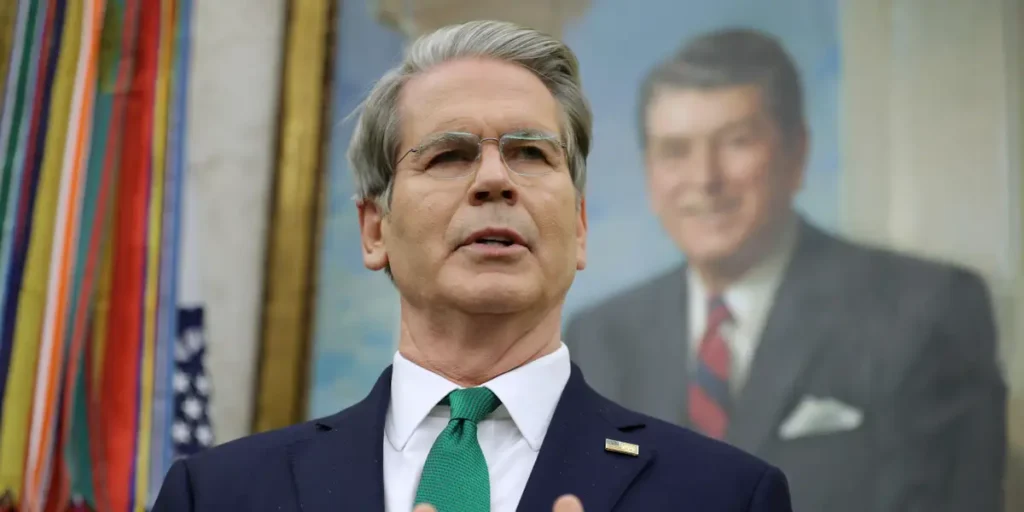

Treasury Secretary Scott Bessent said that President Donald Trump’s proposal to keep Wall Street players from buying single-family homes would not force them to sell their current holdings.

“These big institutions buy housing, then rent them out, and they’re able to depreciate it. They hide their earnings, pay lower taxes,” he said on Thursday at the Economic Club of Minnesota.

“The idea here is bygones are bygones,” Bessent added. “We’re not going to have a forced sale here.”

On Wednesday, Trump said he would ban institutional investors from purchasing single-family homes in an effort to make housing more affordable for Americans. Single-family homes refer to standalone residential buildings with their own entrance designed for one household.

“For a very long time, buying and owning a home was considered the pinnacle of the American Dream,” Trump wrote on a Truth Social post. “That American dream is increasingly out of reach for far too many people, especially younger Americans.”

Shares of asset manager Blackstone fell 5.6% on Wednesday after Trump’s post. Blackstone, which manages $1 trillion in assets, oversees one of the largest rental housing portfolios in the US, with several hundred thousand single-family homes and apartments. Other stocks similarly fell.

Critics say firms like New York-based Blackstone put pressure on the housing market, reducing the availability of homes and driving prices up. Blackstone closed 1.1% higher at the end of the trading day on Thursday.

The institutional players, meanwhile, say lack of housing supply — not big-business ownership — is pushing prices up.

In Minnesota on Thursday, Bessent said that the administration has not decided on the “exact contours” of this new proposal.

“We want to keep the traditional mom and pop owners in. We want to keep families who rent out to their other family members,” he said.

Bessent said that this practice of large firms buying up single-family homes started during the 2008 financial crisis, when private equity companies were among the few parties with the money to buy these homes.

“They hoovered up the single-family housing stock,” he said.

The US Government Accountability Office found that in 2022, the five largest institutional investors owned nearly 2% of single-family rental homes.