The mixed cryptocurrency spot and derivatives buying and selling volume on centralized exchanges declined 11.5% to $2.09T, falling to the lowest mixed month-to-month buying and selling volume this year and the second-lowest since October 2020.

The weakening volume tracked the motion in value, marking the largest lengthy liquidation occasion since the FTX collapse, CCData stated in its August Exchange Review.

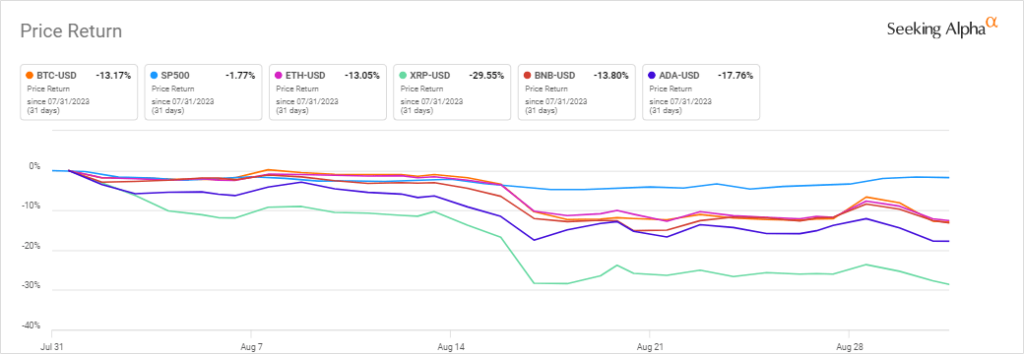

During the month, Bitcoin (BTC-USD) and ethereum (ETH-USD) every dropped 13%, XRP (XRP-USD) tumbled 30%, and cardano (ADA-USD) fell 17%.

Spot buying and selling on centralized exchanges fell for the second straight month, dropping 7.8% to $475B, the lowest month-to-month spot buying and selling volume since March 2019.

“The trading volumes on centralised exchanges have remained low since April this year and are now comparable to the stagnant trading activity in the bear market of 2019,” in accordance to the report.

Even Grayscale’s win over the SEC late in the month failed to buoy volume and bitcoin’s (BTC-USD) value for the month. While the courtroom vacated the SEC’s rejection of changing Grayscale Bitcoin Trust into an exchange-traded fund, it would not give Grayscale permission to proceed with the conversion.

Derivatives volume fell 12.5% in August to $1.62T, the lowest level since December 2022 and the second lowest derivatives buying and selling volume since 2021. With that decline, derivatives’ share of the whole crypto market slid to 77.3% from 78.2% in July, the third straight month of market share losses.

Binance stays the largest alternate for each the spot market and derivatives. With $183B in spot market volume, it holds a 38.5% share, which is its lowest since August 2022. Huobi, with $28.9B of spot market volume, noticed its market share improve to 6.09%, making it the second-largest alternate.

Binance’s derivatives volume was $865B for a 53.5% market share, adopted by OKX at $315B with a 19.5% share, and Bybit at $205B with a 12.7% share, in accordance to the CCData report.

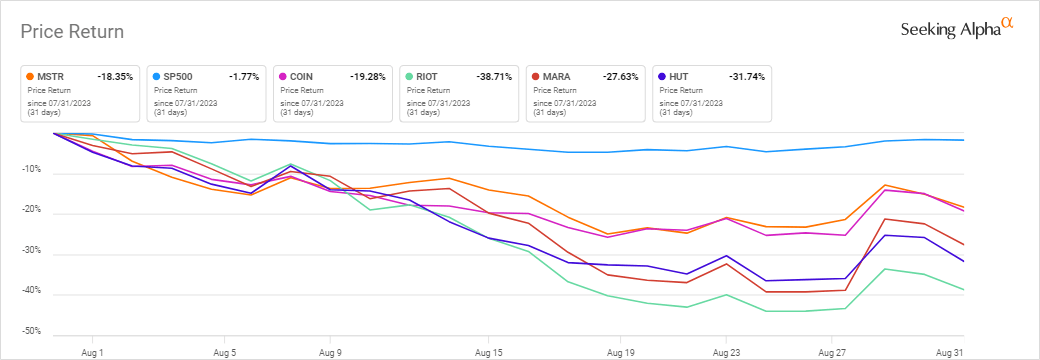

Crypto-exposed shares additionally sank throughout August, as seen in the chart beneath, with bitcoin miners Riot Platforms (NASDAQ:RIOT), Marathon Digital (NASDAQ:MARA), and Hut 8 Mining (NASDAQ:HUT) every falling about 30% for the month.