Bitcoin is currently trading at $110,949, representing a 0.78% increase over the last 24 hours, with a trading volume of $73.3 billion and a market capitalization of $2.2 trillion. Regulatory clarity received a boost when the SEC and CFTC issued a joint statement stating that registered exchanges can offer spot cryptocurrency trading, including with margin and leverage.

No assets were named, but it’s a more friendly US stance towards digital assets. The announcement follows recommendations from the President’s Working Group on Digital Asset Markets and could pave the way for the NYSE and Nasdaq to list spot Bitcoin and Ethereum products.

This shift aligns with broader policy from the Trump administration, which has reduced lawsuits and encouraged growth across the crypto sector. For BTC, the approval adds legitimacy, increases access for U.S. investors, and strengthens institutional confidence.

Strategy’s $449M Bitcoin Buy Reinforces Confidence

Institutional demand remains a central driver. Last week, Michael Saylor’s Strategy purchased 4,048 BTC for $449 million at an average price of $110,981, raising its August total to 7,714 BTC. This figure is smaller than July’s massive 31,000 BTC acquisition but still underscores consistent conviction.

In total, Strategy now holds 636,505 BTC, worth around $46.95 billion, at an average cost of $73,765 per coin. Saylor has described the company’s equity offerings as a “Bitcoin defense department,” funding large-scale purchases while reinforcing its long-term view of BTC as a reserve asset.

Despite raising dividends to 10% in July, Strategy’s stock has fallen 16%, sparking debate over sustainability. Yet its steady accumulation continues to act as a bullish signal, supporting BTC above $110,000.

Key takeaways from recent activity:

- SEC and CFTC authorize spot trading on registered exchanges.

- Strategy buys $449M in BTC, lifting total holdings above 636K BTC.

- Retail adoption continues with small businesses and payment products.

Small Businesses and Bitcoin (BTC/USD) Technical Outlook

Adoption is no longer just an institutional story. Tahini’s, the Canadian shawarma chain owned by the Hamam brothers, has been buying Bitcoin since 2020 to hedge against currency debasement.

Inspired by the early BTC advocates, the company has grown to 65 locations, added a Bitcoin ATM, and is opening its first US location. They are still buying Bitcoin for its utility and growth potential.

On the charts, Bitcoin is showing resilience after rebounding from $108,500. The RSI has climbed to 57, signaling improved buying strength, while the MACD histogram has turned positive, indicating a potential bullish crossover.

Price action has also produced bullish engulfing candles, reinforcing momentum.

Bitcoin is pressing resistance near $111,745. A breakout could target $113,435 and $115,475, breaking the descending channel and shifting sentiment toward accumulation. Failure to hold would bring $108,500 and $107,300 back into play.

For traders, the outlook leans bullish. If Bitcoin clears $111,745 with conviction, the path toward $130,000 becomes increasingly credible. With regulatory clarity, institutional confidence, and retail adoption aligning, Bitcoin’s consolidation may be less a ceiling and more the base for its next major rally.

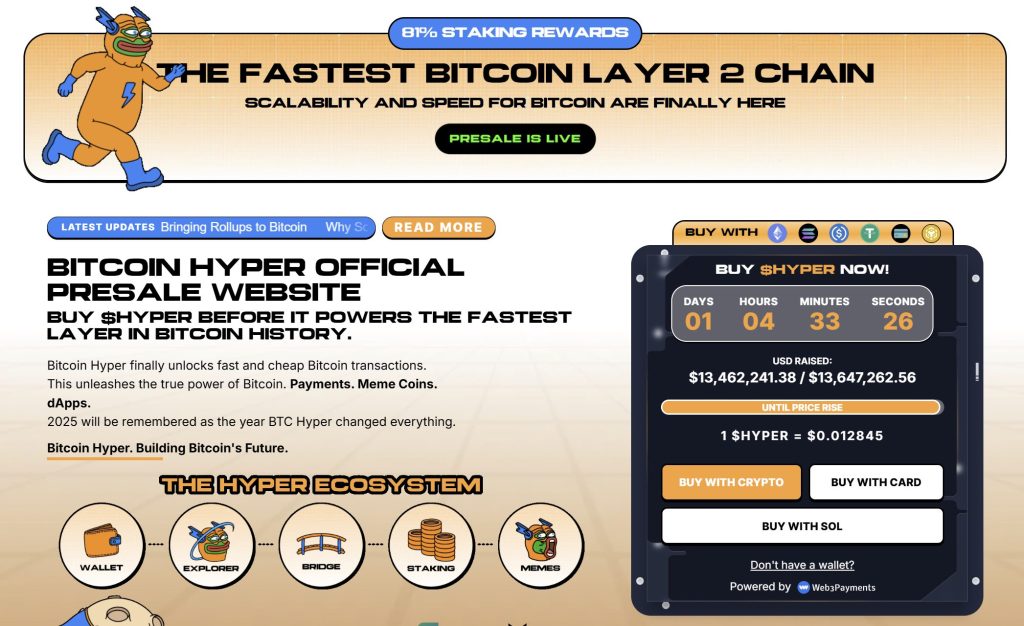

Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the Bitcoin ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining Bitcoin’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $13.4 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012845—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: $449M Strategy Buy and SEC Approval Spark $130K Hopes appeared first on Cryptonews.