XRP recovered 4.59% Friday to $2.3140 as spot ETF momentum intensified, with multiple issuers filing amended S-1s to bypass SEC delays from the ongoing government shutdown, which had earlier affected the bullish XRP price predictions.

Canary Capital removed the delaying amendment language, potentially positioning for the November 13 launch.

Bitwise, Franklin Templeton, and 21Shares followed, racing for first-to-market advantage.

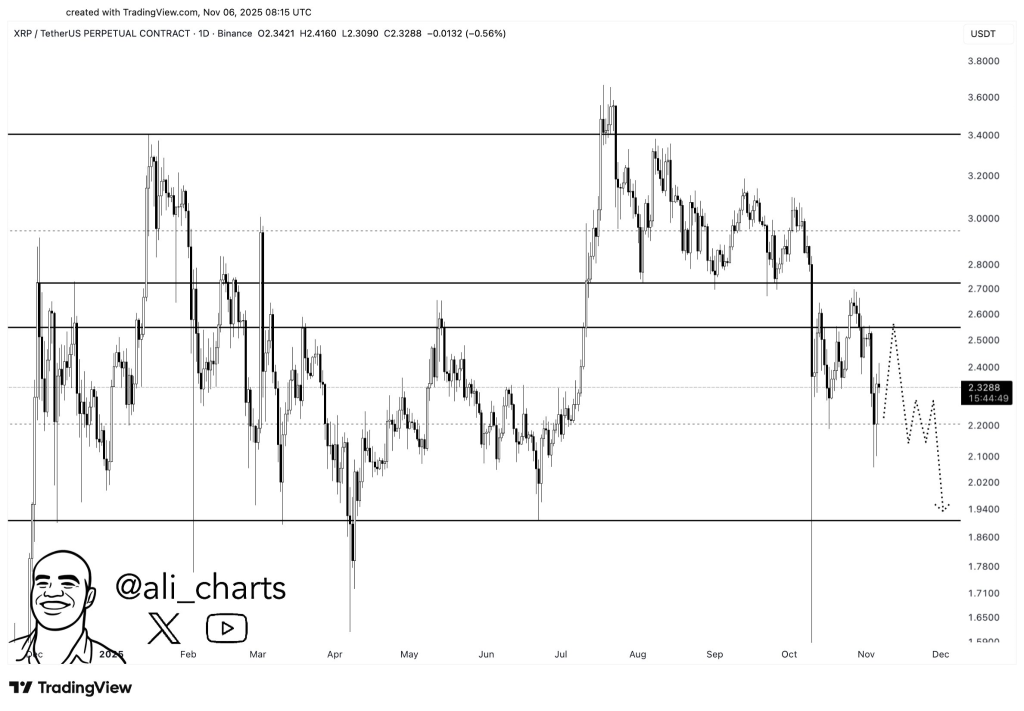

The token trades 7.72% down for November following October’s 11.84% decline, leaving the price below the 50-day and 200-day EMAs as traders monitor death cross confirmation. Post-Swell volatility drove a 36% correction from $3.60 peaks.

ETF Race Accelerates Through Shutdown Loophole

SEC Generic Listing Standards permit commodity-based ETF listings without requiring traditional 19b-4 approval, which can take up to 240 days.

By removing delaying language, issuers can launch after 20 days without SEC queries. The strategy circumvents shutdown-linked delays as the SEC operates with a skeleton staff.

Canary Capital gains a potential first-mover advantage, as competitors are launching shortly after.

CoinShares, Grayscale, and WisdomTree await reopening unless filing amended S-1s.

NovaDius Wealth Management President Nate Geraci called potential launches the “final nail in coffin of previous anti-crypto regulators,” highlighting the shift from the SEC’s Ripple legal battle to Paul Atkins’ Project Crypto initiative.

Death Cross Concerns Battle Ichimoku Strength

XRP tests support at $2.32 with a bearish projection targeting the $1.90-$2.00 zone, representing a 14-17% additional downside.

The 50-day and 200-day EMAs converged ahead of a potential death cross. Immediate support sits at $2.60-$2.70, with the critical zone at $2.00-$2.55.

However, quarterly Ichimoku Cloud analysis reveals XRP has built a base above the 3-month conversion and baseline for the first time in history.

The structural strength suggests a durable advance despite the current 18.87% quarterly decline, contrasting with historical brief rallies that quickly reversed.

The near-term trajectory continues toward $1.90-$2.10 as the death cross drives technical selling, and post-Swell profit-taking persists.

Response to this support determines whether structural strength translates to accumulation or breakdown.

A successful defense validates the bull structure and enables recovery toward $2.50-$2.70. Failure triggers correction toward $1.50-$1.70.

Mine-to-Earn Gaming Meets Meme Coin Economics

Post-swell volatility creates uncertainty in the altcoin market, but innovative projects keep capturing attention.

PepeNode gamifies crypto mining, where users deploy digital Miner Nodes in virtual server rooms.

Players upgrade setups to maximize $PEPENODE rewards plus PEPE and Fartcoin payouts.

The ecosystem burns 70% of the tokens spent on upgrades, which is good for the token’s upside potential.

The presale nears $2 million after passing smart contract audits.

Token Generation Event and decentralized exchange listings approach, alongside on-chain mining features.

Future plans include NFT upgrades and cross-chain rewards. High APY staking and leaderboards drive engagement.

The mine-to-earn model blends strategy, gaming, and DeFi for Q4 2025 altseason.

To join PepeNode, visit the official website and connect your wallet.

Participate in presale using crypto or a bank card.

Buy $PEPENODE Here.

The post XRP Price Prediction: Post-Swell Volatility – Traders Watch for Confirmation of the XRP Death Cross and Next Move appeared first on Cryptonews.