Key Takeaways:

- October has often delivered huge gains for Bitcoin, but October 2025 has been anything but bullish.

- Analysts fear BTC could drop below $100,000 by month-end due to renewed US-China trade tensions and other macro factors.

- BTC is already down 6% for October, compared with an average gain of 19.7% for the month since 2013.

October has historically delivered strong gains for Bitcoin and the wider crypto market, so much so that it’s been dubbed “Uptober”. But October 2025 has been anything but bullish, thanks to renewed global trade tensions.

On Oct. 10, BTC slumped to its lowest level in five months after a selloff that wiped out over $19 billion in leveraged positions. It was the biggest single-day liquidation event in crypto history, as Cryptonews previously reported.

Data from Polymarket last week showed a 52% chance that Bitcoin would drop below the psychological $100,000 mark this month, reflecting investor unease amid rising geopolitical tensions and weakening risk appetite.

As of this writing, BTC is down 6% for October, according to CoinGlass data, compared with an average gain of 19.7% for the month since 2013. Over the past 12 years, Bitcoin has posted losses in October only three times.

Now, while the Polymarket odds have narrowed, analysts warn there’s a real danger Bitcoin could still fall further due to a fluid geopolitical and macroeconomic backdrop. So, what went wrong with “Uptober” 2025?

Bitcoin’s Seasonality Trap

“October often shows favorable seasonality, and not just for Bitcoin,” Illia Otychenko, lead analyst at crypto exchange CEX.io, told Cryptonews.

“Historically, April, July, October, November, and December have been among the strongest months for both stocks and Bitcoin. However, that doesn’t mean October should be good by default,” he added.

Otychenko said Bitcoin’s poor performance this month has been “heavily shaped by rising risk aversion tied to renewed U.S.-China trade tensions” and a market that had already been showing signs of fatigue.

“As Bitcoin hit new all-time highs, its upward momentum weakened, forming a bearish divergence [seen as black lines in the chart below],” he said, adding:

“This suggests the market was becoming exhausted, with each new high weaker than the last, signaling the need for a pause or correction. The October flare-up in U.S.-China trade tensions likely accelerated that process and became a perfect storm.”

While the selloff rattled investors, Otychenko described the pullback as “a necessary cool down that may prevent a deeper correction later.”

“Momentum indicators on weekly and lower timeframes still point to room for further downside, but that’s part of establishing a more sustainable market structure.”

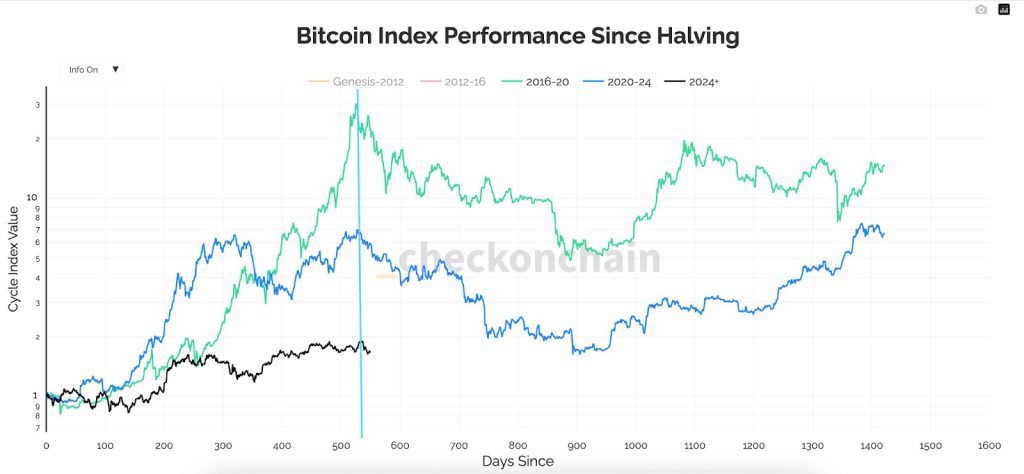

Bitcoin’s latest all-time high of $126,000, set on October 6, came roughly 530 days after its most recent halving, a timing that matches previous cycle peaks. Halvings reduce the amount of BTC entering circulation.

“This doesn’t necessarily mark the top of this cycle,” Otychenko added, “[but] it shows that October 2025 falls late in the typical bullish phase, which may have influenced investor behavior.”

$100K Question: What Could Push Bitcoin Lower?

Bitcoin climbed more than 5% to $113,349 within a few hours on Oct. 21, a pump described by crypto analyst and investor Lark Davis as showing that “the market is hungry and ready to take risks when the time comes.”

Those gains were quickly erased, with the price tanking below $108,000 on the day, per CoinGecko data. On Thursday, Bitcoin rose about 2% but remains 12% off its record high. Analysts warn it could still retest the $100,000 level in the short term.

The top cryptocurrency has flirted with the $100,000 level several times this year, most recently in June, before rebounding sharply. Analysts see that threshold as both a psychological and technical line of defense.

