Key Takeaways:

- WeFi CEO Maksym Sakharov says crypto’s fixation on Wall Street is overshadowing real adoption happening in Africa, Asia and Latin America.

- From stablecoin payments in Lagos to inflation hedges in Buenos Aires, crypto is becoming a tool for survival, not speculation.

- He believes the next wave of growth will come from people excluded from TradFi, using on-chain tools for savings, remittances, and trade.

Crypto adoption is expanding fastest in emerging markets like Nigeria, the Philippines and Argentina, according to Maksym Sakharov, cofounder and CEO of decentralized on-chain bank (deobank) WeFi.

He told Cryptonews that the everyday use of crypto assets for remittances, payments, and savings in unstable economies shows that the industry’s future lies in the developing world, not among U.S. investors.

“For years, the industry’s primary goal has been to attract institutional capital from Wall Street and Silicon Valley, [pursuing regulatory approval, ETFs, and high-net-worth investors],” Sakharov said in an interview.

“This brought in a lot of money and attention, but it also led people to focus too much on one thing, blinding them to where crypto is already being widely used as a survival tool, not just a means to make money.”

Sakharov said the “America-first” fixation has forced players to create products that appeal to regulated institutions, such as custody, auditability, compliance, and tokenized assets.

Meanwhile, it completely ignores “lightweight, mobile-first tools that can solve daily pain points for users in lower-income countries,” he added.

WeFi CEO: Crypto Is a Lifeline

WeFi, which calls itself a decentralized on-chain bank, or “deobank”, operates on the premise that crypto can power a new kind of financial infrastructure that does not depend on centralized intermediaries.

Sakharov spoke about the people driving such a shift.

It includes freelancers in Manila who receive stablecoins as payment for online work, small business owners in Lagos who use crypto to import goods, and families in Buenos Aires who convert their wages into dollar-pegged stablecoins to protect their savings from inflation.

“In Argentina, where inflation has been in the triple digits for a long time, people aren’t just buying Bitcoin to hold,” he tells Cryptonews.

“They’re also using dollar-pegged stablecoins as digital dollars stashed away under the mattress. They exchange their pesos for USDT to pay for rent and groceries, which maintains their buying power.”

In Nigeria, digital currencies have become a lifeline for people who send money across borders and trade. Traditional remittance channels charge up to 7% in fees, but crypto cuts those costs in a big way.

According to Sakharov, that difference means that people “have more money for things like food, school fees, and health care.”

Crypto adoption is also rising in Southeast Asia. The Philippines, where remittances account for about 9% of GDP, has seen more than a million merchants accept digital assets through mobile wallet-linked platforms.

The WeFi CEO said it “makes it easy to use crypto in everyday business.”

Analytics firm Chainalysis recently ranked Brazil, India, Nigeria, Vietnam and the Philippines among the world’s top countries for grassroots crypto activity, driven by high rates of small on-chain transfers and retail trading.

In its latest crypto adoption report, Chainalysis found Sub-Saharan Africa to have some of the strongest indicators of everyday cryptocurrency use, even though it is the smallest crypto economy by transaction volume.

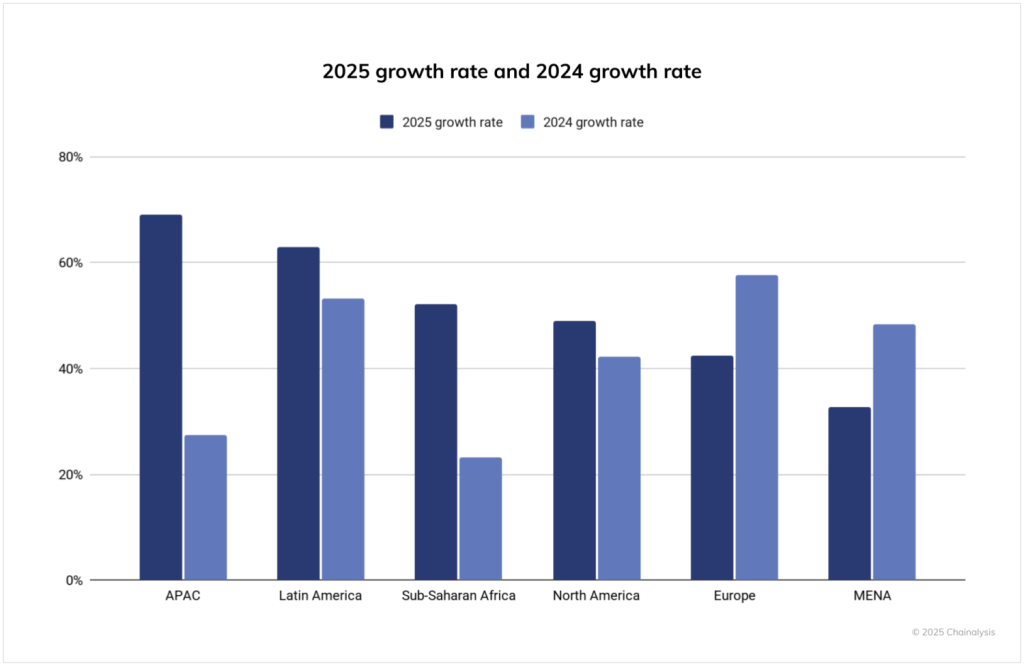

For the year to June 2025, Asia-Pacific was the fastest-growing region for on-chain crypto activity, the report says, with a 69% year-on-year increase in value received. Latin America was at 63% and Sub-Saharan Africa’s adoption rose 52%.

“It is numbers like these that are the most important for long-term, mainstream adoption,” said Sakharov.

The Next Billion Crypto Users

Sakharov estimates that in five to 10 years, global crypto adoption will be driven by people in the Global South, who use crypto like Bitcoin to solve real-world problems. He said digital currencies can help deliver financial inclusion for the 1.4 billion people who remain unbanked worldwide.

“[These] are individuals in regions where the traditional financial system is either too expensive, too inaccessible, or too unstable,” said the WeFi CEO.

He added that users in emerging markets will lead a new phase of mainstream adoption that is defined less by trading volumes or ETF flows, and more by stablecoin savings, retail payments, and remittances.

“ETF flows indicate the level of institutional demand, while trading volume reflects the extent of speculation,” Sakharov said, noting that both miss the main points of cryptocurrency wallets.

“Small on-chain peer-to-peer transfers, merchants accepting payments, and remittance corridors that give families real buying power back. Those are the grassroots signs that show people are using crypto to solve everyday problems, which is a more long-lasting form of adoption.”

WeFi is trying to build for that reality. The company is developing so-called “mobile-first” infrastructure that connects with local wallets, providing stablecoin settlement rails, self-custodial options, and merchant payment stacks on-chain. As Sakharov tells Cryptonews.

“The aim is to make crypto feel like ordinary money that everyone can jump right into: quick to move, low-fee, and usable from a basic smartphone.”

But he says key gaps still exist in reaching underserved people, especially around education, user experience, and seamless access.

Sakharov also warned that the industry risks repeating the same inequalities in traditional banking if it simply moves old systems onto the blockchain.

“The technology itself is neutral,” said Sakharov. “How we use it will decide what happens going forward. We will have failed if we replicate the old, complicated, closed systems for the rich.”

The post Crypto’s Next Billion Users Are in the Global South, Says Deobank WeFi CEO appeared first on Cryptonews.