Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

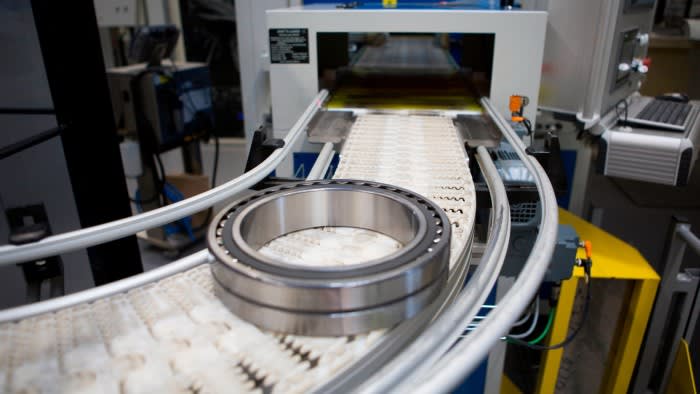

SKF, the world’s largest manufacturer of bearings, is planning to break itself up after coming under pressure from Cevian Capital, Europe’s biggest activist investor.

The Swedish group said on Tuesday that it would spin off its less profitable automotive business and keep its higher-margin industrial unit, sending its shares up by as much as 10 per cent.

“Both businesses are global leaders in their respective fields and will through a clearer focus increase customer value and leverage on their strategies as standalone companies,” said Hans Stråberg, SKF’s chair.

SKF joins a growing trend of industrial companies seeking disposals to become more focused after conglomerates such as General Electric and Maersk have slimmed down in recent years.

Much of the impetus for such break-ups has come from activist investors such as Sweden’s Cevian, which have pushed for change at industrial companies from Thyssenkrupp in Germany and Cookson in the UK to ABB in Switzerland and Volvo Group.

“This is a significant step towards unlocking SKF’s full value potential,” said Christer Gardell, founding partner of Cevian, which is SKF’s second-largest shareholder with an 8 per cent stake.

He added that both the spun-off automotive business and the remaining industrial unit should be able to increase profitability markedly, leading SKF’s valuation as a proportion of profits to double.

Cevian pointed to data showing that despite having a similar operating margin to Swedish industrial peers such as Assa Abloy, Alfa-Laval, ABB, and Trelleborg, SKF’s shares currently traded on a multiple under half of those companies.

The spin-off represents the biggest move by Rickard Gustafson, SKF’s chief executive since 2021, to boost its share price, which has essentially stagnated for more than the past decade.

“I . . . said [in 2022] that we need to take bold decisions to unlock additional long-term profitable growth opportunities. Initiating a separation of the automotive business is one of those decisions,” he said on Tuesday.

SKF’s board is proposing to distribute shares in the automotive business, which will pursue a separate listing in Stockholm, to its existing shareholders. The move will be proposed to the 2026 annual meeting of SKF and should be completed in the first half of that year, according to the Swedish group.

Last year, the automotive business had annual revenue of SKr30bn ($3bn) and an underlying operating margin of 5.6 per cent.

SKF’s industrial business — which provides bearings, seals and lubrication systems for a variety of heavy industries such as machine tools and railways — had revenues of SKr73bn and an underlying operating margin of 15.4 per cent.

FAM, a foundation run by the Wallenberg family that is SKF’s largest shareholder with 29 per cent of voting rights, also supported the break-up.

“The split will provide better opportunities for the two focused companies to continue creating profitable growth and long-term value,” said FAM’s chief executive, Håkan Buskhe.