For one in every of each 5 Americans, a very powerful fall ritual has nothing to do with leaf-peeping or soccer or pumpkin spice.

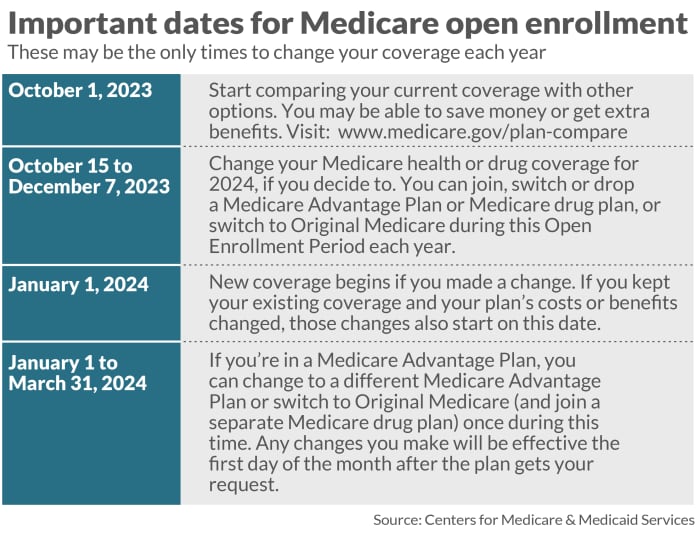

Oct. 15 to Dec. 7 is the annual open enrollment interval for shoppers to select a Medicare or Medicare Advantage plan.

The healthcare selection is essential however altering for the 60 million Americans on Medicare. In 2023, for the primary time, most seniors opted for Medicare Advantage over conventional Medicare, with 30.8 million choosing the privately managed plans.

As a son who has tried to assist my very own mother and father choose a medical plan, I discover the entire course of daunting — and I’m CEO of a senior well being firm.

My mother and father’ mailbox and electronic mail containers began filling with medical gross sales pitches in the summertime — typically it’s laborious for them to look at their TV exhibits with out a native healthcare advert — and the onslaught doesn’t cease till after the primary snowfall.

After seeing either side of the healthcare choice course of as a son and medical government, I provide the following pointers to assist simplify the looking for a Medicare or Medicare Advantage plan:

Start by making a listing of what’s essential

The key right here is to match your particular medical wants with the providers lined by a selected plan. Do you have got medical specialists essential to your private healthcare? Make certain they’re lined by your plan. If you depend on one prescription drug, then examine the worth below completely different plans. Some plans provide 24-7-365 telephone recommendation from nurses — that’s a fantastic thought if you need peace of thoughts, or reside removed from family members and have medical points that come up in the midst of the evening. Are you one of many Northern snowbirds who winter in Florida or Arizona or someplace else heat? Make certain your protection extends to different states.

Consider the incentives of medical plan brokers

Brokers could also be specialists on the ins-and-outs of competing plans — and execs at serving to you comparability store — but it surely’s essential to ask how they’re paid. Does your dealer have a monetary incentive to steer you towards a selected plan? Is the dealer’s pay lowered in case you select completely different protection? Financial transparency is one of the best and fairest coverage.

Is there coordinated care?

Plans that provide a single level of contact could make healthcare a lot simpler — consider it as a medical concierge to coordinate docs, bodily therapists, testing labs, and pharmacists. The finest coordinators concentrate on healthcare, not simply sick care, by selling wellness applications that can assist you stop smoking, drop a few pounds, and construct energy and stability by turning into lively once more. Another massive benefit of coordinated care: Sending assist to your home if you find yourself sick or want mobility or rehab assist.

Focus on geriatricians

The older we get, the extra difficult our medical points are usually. A geriatrician is the one physician, particularly skilled in ageing, who can see how therapies from completely different specialists have an effect on one another. What occurs if a number of docs individually prescribe 10 medicines for 4 situations? Does your osteoporosis medicine have a consequence for reminiscence care? Seniors deserve an skilled who’s contemplating your plan for residing, not simply specializing in stopping loss of life.

Consider private tech

Remote monitoring generally is a lifesaver. Plans with a robust telehealth element — you may discuss with a health care provider, nurse, or psychological well being therapist from house through a videoconference in your smartphone or laptop — can prevent journeys to the physician’s workplace. Some plans additionally provide private tech like Fitbit-style step counters, Apple watches, pulse-oximeter gadgets, and heart-rate screens, in addition to wearable tools that notifies helpers in case of a fall or medical occasion. Medical tech all the time ought to include cautious and thorough instruction from affected person specialists.

The key right here is for seniors to look past the standard advantages supplied by the standard plan. At this level, the usual for Medicare Advantage plans is to cowl dental, imaginative and prescient, and listening to protection.

It’s value the additional analysis, although, to seek out the precise plan that can prevent cash by selling wellness and prevention.

The proper plan mustn’t confuse you. It ought to allow you to age the best way you need.

Joel Theisen, BSN, RN, is founder and chief government of Lifespark, a Minnesota-based senior well being firm. Follow him on Twitter: @Lifespark_CEO.