Published:

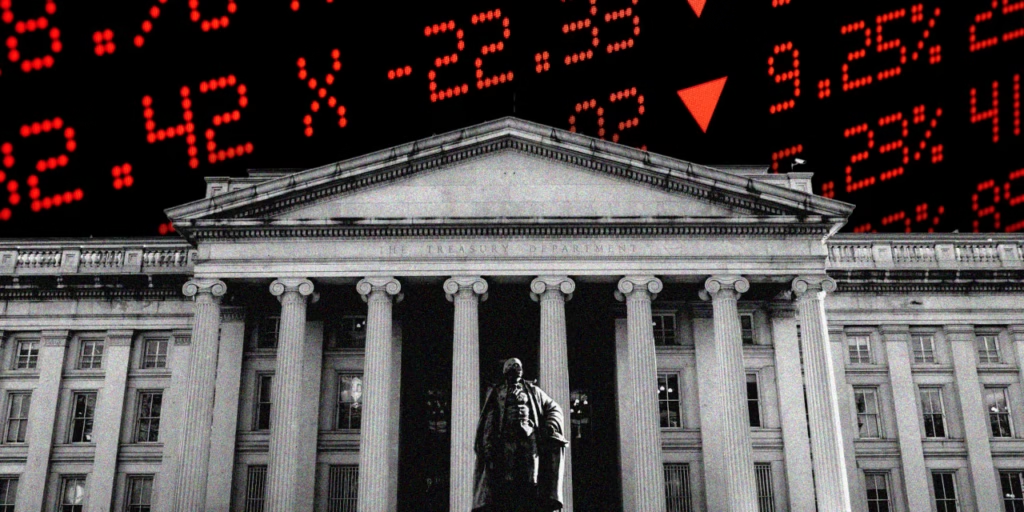

Long-dated U.S. government debt was getting slammed on Tuesday as nervous investors reacted to President

Donald Trump’s plans to slap 10% tariffs on imports from eight European countries beginning next month.

Tuesday’s selloff within the $30 trillion Treasury market sent the benchmark 10-year yield BX:TMUBMUSD10Y to an intraday high of 4.3% and on its way toward its highest closing level in five months. The rate on the 30-year bond BX:TMUBMUSD30Y jumped to as high as 4.95% and headed for a closing level not seen in more than four months. At one point, the long bond was also poised for its biggest one-day selloff since July 11, when it sold off on renewed fears about U.S. trade wars with Canada and Europe. Yields and bond prices move in opposite directions, meaning that the former spikes during aggressive selloffs of the corresponding Treasury maturity.