Bitcoin is trying to stabilise after a sharp $4,000 sell-off on December 17, trading near $87,000. The immediate question for market participants is straightforward: can BTC recover enough ground to reclaim $90,000 before Christmas, or has the recent drop shifted momentum decisively lower?

The timing matters. Markets are entering a period of thinner liquidity, and US CPI data due today could determine whether risk appetite stabilises or fades further. With inflation expectations shaping interest-rate outlooks, Bitcoin is responding less to crypto-specific developments and more to macro signals.

Sentiment Weakens as Risk Appetite Fades

Investor positioning has turned defensive following last week’s decline. The Crypto Fear and Greed Index has fallen to 22, placing sentiment firmly in fear territory. This reflects reduced risk-taking rather than forced selling, with traders scaling back exposure while waiting for clearer confirmation.

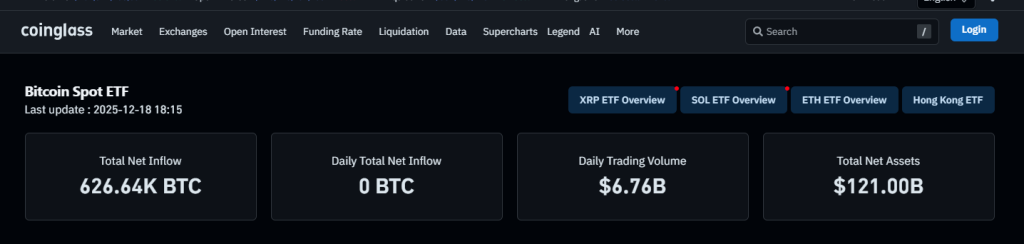

ETF activity supports this view. US spot Bitcoin ETFs recorded a net inflow of roughly 5,210 BTC on December 17, according to CoinGlass data. However, inflows stalled in subsequent sessions. While cumulative net inflows remain substantial at around 626,600 BTC, the lack of consistent daily additions points to hesitation rather than renewed demand.

Trading activity also remains contained. Daily spot ETF trading volume stood near $6.76 billion, with total net assets holding close to $121 billion, indicating stability but limited appetite for aggressive positioning.

Fundamentals Hold, but Macro Sets the Pace; US CPI In Focus

Bitcoin’s longer-term fundamentals remain intact. Circulating supply stands near 19.96 million BTC, continuing its gradual move toward the fixed 21 million coin cap. Network security remains stable, and while institutional activity has slowed, there is no sign of a broad exit from the market.

In the near term, macro conditions are driving price action. Markets are focused on US CPI data due at 13:30 UTC, which carries added weight after October’s report was cancelled and November data were partially incomplete due to the federal government shutdown.

According to the US Bureau of Labor Statistics, the most recent complete data showed headline CPI at 3.0% year on year, with core inflation slowing to 3.0%.

Consensus forecasts now point to headline CPI at 3.1% and core inflation at 3.0%, both above the Federal Reserve’s 2% target.

With daily Bitcoin trading volume near 44 billion dollars, participation appears steady but cautious. A stronger CPI reading could weigh on risk assets, while a softer print may give Bitcoin room to stabilise.

Bear Flag Breakdown Keeps Pressure On

Technically, Bitcoin remains under pressure. The daily chart confirms a bear flag breakdown, signaling continuation of the prior downtrend rather than a pause. BTC is trading below the 50-day EMA near $94,500 and the 100-day EMA around $100,100, both of which continue to cap upside attempts.

Momentum indicators align with this view. The RSI in the low-40s shows persistent bearish pressure without reaching oversold levels. Recent candles reflect weak follow-through on rallies, suggesting buyers are hesitant ahead of macro risk.

Key support sits in the $85,000–$84,000 zone. A daily close below this area would expose $80,600. On the upside, Bitcoin needs to reclaim $90,200 decisively to challenge the bearish structure.

Bitcoin Price Prediction Ahead of Christmas

In the near term, Bitcoin’s path hinges on US CPI and follow-through price action. A move above $90,000 before Christmas is possible, but it likely requires a softer inflation print and a quick reclaim of broken support. Without that, rallies may struggle and remain vulnerable to selling pressure.

For now, Bitcoin appears caught between macro uncertainty and technical resistance. Whether the next move is a recovery toward $96,800 or a deeper test toward $80,000 will depend less on sentiment and more on how markets digest inflation data and risk heading into year-end.

While Bitcoin reacts to macro pressure, some investors are also watching early-stage crypto projects nearing critical presale deadlines.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Close

PEPENODE is gaining momentum as a next-generation meme coin that blends viral culture with interactive gameplay. With over $2.36 mn raised and the presale approaching its cap, interest is building fast as the countdown enters its final stretch.

What makes PEPENODE stand out is its mine-to-earn virtual ecosystem. Instead of passive holding, users can build digital server rooms using Miner Nodes and facilities, earning simulated rewards through a visual dashboard. The concept brings gamification and competition into the meme coin space, giving holders something to do before launch.

The project also offers presale staking, allowing early participants to earn boosted rewards ahead of the token generation event. Leaderboards and bonus incentives are planned post-launch to keep engagement high.

With 1 $PEPENODE priced at $0.0012016 and limited allocation remaining, the presale is entering its final opportunity window for early buyers.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Can the BTC Price Push Above $90,000 Before Christmas After the $4K Dump on Dec.17? appeared first on Cryptonews.