NEWYou can now listen to Fox News articles!

For more than two decades, Washington and New Delhi built a strategic partnership that was hailed as one of the great success stories of post–Cold War diplomacy. Today, that relationship is facing its most serious test in years — and India is signaling it has other options.

“We’re in a situation in the U.S.–India relationship where the premises and assumptions of the last 25 years — that everybody worked very hard to build, including the president in his first term — have just come completely unraveled,” said Evan Feigenbaum, a South Asia expert at the Carnegie Endowment for International Peace. “The trust is gone.”

Since President Trump imposed sweeping tariffs on Indian imports, New Delhi has turned visibly eastward. India’s national security advisor traveled to Moscow in recent weeks, its foreign minister is visiting this week and Chinese Foreign Minister Wang Yi just concluded talks in Delhi. Prime Minister Narendra Modi is preparing for his first trip to China in more than seven years, while Russian President Vladimir Putin is expected to host him in Moscow before the end of the year.

The pivot underscores how tariffs meant to punish India for its continued purchases of Russian oil may instead be pushing New Delhi closer to America’s rivals.

TRUMP AND PUTIN’S RELATIONSHIP TURNS SOUR AS PRESIDENT PUSHES FOR RESOLUTION WITH UKRAINE

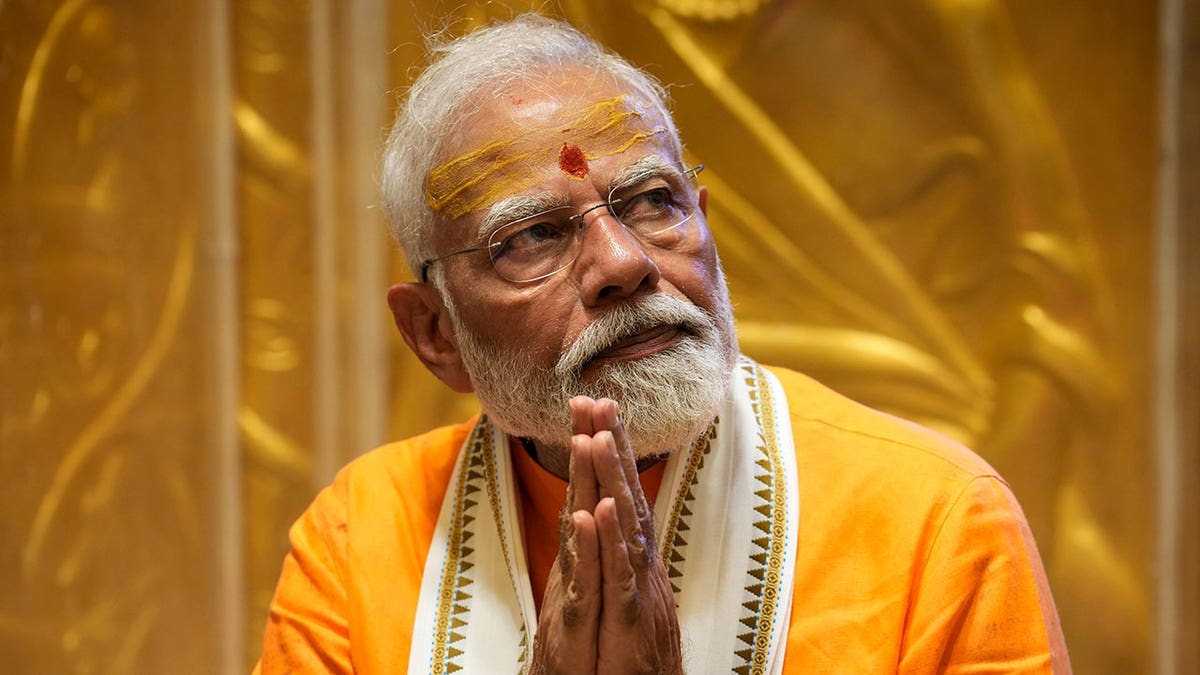

Prime Minister Narendra Modi is preparing for his first trip to China in more than seven years, while Russian President Vladimir Putin is expected to host him in Moscow before the end of the year. (AP Photo/Rajesh Kumar)

Tariffs and backlash

Trump slapped a 25% tariff on Indian imports earlier this year, citing India’s willingness to keep buying Russian crude. On August 27, that tariff is set to double to 50%.

Indian public opinion has bristled at what many see as U.S. interference in sovereign decision-making. “They’re signaling very clearly that they view that as interference in India’s foreign policy, and they are not going to put up with it,” Feigenbaum said.

Despite initial hesitation, state-run refiners resumed Russian oil purchases, lured by discounts of 6–7%. Russian oil now accounts for 35% of India’s imports, up from a negligible 0.2% before the Ukraine war. Moscow, for its part, has seized the opening. “We continue to ship fuel, including crude oil and oil products, thermal and coking coal,” said Russian First Deputy Prime Minister Denis Manturov. “We see potential for the export of Russian LNG.”

