Terry Smith, the fund supervisor of the £23.7 billion ($30 billion) Fundsmith Equity Fund, is commonly known as Britain’s reply to Warren Buffett.

He’s coming off a 12 months through which he underperformed his benchmark, the MSCI world index, which he attributed to weak point in Estee Lauder

EL,

McCormick

MKC,

and Mettler-Toledo

MTD,

amongst different holdings, although his annualized 15.3% return since 2010 is about 4 factors forward.

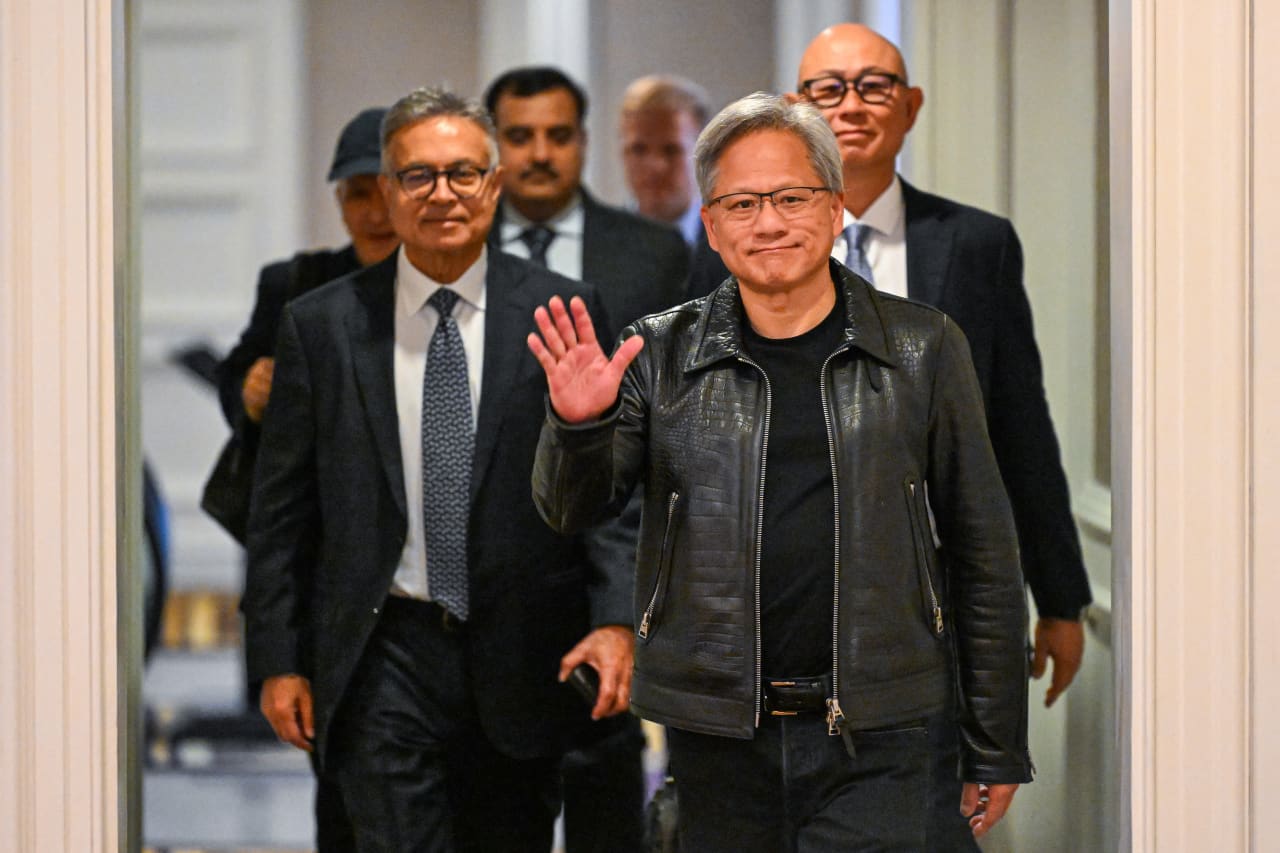

In Smith’s annual letter to traders, he mentioned the inventory market has determined that Nvidia

NVDA,

would be the winner in designing chips for synthetic intelligence and that Microsoft

MSFT,

would be the winner because the supplier of an AI mannequin.

“If it may well achieve this at this stage it might appear to me to be a break with custom. Think again to a number of the main know-how developments of the previous half century or so and the early leaders:

- Microchips: Intel

- Internet Service Providers: AOL

- Mobile Phones: Nokia

- Search Engines: Yahoo

- Smartphones: Research In Motion (Blackberry)

- Social Media: Myspace.”

Where are they now, he asks? (Intel is making an attempt to re-establish itself; Apollo Global Management owns each AOL and Yahoo after each fell on exhausting occasions; Nokia and Research In Motion are each out of the cellphone enterprise; and Myspace now not exists.)

It must be famous that Smith does maintain Microsoft, which after Meta Platforms

META,

was the second-best driver of efficiency for his fund. He mentioned even when the entire so-called Magnificent Seven fitted the fund’s funding standards, he wouldn’t need to personal all of them, owing to focus threat.