“You have a very nice haircut. Did you cut it yourself?”

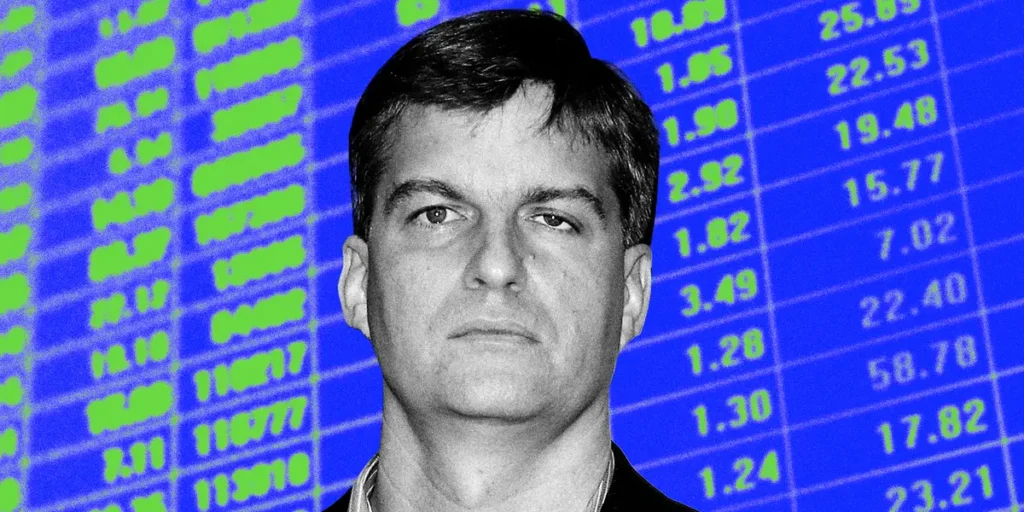

Michael Burry, played by Christian Bale, earnestly poses that question to a bewildered analyst in the movie “The Big Short,” which chronicles the investor’s massive bet against the mid-2000s housing bubble.

The memorable scene is based on a misguided comment the real-life Burry once made, which he revealed in a comment on his Substack.

“That is a riff on something similar when I complimented a woman on her dress and asked if it was homemade,” Burry wrote. “The pained look was similar.”

Sharing a personal anecdote like that marks a sea change for Burry. Until recently, he was one of finance’s most enigmatic figures, known for posting cryptic warnings on X, then deleting them, and vanishing from social media for months or years at a time.

That changed in November, when Burry closed his hedge fund to outside cash and reinvented himself as a newsletter writer. His posts diagnosing an AI bubble and explaining his bets against Nvidia and Palantir have drawn plenty of attention. But his detailed answers to dozens of questions on myriad topics have largely gone unnoticed.

Business Insider trawled through the comment sections and discussion threads on Burry’s Substack to read all of his responses to subscribers as of Friday last week.

They offered wide-ranging, unprecedented insights into the personal and professional life of a renowned yet mysterious investor.

Opening up

Elite investors tend to keep a low profile. Even the newly retired Warren Buffett only communicated with Berkshire Hathaway shareholders a handful of times a year.

Burry has broken that mold, shifting from virtual silence as a fund manager to pretty much running a 24/7 “Ask Me Anything.”

He’s freely shared his thoughts on the day’s headlines and latest market moves.

Cassandra Unchained/Business Insider

“I think there is no doubt a SpaceX-X merger — and even an xAI merger — would be accretive to shareholder value for Tesla,” he recently wrote. “However, share value is different than share price.”

“It does seem to me that Trump’s kryptonite is the American stock market,” reads another of his comments. “Nothing else touches him.”

“In my view, there are no bigger shoes to fill than Warren’s,” he wrote on another occasion. “I do not believe anyone can fill them, especially at Berkshire.”

Burry has also spilled the beans on the contents of his portfolio, down to what stock he bought on a particular day and the average price he paid.

Cassandra Unchained/Business Insider

Moreover, he’s pulled back the curtain on how he approaches investing. He’s discussed earnings calls, analyzed stock charts, held forth on human psychology, and outlined his macroeconomic views in comments and messages to subscribers.

Burry has delved into subjects as esoteric as the dynamics of health insurance marketplaces. He’s also shed light on his daily habits and interests, often with humor and humility.

“Young people sometimes don’t know how playful and goofy us older guys are,” he recently wrote.

When a reader queried if he’d consider starring in a documentary, Burry quipped: “Me sitting in front of a computer in my shorts? Or sitting in a chair reading? Doesn’t sound too compelling.”

Asked how he felt on a scale of 1-10, Burry replied: “I am pretty much a 5 all the time. My wife can attest. My 54-year-old face is not etched by many smiles.”

Responding to a follow-up question about how he felt when his “Big Short” initially went south, he wrote: “That manifested in my gut. Not fun. I was headed to surgery. Then the trade worked out and I was cured.”

“Sir you need sleep,” one thoughtful subscriber wrote. “Thank you. I got four hours in,” Burry replied.

Cassandra Unchained/Business Insider

Once a closed book, the investor has revealed that he’s reading “The Sun Eater” book series by sci-fi writer Christopher Ruocchio, had a “heck of a time” at an Aerosmith concert in the ’80s, played Pokémon with his kids, and titled one post after a heavy-metal song called “The Jig Is Up” by Ice Nine Kills.

He’s also disclosed some of his favorite investments. He wrote that he’s been holding gold and silver for more than 20 years now, and snaps up Samsung Electronics stock every time it gets cheap — a strategy that has “worked spectacularly several times” in the past two decades.

Burry, whose Substack is titled “Cassandra Unchained,” has also lived up to his reputation for doom-and-gloom predictions.

“But before a couple of years pass, I see a 100 car wreck that will hurt a lot of AI bulls,” he wrote, underlining his concern about where the market is headed.