Aster (ASTER), one of the most discussed decentralized exchange (DEX) tokens in recent weeks, dropped more than 20% in the past 24 hours, wiping out much of the rally that followed Binance founder Changpeng Zhao’s (CZ) endorsement.

The decline delivered massive gains to a trader known as the “Anti-CZ Whale,” who now holds over $21 million in unrealized profits from shorting ASTER across two wallets.

The downturn follows a volatile stretch for ASTER, which surged last week after CZ revealed he had personally purchased more than $2 million worth of the token.

CZ’s post immediately triggered buys, pushing ASTER from around $0.91 to a high of $1.26 before reversing sharply as whales began increasing their short exposure.

‘Anti-CZ Whale’ Nets $18.4M as ASTER Drops Below $0.90 After CZ’s Buy

According to on-chain data compiled by Lookonchain and Hyperliquid, two wallets linked to the so-called Anti-CZ Whale opened substantial short positions in ASTER shortly after CZ’s announcement.

Together, the wallets control more than $51 million in ASTER shorts, generating about $18.4 million in unrealized profit as the token slid back below $0.90.

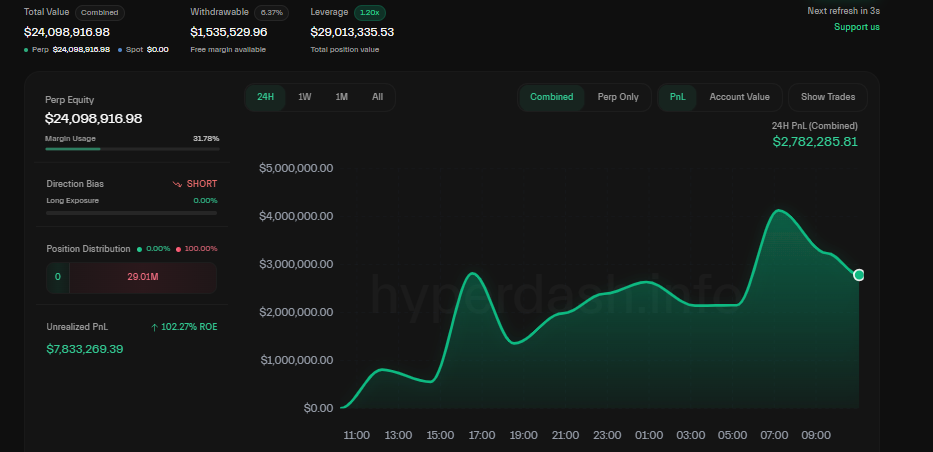

One of the wallets, identified as 0xbadb, holds roughly $24.6 million in equity with positions focused on ASTER and Dogecoin (DOGE).

The account shows an unrealized profit of $8.38 million, primarily driven by its ASTER short from an entry of $1.16 to a current price of $0.88, a 25% decline.

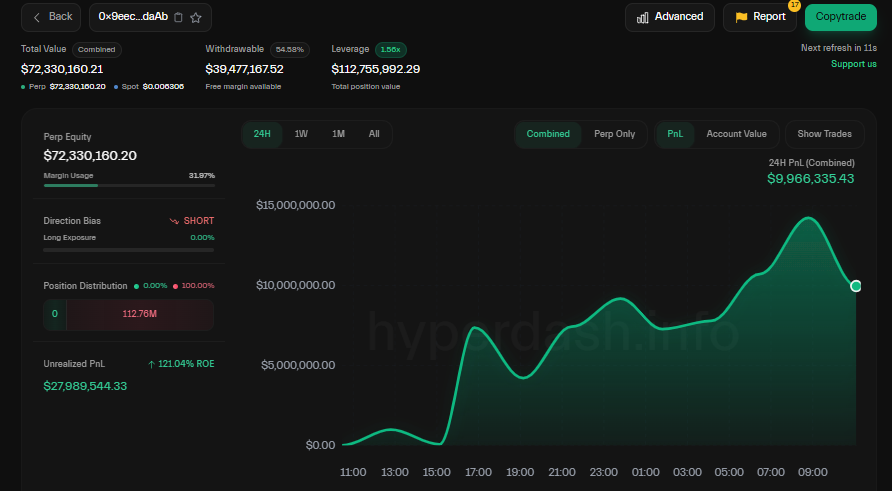

The second wallet, 0x9eec9, carries an even larger book of $73.7 million across several assets, including ASTER, DOGE, ETH, XRP, and PEPE. It has logged over $29 million in unrealized gains, with ASTER alone contributing around $14 million.

Both accounts maintain full short exposure using leverage between 3x and 20x, bringing the trader’s total unrealized profit on Hyperliquid close to $100 million.

CZ Admits “Poor Timing” After Aster’s 57% Monthly Drop; Analysts Eye Technical Rebound

Aster’s 24-hour trading volume has fallen sharply to around $1.35 billion, down 47% from the previous day, signaling fading market activity after the initial rally.

The token, once trading as high as $2.41, is now down over 63% from its all-time high. It has declined 13.3% in the past day, 17.8% over the week, and nearly 57% in the last 30 days.

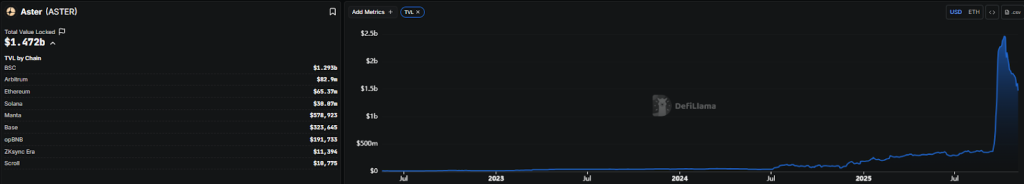

According to DefiLlama data, Aster’s total value locked (TVL) has dropped from $2.5 billion in early October to about $1.47 billion.

CZ reacted to the market slump by admitting his history of poor timing in crypto buys. “Every time I buy coins, I get stuck in a losing position,” he wrote on X.

He recalled buying Bitcoin at $600 in 2014 before it fell to $200 and BNB in 2017 before it dropped 30%. He added that he recently increased his ASTER holdings but warned others to “be careful of risks.”

CZ also hinted he may stop publicly revealing future purchases to avoid influencing market sentiment.

Despite the downturn, some analysts believe ASTER could be approaching a short-term rebound.

Chart watchers say the ASTER/USDT pair is forming a falling wedge pattern on the four-hour chart, a technical signal often linked to potential reversals.

The price is hovering near $0.95, where selling pressure appears to be easing. A breakout above $1.01 could trigger a short-term recovery toward $1.20 or $1.50 if momentum returns.

However, a drop below $0.85 could expose the token to further losses, with support near $0.76.

The post ASTER Plunges 20% as “Anti-CZ” Whale Scores $21M Profit On Short Bets appeared first on Cryptonews.

https://t.co/jezvlAbXax

https://t.co/jezvlAbXax BNB (@cz_binance)

BNB (@cz_binance)