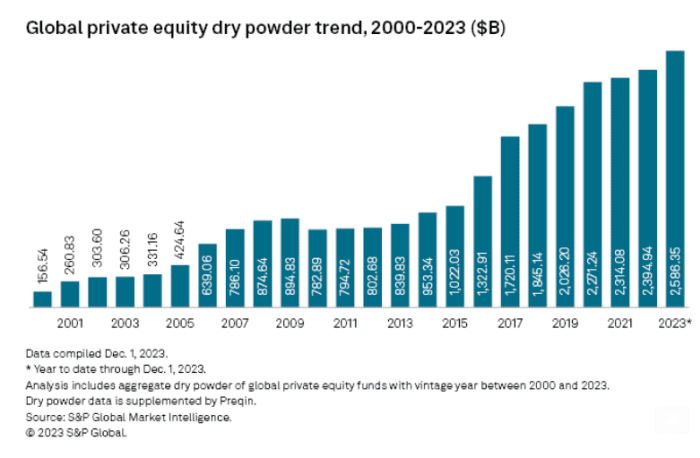

Capital ready to be deployed within the non-public fairness market, or so-called dry powder, rose 8% to a report $2.59 trillion prior to now 12 months, S&P mentioned Tuesday.

S&P mentioned the mountain of unused capital within the trade comes after a gradual 12 months in dealmaking “with limited opportunities” for corporations which have raised cash from buyers lately.

Also learn: Private fairness: Everything you at all times wished to find out about this $12 trillion asset class however had been afraid to ask

Dry powder, or unemployed capital by private-equity corporations, is up by 8% prior to now 12 months, in a lackluster surroundings for mergers and acquisitions.

S&P

Apollo Global Management Inc.

APO,

leads the listing with $55.1 billion in dry powder, adopted by $43.2 billion for KKR & Co.

KKR,

$39.44 billion for CVC Capital Partners and $30.9 billion for Ardian.

Blackstone Group Inc.

BX,

ranks fourth with $29 billion in dry powder, adopted by $27 billion for Carlyle Group Inc.

CG,

$24.2 billion for Clayton, Dubilier & Rice LLC, $24 billion for Hellman & Friedman LLC and $23 billion for TPG Inc.

TPG,

“Record dry powder accumulation is rooted in the robust M&A market of the last several years,” S&P mentioned.

Merger and acquisition exercise previous to 2022 set excessive valuation expectations for sellers, which remained elevated whilst macroeconomic situations more and more slowed deal exercise beginning final 12 months, S&P mentioned.

In a separate research, financial-technology firm and broker-dealer Percent Securities LLC mentioned dry powder within the private-credit area now suggestions the scales at $1.3 trillion, or about 25% of all capital accessible for funding.

“The large amount of dry powder across allocators indicates momentum will only continue to accelerate as firms continue to lean into the asset class,” mentioned Nelson Chu, founder and chief government of Percent. “We are already seeing a variety of interesting trends on the Percent platform foreshadowing the ways allocations and deal types will shift into 2024.”

Also learn: Why rich buyers put $125 billion into this new kind of private-equity fund final 12 months