“The 50-week simple moving average, which acted as a key support level not only in this cycle, but in previous ones as well, is also near $100,000,” Otychenko said. “If BTC confidently breaks below that level, it could reinforce further bearish momentum.”

The simple moving average, or SMA, is a metric used by traders to spot bullish or bearish trends.

Meanwhile, prediction markets like Polymarket have become popular for tracking investor sentiment in real time. Last week, traders on the platform gave a 52% chance that BTC would fall below $100,000 by the end of October.

Experts are hesitant to read too much into the short-term odds.

“Fifty-two percent means it’s a coin flip,” Thomas Chen, the CEO of Bitcoin DeFi platform Function, told Cryptonews. “Polymarket odds are good as a real-time sentiment gauge … but by no means is it prophetic.”

“Polymarket bet shows the consensus of the crowd, but Bitcoin depends on a lot more: liquidity flows, macroeconomic conditions, and institutional positioning, not just sentiment.”

Chen said Bitcoin’s changing market structure has made it more sensitive to macroeconomic shocks than in earlier years.

“In previous cycles, Bitcoin was a speculative, risk-on asset detached from traditional finance,” he said. “Now, with $150 billion [6.8% of total supply] held in Bitcoin ETFs, it is sensitive to macro liquidity and interest rate expectations.”

He added that institutionalization brought both stability and vulnerability. “Bitcoin is now a mainstream asset,” said Chen. “So, [it] can be sold off in risk-off and flight to safety environments” just like any other asset.

Macro Headwinds Deepen

It’s still early days, but Chen expects that the foundation for stronger BTC uptake by institutions has been laid.

“The ETF approval created a compliant, accessible vehicle for investors. As Bitcoin’s price increases, so does its network security, institutional confidence, and repeats reflexively.”

Despite mainstream adoption, Chen, the erstwhile managing director of crypto asset custodian BitGo, managing over $100 billion in assets, said several catalysts could drive BTC below $100,000 over the coming weeks.

Key risks include “sustained exchange-traded funds outflows, geopolitical conflict, and hawkish pivot from the Fed,” said Chen. Liquidity, above all else, remains the crypto market’s number one pressure point, he detailed.

“If several treasuries attempt to reduce exposure during a downturn, the market can’t absorb that efficiently. It’s not the Bitcoin network that breaks, it’s the balance sheet design that meets leverage.”

Chen noted that the conversation has moved from Bitcoin accumulation to management. “The new question is: who can manage BTC like a treasury-grade asset? It’s no longer simply ‘Who is buying BTC today?’” he quipped.

Bitcoin (BTC)24h7d30d1yAll timeMuch of Bitcoin’s weakness in October 2025 has been tied to macro and geopolitical developments.

Crypto’s $19 billion futures purge was triggered by U.S. President Trump, who threatened a 100% tariff on China starting Nov. 1. Trump was reacting to reports that Beijing had placed restrictions on rare earth minerals exports.

“Bitcoin’s volatility is currently closely tied to developments in the U.S.-China trade conflict,” said Otychenko. “We’ve seen brief recoveries during de-escalation and renewed selling pressure when tensions rise.”

Earlier, the market’s focus centered on the Fed’s rate-cut cycle and tariff policies, the CEX.io analyst detailed. Now, concerns about a government shutdown and slowing global growth are adding to the caution.

A number of upcoming developments could help stabilize sentiment around Bitcoin.

“U.S. officials hinted that the government shutdown may soon be resolved, while Trump’s upcoming meeting with Xi Jinping could bring more clarity to the trade dispute,” Otychenko said.

“In addition, Jerome Powell recently signaled that the Fed’s quantitative tightening cycle may be nearing its end. If these factors play out positively, Bitcoin could rebound even before testing $100,000.”

Cycle or Structural Shift?

Callan Sarre is the co-founder of Threshold Labs, the creator of tBTC, a decentralized, trust-minimized layer for bringing Bitcoin liquidity to other blockchains. Speaking to Cryptonews, Sarre said the current turbulence may simply confirm that Bitcoin’s four-year cycle remains intact.

“The market had been unsure if the four-year cycle had broken or not, because of unprecedented validation of BTC as an asset,” he stated.

“The [Oct. 10] flash crash seems to highlight widespread weak points of the crypto ecosystem. I think this is a major catalyst in sentiment, and I’m expecting the 4-year cycle pattern to sustain itself for now.”

Others believe the current cycle differs fundamentally from previous ones due to changing regulations and politics.

“The crypto industry is playing on a new field since Trump’s inauguration,” Austin King, co-founder of Nomina, told Cryptonews.

“Never before have we seen the largest U.S. asset managers as well as the President himself advocating for crypto. Investors trying to pattern-match to older cycles are likely to lose their shirts,” he added.

The post So Much for ‘Uptober’. Could Bitcoin Slip Under $100,000 By Month-End? appeared first on Cryptonews.