Crypto ownership in the UK dropped noticeably in 2025, even as the investors who stayed in the market continued to build larger holdings, according to new figures from the Financial Conduct Authority (FCA).

The data from FCA’s Cryptoassets Consumer Research 2025 report shows that 8% of UK adults currently own some form of cryptocurrency. That is down from 12% a year earlier, marking the first clear decline in participation since crypto use surged during the pandemic.

While fewer people now hold digital assets, ownership has not fallen back to early levels. In 2021, just 4% of adults reported owning crypto, meaning today’s figure is still roughly double what it was four years ago.

The figures point to a market that is becoming smaller but more concentrated. Rather than attracting new entrants, crypto ownership appears to be shifting toward existing users who are committing more capital and holding their assets for longer periods.

Crypto Ownership in the UK Still Dominated by 18–34 Age Group

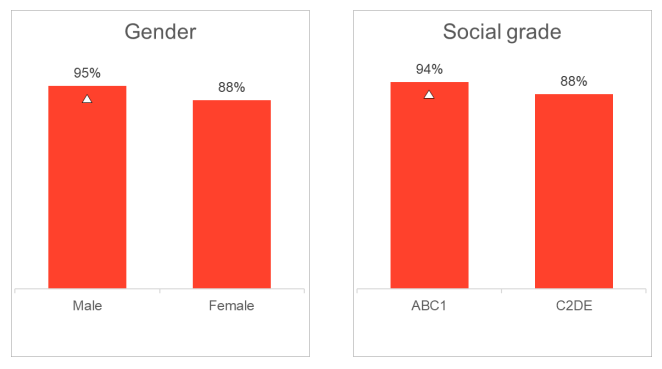

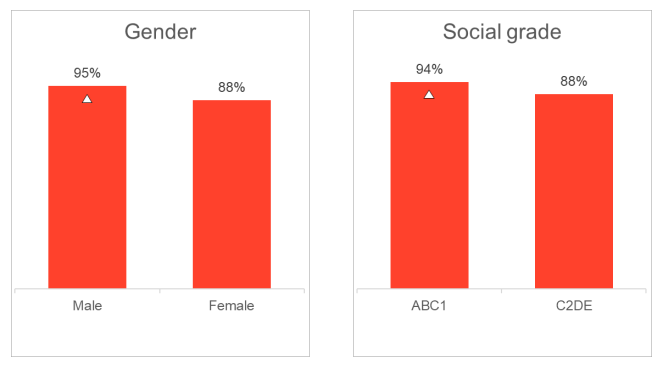

The profile of crypto holders has remained broadly consistent. Ownership is higher among men at 11%, compared with women, and is most concentrated among people aged 18 to 34, where 15% report holding crypto.

Overall public awareness of crypto remains high, with 91% of respondents saying they have heard of cryptocurrencies, matching 2024 levels and continuing a multi-year trend of widespread familiarity.

Individuals from ethnic minority backgrounds and higher-income social grades are also more likely to own digital assets, according to the FCA’s nationally representative survey of more than 2,300 respondents.

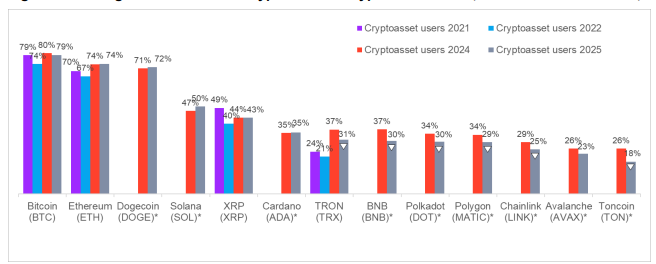

Bitcoin remains the most commonly held cryptoasset, owned by 57% of users, and recorded a five-percentage-point recovery after several years of declining ownership.

Ethereum followed at 43%, largely unchanged from 2024. Also, other assets were held at much lower levels, with Solana, Dogecoin, XRP, and Cardano the most commonly mentioned beyond the two market leaders.

Small Holders Exit as High-Value Crypto Portfolios Grow

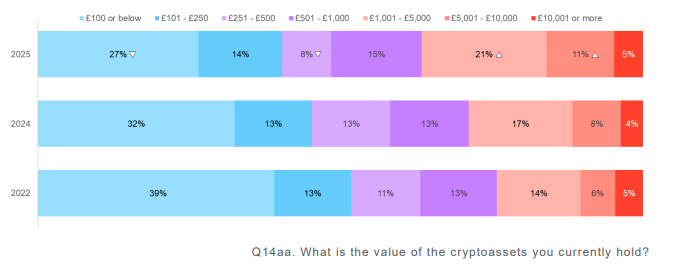

Behind the headline decline in ownership, the report shows a steady shift toward higher-value holdings.

The share of users holding £1,001 to £5,000 in crypto rose to 21%, up four percentage points from 2024, while those holding £5,001 to £10,000 increased to 11%, up three points.

At the same time, the number of people holding £100 or less continued to fall, extending a trend seen over several years.

The FCA noted that the difference between high- and low-value holders has widened since last year, particularly in motivations linked to long-term investing.

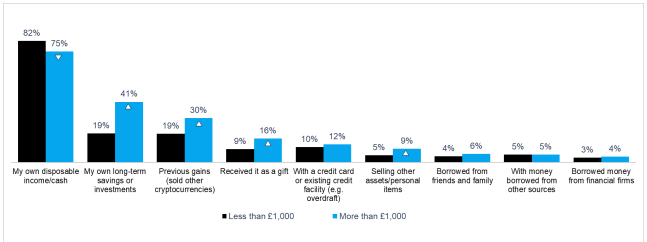

Most crypto purchases continue to be funded using personal cash.

Around 76% of users relied on disposable income, while 25% used long-term savings and 19% used previous investment gains.

The use of credit cards or borrowing fell further, with just 9% reporting credit-based purchases, down five percentage points from 2024.

The data also suggests that new adoption is slowing, noting that only 5% of crypto owners first bought assets after October 2024, while most entered the market between 2019 and 2021.

Incentives such as rewards or promotions also declined, with just 17% of users reporting receiving one in the past six months.

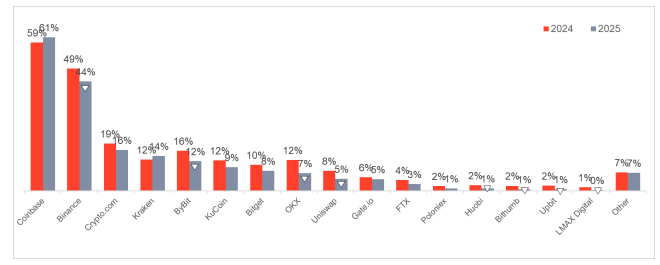

The report also noted centralized exchanges remain the dominant access point, used by 73% of UK crypto users, an increase from last year. Coinbase and Binance remained the most widely used platforms, though Binance’s share declined.

UK Ranks 11th in Global Crypto Adoption as regulation gets clearer

The findings come as the UK continues to reshape its regulatory framework. In 2025, the government introduced legislation to bring crypto activities under the FCA’s supervision while also formally recognizing digital assets as personal property under UK law.

Full implementation of the regime is not expected until 2027, but the FCA has already accelerated approvals and launched consultations covering trading, staking, lending, and decentralized finance.

Globally, the UK ranked 11th in Chainalysis’ crypto adoption index, behind countries such as India, the United States, Brazil, and Vietnam.

The post UK Crypto Ownership Plunges to 8% — But High-Value Portfolios Are Soaring appeared first on Cryptonews.

The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.