Digital asset investing company Pantera Capital says Solana (SOL) is approaching a major inflection point in its adoption as the third-largest crypto play after Bitcoin and Ethereum.

In a September 18 company post, Pantera hinted that blue-chip companies like Stripe and PayPal are starting to build on Solana, and the story for Solana is just beginning.

The San Francisco-based firm added that ETF launches accelerated institutional adoption of BTC and ETH, with 43 Bitcoin ETFs launched and 165 public companies holding BTC.

Pantera Capital Backs SOL to Surpass $300 Says ‘Institutional Moment’ Incoming”

Similarly, 21 Ethereum ETFs have launched with 16 public companies holding ETH, but Solana has zero Solana ETFs with just 5 public companies holding SOL.

Institutions are currently under-allocated to SOL relative to BTC and ETH, holding less than 1% of the total supply, compared to 16% of BTC and 7% of ETH.

With a Solana ETF approval expected as early as Q4 2025, Pantera Capital believes Solana is next in line for its “institutional moment.”

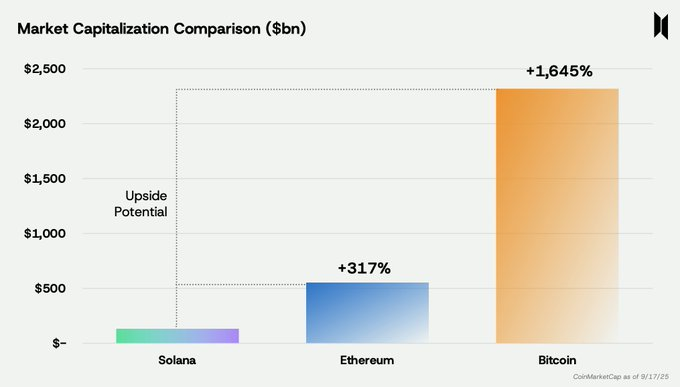

In terms of market capitalization, Solana is still just a fraction of Bitcoin (1/20th) and Ethereum (1/4th).

Yet Solana leads both in key usage metrics, with the most active user addresses of over 2.44 million and chain app revenue of over $6 million.

Pantera reaffirms that it believes Solana offers greater asymmetric upside potential.

Pantera Capital recently led a $500M fundraising for Helius Medical Technologies to launch a Solana treasury focused on acquiring SOL.

Institutional interest in Solana continues to rise, with firms such as Upexi, DeFi Development Corp, and Bit Mining all accumulating SOL reserves in recent months.

Pantera Capital’s CEO, Dan Morehead, has now confirmed Solana is their biggest position, worth a massive $1.1 billion.

Technical Analysis Points to Bullish Momentum

Solana has been outperforming Ethereum in recent weeks and is now sitting at a key zone where it could break into fresh all-time highs.

Most experts have set their Solana price predictions sky-high, with some calling for $1,000 by 2026.

Global investment firm VanEck is predicting $SOL could surge to $520 before the year’s end.

Daily Chart Analysis

The Solana daily chart highlights a clear resistance zone around $260–$280, which has historically acted as a supply area where sellers step in.

The price is currently trading at $238 after a sharp move upward, showing early signs of rejection near this resistance.

The chart also marks a demand zone between $180–$200, which has served as a strong base for previous rallies.

If Solana fails to hold momentum at current levels, a pullback toward the $200 region appears likely, where buyers would look to defend and reload.

From there, the projection favors a rebound that could retest and potentially break the $260–$280 resistance zone.

A clean breakout above this level would likely open the path for a stronger continuation rally, targeting new highs above $300.

Weekly Chart Shows Cup-and-Handle Formation

On the weekly chart, SOL shows a large cup-and-handle structure that has been forming since the 2021 peak, with the neckline sitting in the $260–$295 zone, a critical resistance area.

The price recently staged a breakout attempt from $218, indicating early momentum toward reclaiming this neckline.

If Solana can firmly break and hold above $260–$295, it would confirm the pattern and open the door to higher targets.

The first measured move lies around $341–$370, which aligns with a 50% Fibonacci retracement level and could act as the first major profit-taking zone.

Beyond that, the chart highlights ambitious upside targets at $450, $475, and eventually $523, suggesting a potential run toward retesting all-time highs.

For now, the neckline remains the most important test.

If Solana fails to break above it, the price could see a pullback toward the $200–$210 support zone before attempting another breakout.

The post Pantera Capital Says Solana at a ‘Major Inflection Point’ as Third-Largest Crypto Play — Is $300 $SOL Realistic? appeared first on Cryptonews.

Solana Treasury Firms like

Solana Treasury Firms like