Bitcoin mining operations strengthen electrical grids rather than destabilize them, and they help reduce consumer electricity costs through demand flexibility and grid services, according to a comprehensive analysis by independent researcher Daniel Batten, which directly challenges persistent misconceptions about the industry’s energy impact.

The research, titled “Common Bitcoin Energy Misconceptions,” dismantles several widely circulated claims about Bitcoin mining’s resource consumption and environmental footprint.

Batten presents evidence from peer-reviewed studies and real-world grid data that contradicts narratives suggesting the technology burdens power systems and drives up consumer costs.

Grid Stabilization Through Flexible Demand

Multiple independent studies confirm Bitcoin mining’s capacity to balance electrical grids due to its interruptible nature, particularly on networks transitioning toward higher concentrations of variable renewable energy sources like solar and wind.

A whitepaper referenced by Batten from Duke University energy experts concluded that Controllable Load Resources, including Bitcoin mining operations, help stabilize grids and defer the costs of expensive infrastructure upgrades.

He also referenced research from ERCOT, the Texas grid that hosts the largest concentration of Bitcoin mining globally, which shows predominantly stabilizing effects from near-daily Frequency Regulation and Demand Response services.

Former ERCOT interim CEO Brad Jones summarized the findings: “[Bitcoin mining operations] have found a way to come into the market and take some of that excess wind in offpeak periods. Then it can turn down whenever we need the power for other customers… And if a generator trips offline, it can very quickly respond to that frequency disruption and allow us to balance our grid more efficiently.“

According to him, Texas documented one mild localized destabilization incident involving Bitcoin mining on April 25, 2024, while multiple large-scale stabilization events occurred over the same multi-year period, including emergency grid support during the July 2022 heatwave.

Consumer Cost Reduction Through Multiple Mechanisms

Contrary to claims that Bitcoin miners increase residential electricity expenses, data presented by Batten from Texas between 2021 and 2024 shows that total electricity costs paid by residential customers rose 23.8%, or 7.0% when inflation-adjusted, compared to the national average increase of 24.67%.

The analysis identifies five mechanisms through which Bitcoin mining reduces consumer costs:

- Monetizing renewable energy that would otherwise be wasted

- Creating competitive markets for Ancillary Services

- Eliminating the need for additional gas peaker plants

- Reducing curtailment fees

- Deferring grid infrastructure expenses.

Jones noted “the capability for [Bitcoin Mining] to meet our ancillary services at the lowest possible cost means lower costs for all consumers in the State of Texas.”

After the 2021 Texas blackouts, ERCOT initially proposed building gas peaker plants at an estimated cost of $18 billion, but instead integrated Bitcoin miners as a flexible load capable of rapidly reducing consumption during grid stress.

Two documented international cases demonstrate direct price impacts.

Norwegian residents in September 2024 experienced a 20% increase in electricity prices after Bitcoin mining operations departed.

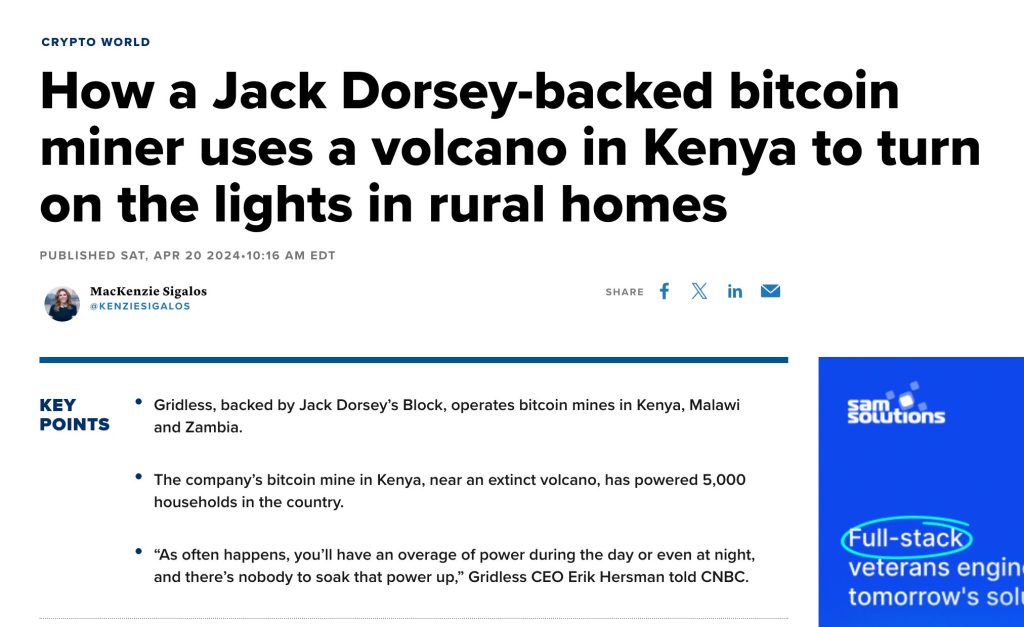

Additionally, CNBC reported that adding Bitcoin mining to a rural microgrid in Kenya “dropped the price of power from 35 cents per kilowatt hour to 25 cents per kWh” by monetizing previously wasted hydroelectric energy.

Transaction Metrics and Environmental Performance

Batten’s document also addresses the per-transaction energy claim, stating the metric “is dismissed in four peer-reviewed studies (Masanet et al., 2019; Dittmar et al., 2019; Sedlmeir et al., 2020; and Sai and Vraken, 2023) as well as by Cambridge University because Bitcoin’s resource use does not come from its transactions.“

Cambridge data from 2025 showed that previous estimates overestimated Bitcoin’s electronic waste by 1204%, indicating an actual annual eWaste of 2.3 kilotons rather than the claimed 30 kilotons.

Bitcoin mining has crossed the 50% sustainable energy threshold according to robust third-party data, exceeding the global average grid mix of approximately 40% renewable energy.

Cambridge estimates current Bitcoin mining emissions at 39.8 MtCO2e attributable to greenhouse gas emissions from scope-2 electricity usage, with 5.5% of annual carbon debt offset through methane mitigation from oil and gas operations.

Notably, according to a recent Cryptonews report, Bitcoin’s mining difficulty rose to 148.2 trillion in the final adjustment of 2025, with projections pointing toward 149 trillion by January 8, 2026, as average block times hover near 9.95 minutes.

Despite the growing difficulty, Russian President Putin claimed in December that the US and Russia are discussing joint management of Ukraine’s Zaporizhzhia Nuclear Power Plant for Bitcoin mining.

The post Bitcoin Mining Actually Stabilizes Grids and Lowers Costs, Researcher Says appeared first on Cryptonews.

Bitcoin’s mining difficulty is once again edging closer to uncharted territory as the network prepares for its first adjustment of 2026.

Bitcoin’s mining difficulty is once again edging closer to uncharted territory as the network prepares for its first adjustment of 2026.