The crypto market is up today, and some 80 of the top 100 coins have appreciated over the past 24 hours. Overall, the cryptocurrency market capitalization has increased by 0.5%, now standing at $3.94 trillion. At the same time, the total crypto trading volume is at $94.3 billion, a lower level than seen over the past few days.

Crypto Winners & Losers

At the time of writing, seven of the top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) appreciated 0.4% at the time of writing, meaning that it’s mostly unchanged, currently trading at $111,425. This is the smallest rise on the list.

At the same time, Ethereum (ETH) is down 0.3%, meaning that it’s also largely unchanged in a day, now trading at $4,290. This is also the only drop in the category, alongside Lido Staked Ether (STETH).

On the other hand, the highest increase is Dogecoin (DOGE)’s 7.4% to the price of $0.2335.

It’s followed by XRP (XRP)’s 2.8%, now changing hands at $2.91.

Looking at the top 100 coins, about two dozen coins are down, and the rest are up.

Worldcoin (WLD) is the category’s winner. It’s up 23.9% in a day, $1.26.

Pudgy Penguins (PENGU) is the only other coin with a double-digit rise. The coin appreciated 11.9%, now trading at $0.03195.

On the other side, there is one coin with a double-digit fall: World Liberty Financial (WLFI) with 12.6% to $0.2093. It’s been dropping since its recent launch.

Meanwhile, El Salvador has bought 21 BTC to celebrate the nation’s fourth anniversary of the Bitcoin Law.

This latest purchase has brought the country’s total to 6,313.18 Bitcoin, valued at over $701 million.

‘Liquidity Conditions Could Improve Risk Sentiment Across Crypto‘

James Toledano, Chief Operating Officer at Unity Wallet, commented that September can be a weaker month for Bitcoin. Yet, “this year feels a little different,” as we’ve seen increases.

“Optimism around a potential [US Federal Reserve] rate cut has helped BTC hold ground around the $110K level, conviction remains a little muted until policy clarity arrives,” he explains.

Elaborating on the potential rate cut, “markets are currently pricing in a high probability of at least a 25 basis-point cut,” Toledano said, “and if delivered, liquidity conditions could improve risk sentiment across crypto.”

“In the near term, Bitcoin’s price action is likely to remain range-bound, but the Fed’s tone will be the key driver of whether momentum builds into Q4,” the exec concluded.

Bitunix analysts added that in the short term, risk assets benefit from dovish expectations. However, “if the Fed moves too aggressively on rate cuts, it could trigger recession fears that dampen bullish sentiment.”

Meanwhile, Glassnode found that over the past year, the 5–7y BTC cohort’s Realized Cap fell from $14.9 billion to $8.5 billion. “Almost all of this supply simply aged into older bands, highlighting the persistence of long-term holders,” they concluded.

Levels & Events to Watch Next

At the time of writing on Monday morning, BTC trades at $111,425. For the large part of the last 24 hours, the world’s number one coin traded sideways. It then decreased to the intraday low of $110,690 before jumping to the intraday high of $111,795.

This is still not far from the week’s high of $113,225, while the current price is down 10.1% from the all-time high of $124,128, recorded 25 days ago.

Bitcoin has recently been consolidating near $110,800. Falling below this, the price would meet supports at $108,450 and $107,400. Yet, a climb above $113,400 may lead to $115,400 and $117,150.

Ethereum is currently trading at $4,290. The trading was relatively choppy over the past day. The lowest point was $4,272, while the highest is the current price.

Over the past week, ETH moved from the lowest point of $4,241 to the highest price of $4,482.

Should the coin climb above $4,490 and hold that level, it may move towards $4,665 and $4,865. Conversely, a fall below $4,250 could result in the lower levels of $4,070, $3,940, and $3,785.

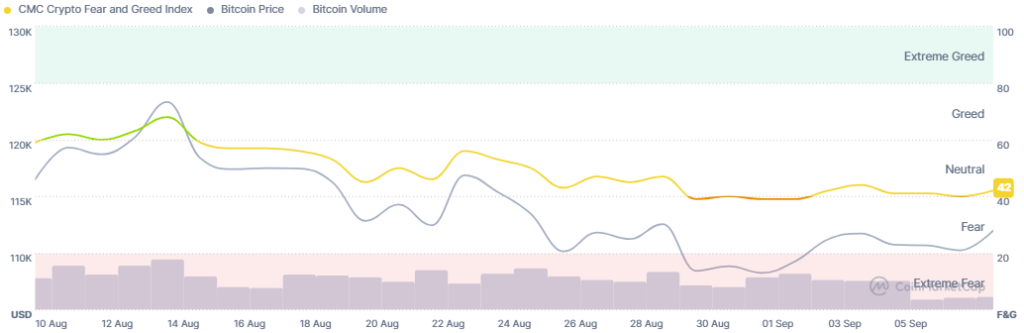

Meanwhile, the crypto market sentiment hasn’t moved significantly over the weekend, and it has stayed in the neutral zone. The crypto fear and greed index increased from 40 yesterday to 42 today.

The caution reigns among investors, as they await additional signals that would point to the direction the market will take in the mid-term.

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded $160.18 million in outflows on Friday, the previous day of trading. Three ETFs saw negative flows, and none recorded inflows.

BlackRock, Bitwise, and Grayscale noted outflows of $63.21 million, $49.65 million, and $47.33 million, respectively.

The US ETH ETFs also saw another day of outflows on 5 September, with $446.71 million.

No funds had inflows, and five had outflows. The highest of these is BlackRock’s $309.88 million, followed by Grayscale’s $51.77 million.

Meanwhile, Ethereum’s on-chain revenue fell sharply in August, even as ETH surged to new all-time highs. According to Token Terminal, Ethereum revenue, driven by token burns that benefit ETH holders, fell 44% month-over-month to $14.1 million, down from $25.6 million in July.

In other news, Japanese Metaplanet bought an additional 136 Bitcoin on Monday, for a total price of $15.2 million. The corporate BTC accumulator has seen a BTC Yield of 487% YTD 2025.

Per CEO Simon Gerovich, the company holds a total of 20,136 BTC, with a cumulative purchase amount of $2.8 billion, taking sixth place among the top corporate Bitcoin holders.

This said, businesses across major industries have bought 1,755 BTC daily, contributing over $1.3 trillion to Bitcoin’s market cap during the last 20 months.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has increased over the past day, while the stock market saw a mixed picture on its previous day of trading. By the closing time on Friday, the S&P 500 was down by 0.32%, the Nasdaq-100 increased by 0.082%, and the Dow Jones Industrial Average fell by 0.48%. This followed the August jobs report on Friday, which boosted expectations that the US Federal Reserve will cut interest rates this month.

- Is this rally sustainable?

We’ve been seeing slight increases and drops for a while now, with the market largely correcting and then consolidating. Analysts expect the market to continue increasing, at least by the end of this year, but for now, it’s still uncertain whether we’ll see additional corrections in the short term.

Crypto Winners & Losers

At the time of writing, seven of the top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC)…

The post Why Is Crypto Up Today? – September 8, 2025 appeared first on Cryptonews.