, however as dealmaking slows, is the social gathering over for the world’s most worthwhile legislation agency?

We’re additionally studying . . .

-

Bidenomics’ classes: Labour ought to heed each the warnings and successes of Biden’s funding programme within the US, writes Claire Ainsley, the UK social gathering’s former govt director of coverage.

-

Iran’s ‘first lady’: The wives of Iran’s previous presidents had been hardly ever seen in public, a lot much less politics. Jamileh-Sadat Alamolhoda, who has damaged with custom, speaks with the FT.

-

Catalan independence: Now is the time for a recent spherical of negotiations with Spain in direction of a referendum for independence, writes Catalonia’s regional president Pere Aragonès.

-

Guyana on edge: Venezuela’s risk to annex a big a part of its neighbour’s territory following a divisive referendum has stoked fears of invasion.

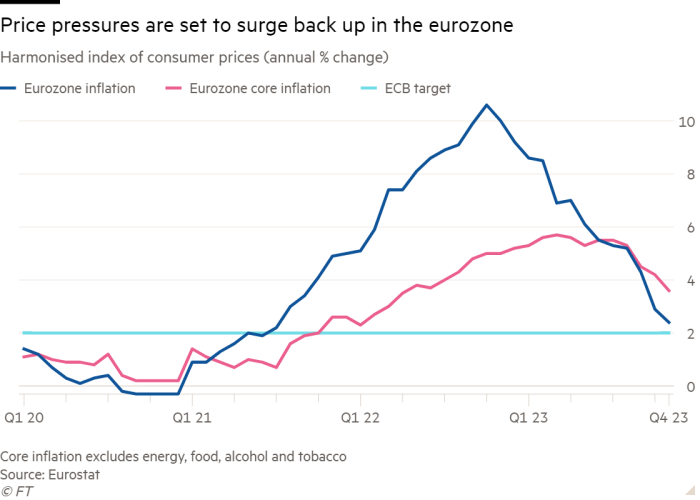

Chart of the day

Is the market proper in anticipating a decreasing of borrowing prices quickly? What may stop rate of interest cuts in March? Martin Arnold solutions questions that will probably be on policymakers’ minds when the European Central Bank meets on Thursday.

Take a break from the information

From an Egyptian oasis to a yurt in Tromsø, Norway, journey writers share with the FT their high discoveries — and disappointments — of the previous yr.

Additional contributions from Benjamin Wilhelm and Gordon Smith

Recommended newsletters for you

Working It — Everything you’ll want to get forward at work, in your inbox each Wednesday. Sign up right here

One Must-Read — The one piece of journalism it’s best to learn as we speak. Sign up right here