TRUMP’S DEADLINE ON SECONDARY TARIFFS ARRIVES; US-RUSSIAN RELATIONS HANG IN THE BALANCE

Moscow and Beijing step in

Russia is using the rift to promote its vision of a “great Eurasian partnership” linking Moscow, Beijing and Delhi.

“All of this engagement we’re seeing between India and China now is not exclusively coming because of Trump and his tariffs,” said Michael Kugelman, a Washington-based South Asia analyst. “We’ve actually seen indications for almost a year of India wanting to ease tensions with China and strengthen relations, mainly for economic reasons. But the Trump administration’s policies have made India want to move even more quickly.”

Modi, right, has deepened engagement with China and Russia as a result of U.S. tariffs. (MAXIM SHIPENKOV/Pool via REUTERS)

Some of India’s moves are diplomatic theater meant to signal anger at Washington. But others are more durable. “India is going to double down on some aspects of its economic and defense relationship with Russia,” Feigenbaum said. “And those parts are not performative.”

Kugelman noted that before the Ukraine war, India had already begun reducing its reliance on Russian arms imports in favor of U.S., French and Israeli systems. “But as soon as the invasion happened, India very quickly started buying more from Russia, particularly energy,” he said. “This is essentially validation of a view in India that the U.S. can’t be trusted, whereas Russia can — because Russia is always going to be there for India no matter what.”

Domestic politics and defiance

Modi has used the standoff to reinforce his image at home as a defender of sovereignty. “India actually made a fair number of concessions to the Trump administration early on in its second term,” Kugelman said, citing tariff reductions and agreements to repatriate undocumented workers. “Because of those concessions, India needs to be careful about signaling further willingness to bend. This is one reason there was no trade deal — Modi put his foot down.”

Trump met with Russian President Vladimir Putin on Friday, after hitting India with 50% tariffs for its purchase of Kremlin oil. (Andrew Harnik/Getty Images)

While not directly criticizing Trump, Modi has emphasized that his priority is protecting the livelihoods of farmers, small businesses and young workers. That defiant tone, Kugelman added, has “real political mileage” in India’s domestic debate.

Washington’s frustration

The Trump administration has shown no signs of backing down. Former White House trade advisor Peter Navarro blasted India’s oil purchases as “opportunistic” and “deeply corrosive” in a Financial Times op-ed this week.

“This two-pronged policy will hit India where it hurts — its access to U.S. markets — even as it seeks to cut off the financial lifeline it has extended to Russia’s war effort,” Navarro wrote. “If India wants to be treated as a strategic partner of the U.S., it needs to start acting like one.”

INDIAN PRIME MINISTER MODI TAKES PAGE FROM TRUMP, SAYS ‘MAKE INDIA GREAT AGAIN,’ OR ‘MIGA’

From nuclear deal to strategic drift

The contrast with the U.S.–India relationship of two decades ago could not be starker. In 2008, the two countries struck a landmark civil nuclear deal that gave India access to American technology and fuel despite not being a signatory to the Non-Proliferation Treaty.

“India put the entire government on the line for the deal,” Feigenbaum recalled. “Bush really went to the mat and provided a lot of assurances to Congress that were politically not easy, but he was willing to take risks for the relationship.”

At that time, Washington and Delhi managed to work around their disagreements. “The U.S. objected to many aspects of India’s relationships with Iran, Burma and Russia,” Feigenbaum said. “India objected to aspects of the U.S. relationships with China and Pakistan. But neither side let that bleed back into the bilateral relationship in a completely debilitating way.”

Can the Quad survive?

For years, the U.S. has viewed India as a democratic counterweight to China’s authoritarian model — central to its Indo-Pacific strategy under Obama, Trump and Biden. But now the question is whether that glue still holds.

“Both sides agree that countering China is the main glue that has really bound this relationship together over this 20-year period,” Kugelman said. “But the tensions, most of which are on the trade side, have begun to spill over into the broader partnership.”

He noted that India will continue to see China as a long-term competitor because of border disputes and Beijing’s alliance with Pakistan. “Those realities make it hard to imagine India no longer seeing China as a threat,” he said. “So the rationale for the Quad remains. But if the U.S.–India relationship continues this free fall, it will be very difficult to sustain.”

Talks on new defense cooperation are still on the calendar. But for now, Kugelman warned, trust has eroded: “You talk about defense cooperation, intelligence sharing — that requires a lot of trust. And given what’s happened over the last few months, that might be a harder sell for the Indians.”

CLICK HERE TO GET THE FOX NEWS APP

India’s new signaling

Feigenbaum sees India’s latest maneuvers as a reversal of past dynamics. “Then, India was leveraging its partnership to signal to then-foe China that it had options,” he said. “Now they’re working with the Chinese to signal Washington rather than the other way around.”

The message is clear: India will pursue its interests on its own terms, even if that means drawing closer to America’s rivals.